If you are bullish on Gold and would like to know about little-known opportunities to make 210% or more, please pay close attention.

Thanks to a combination of record-low valuations, strengthening fundamentals, and the most inflationary monetary and fiscal policy in history, we are looking at a once-in-a-generation opportunity to make record profits over the next several years.

I am not talking about buying physical Gold or Silver.

And I am not talking about buying gold indexes or senior mining stocks either.

Rather, I am talking about junior miners... small developers or producers that can double, triple, or even quadruple in price in a short period of time.

For example, one junior gold producer rocketed 317% in 18 months.

A junior exploration company shot up 155% in just 2 months.

And a little-known nano-cap silver junior surged 300% in 10 months.

Premium subscribers had a chance to earn these gains.

Thanks to the 3-year long bear market, the opportunities to profit over the next 12 to 24 months could be even better.

Here’s why...

First of all, the timing could not be better.

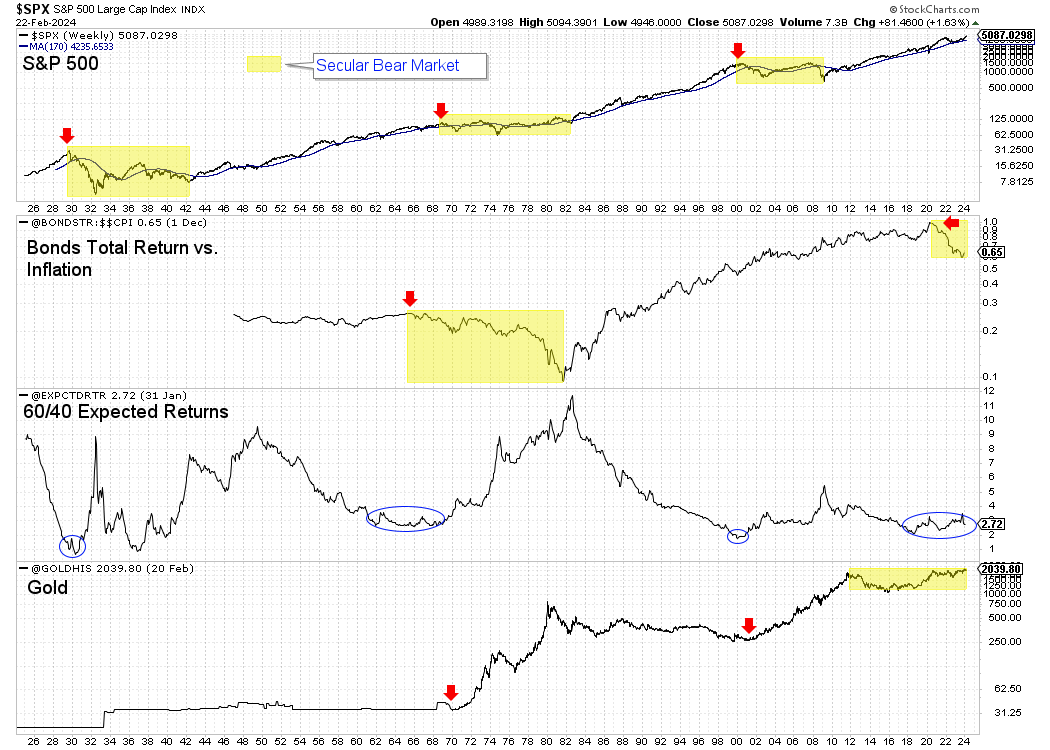

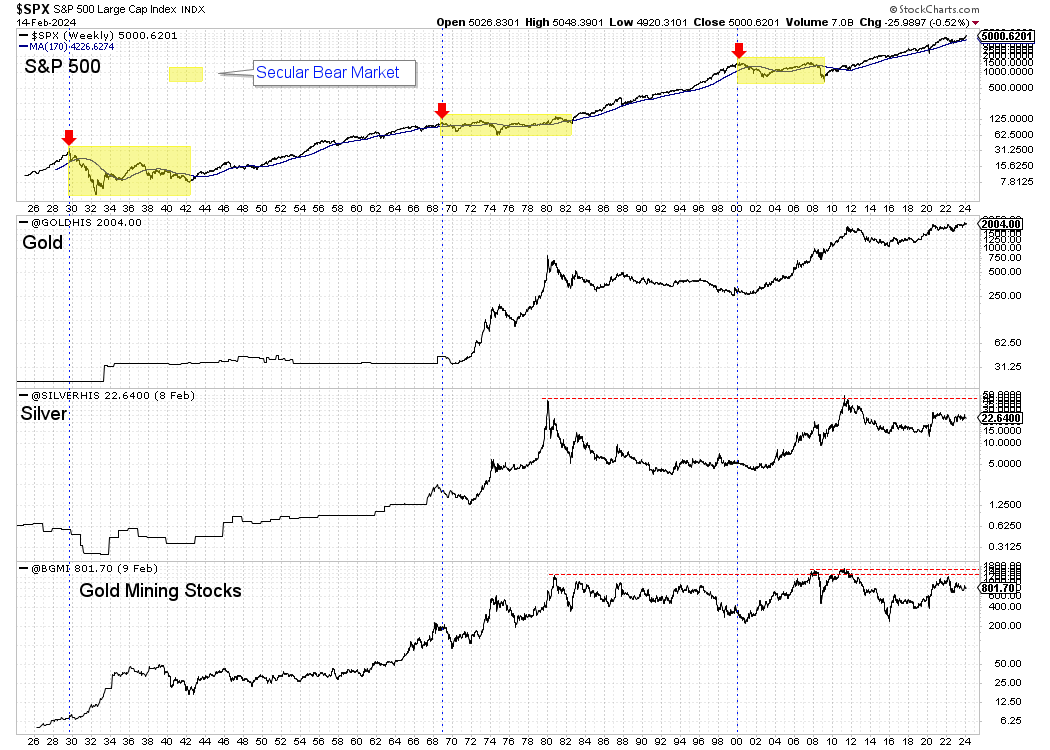

Gold and precious metals markets perform best when conventional stocks and bonds are in a secular bear market and expected future returns from stocks and bonds are historically low.

