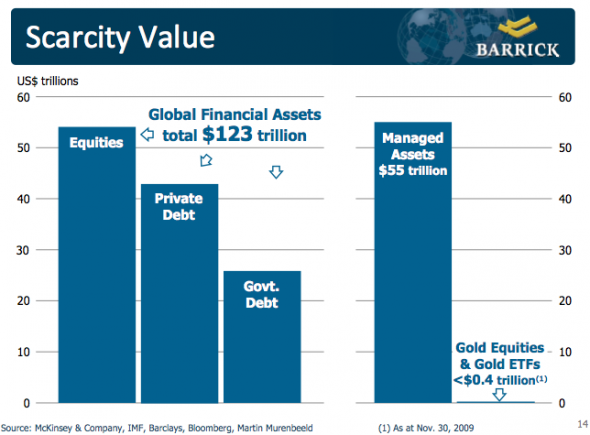

Gold is only 0.7% of Global Managed Assets

That is actually Gold and Gold equities. That is quite the bubble there……Not!

I also found this nugget from 2006, from John Hathaway of the Tocqueville Gold Fund:

“In the bleak days of 1935, the market cap of above-ground gold equaled 15 percent of U.S. financial assets. In 1980, when bonds were dubbed ‘certificates of confiscation’ and good-quality equities traded at six times earnings and 6 percent dividend yields, that same percentage was 29 percent. In today’s carefree world, that percentage is only 3 percent. The price of gold can double or triple in the absence of catastrophic outcomes simply as more investors attempt to position the exchange-traded fund.”

What happens if everyone in the world doubles their gold exposure? Triple? Triple the exposure would still be only 2% of all global assets. And what about the newcomers? Simply put, this has the makings of an incredibly explosive situation over the next few years.