Posted on

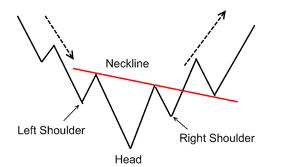

HUI Gold Bugs Index Symmetry

There is a growing presence out there talking about a potential Inverted Head & Shoulders (IH&S) on the HUI, which NFTRH has had going since mid-late last year. Below is a simple view of it, with last week’s ‘Week 2 down’ making perfect sense (symmetrically speaking) with ‘Weeks 1 & 2 up’. NFTRH subscribers … Continue reading