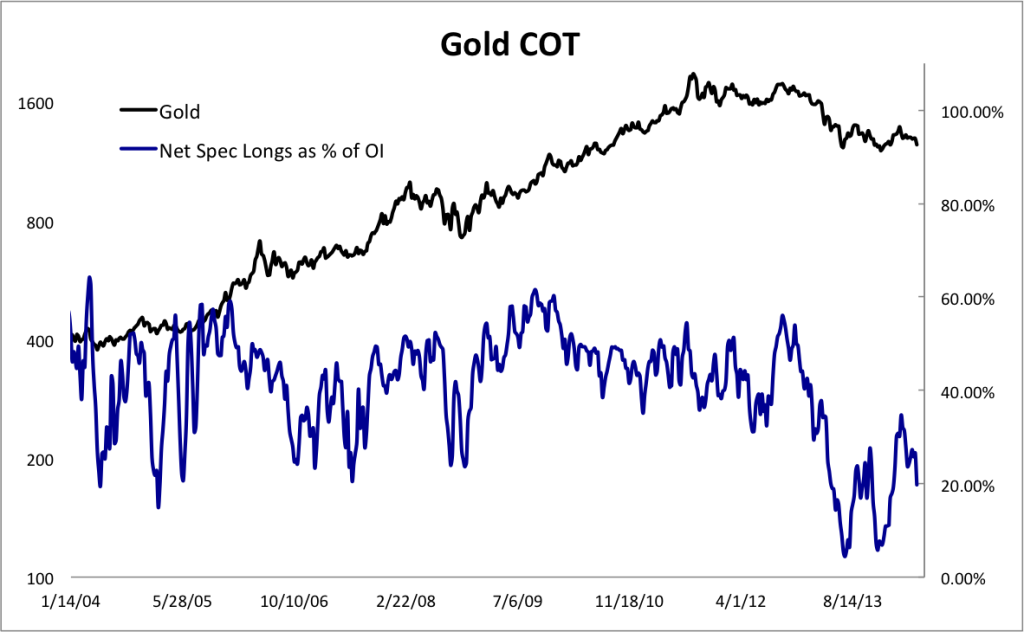

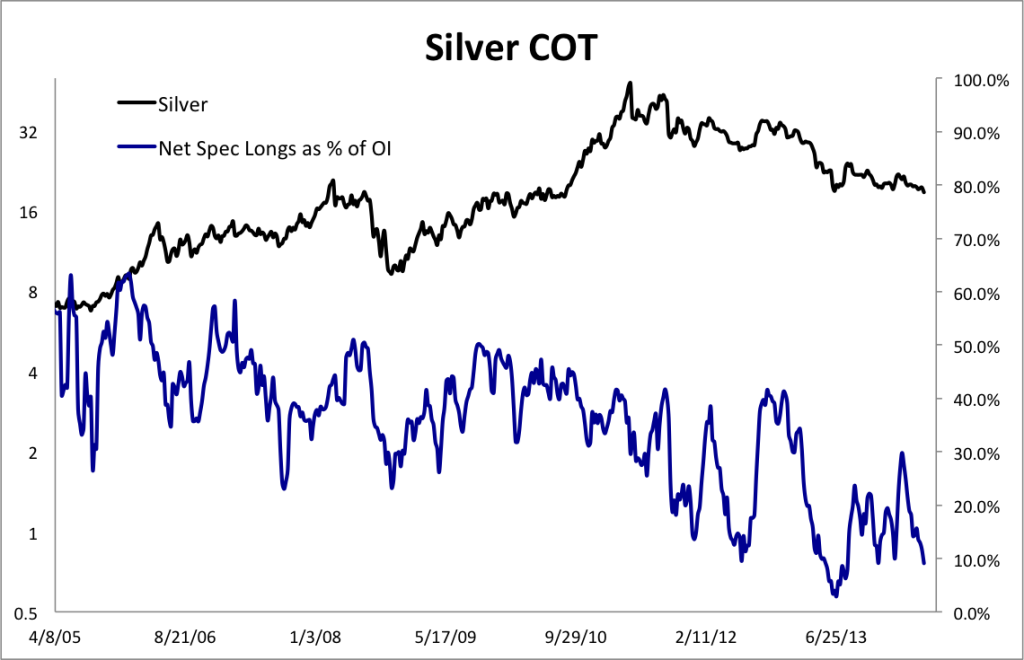

Updated Gold & Silver COTs

First let us look at Gold. The net spec position plunged from about 26.7% last week to below 20% as of Tuesday. Speculators are still too long this market. We need to see quite a bit more liquidation before an extreme is reached. I reiterate my $1080 target, mentioned in yesterday’s editorial.

Silver is getting more interesting. The net speculative position (long) is less than 10%. As of Tuesday, before most of the dumping this week, the net spec position was about 14K contracts. The previous lows were less than 3% and ~6K contracts.

As of last week gross short positions in Silver were very close to an all time high as Tiho Brkan’s chart shows. Today’s data now shows gross short positions at 58K contracts, which I believe is a new all time high! Judging from the above chart, that means there are a few more longs then usual that need to be flushed out. And they very well could have been flushed out over the last two days.

Finally, here is a look at the short positions as a percentage of open interest. Not quite at a potential all-time high but certainly getting very close.

For more charts, actionable analysis and information, consider joining our premium service.