The performance of Gold, Silver, and junior miners in recent years has been limited by conventional stocks and bonds being in a secular bull market.

That is about to change.

The secular bull market in bonds has ended, and the stock market is not too far behind. The current expected return from a conventional 60/40 portfolio (60% stocks, 40% bonds) remains extremely low and in line with levels seen in 1929, the mid-1960s, and 2000.

Hence, Gold, with a break above $2100/oz, is in a position to begin at least a decade-long secular bull market.

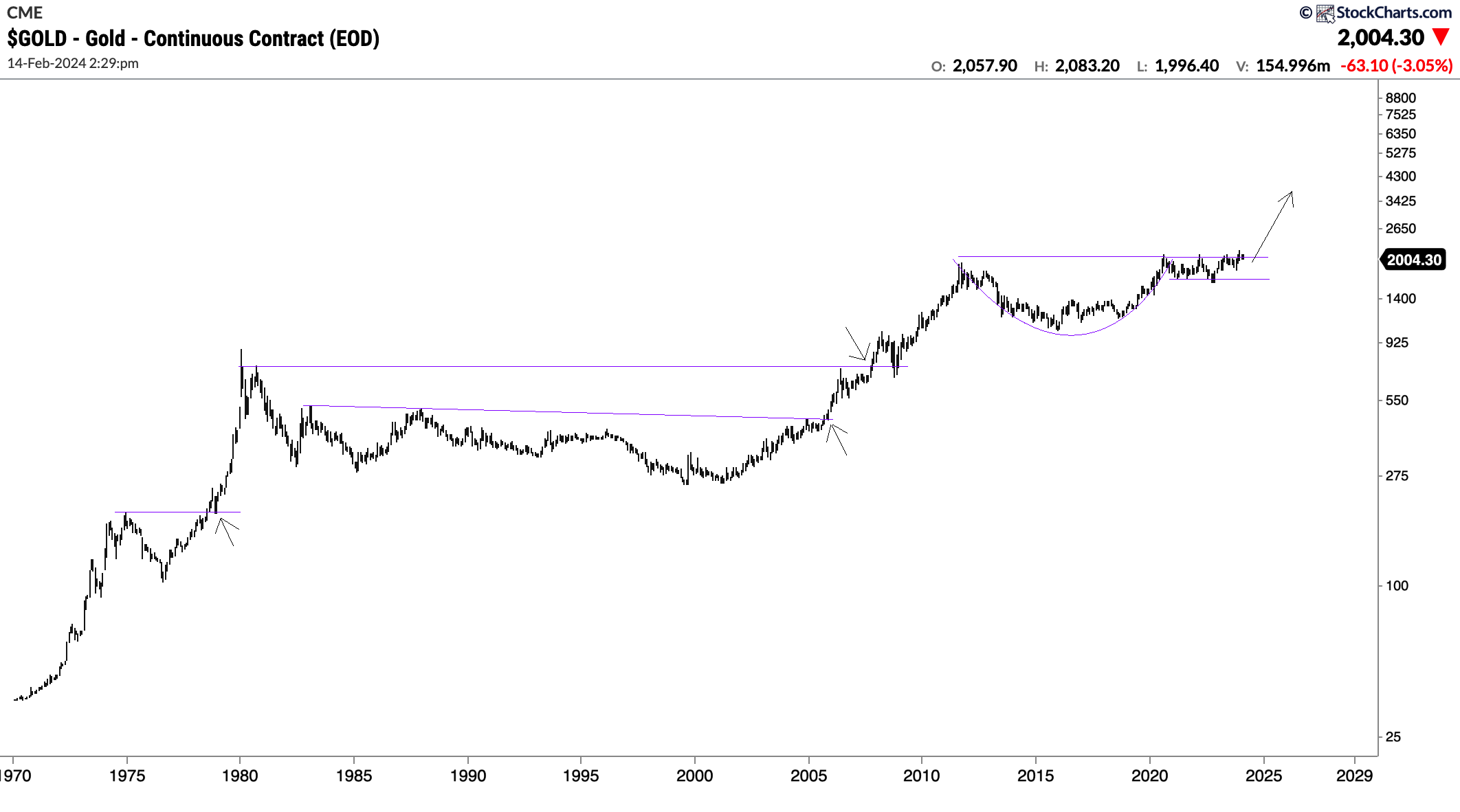

Next, consider that Gold has formed one of the most bullish technical patterns possible, known as a “cup and handle pattern.”

When Gold breaks above $2,100/oz, this pattern will trigger a measured upside target of $3,000/oz and a logarithmic target as high as $4,100/oz.

Gold moved explosively to the upside following breakouts in 1978, 2005, and 2019, but this breakout could unleash the most explosive move in its history.

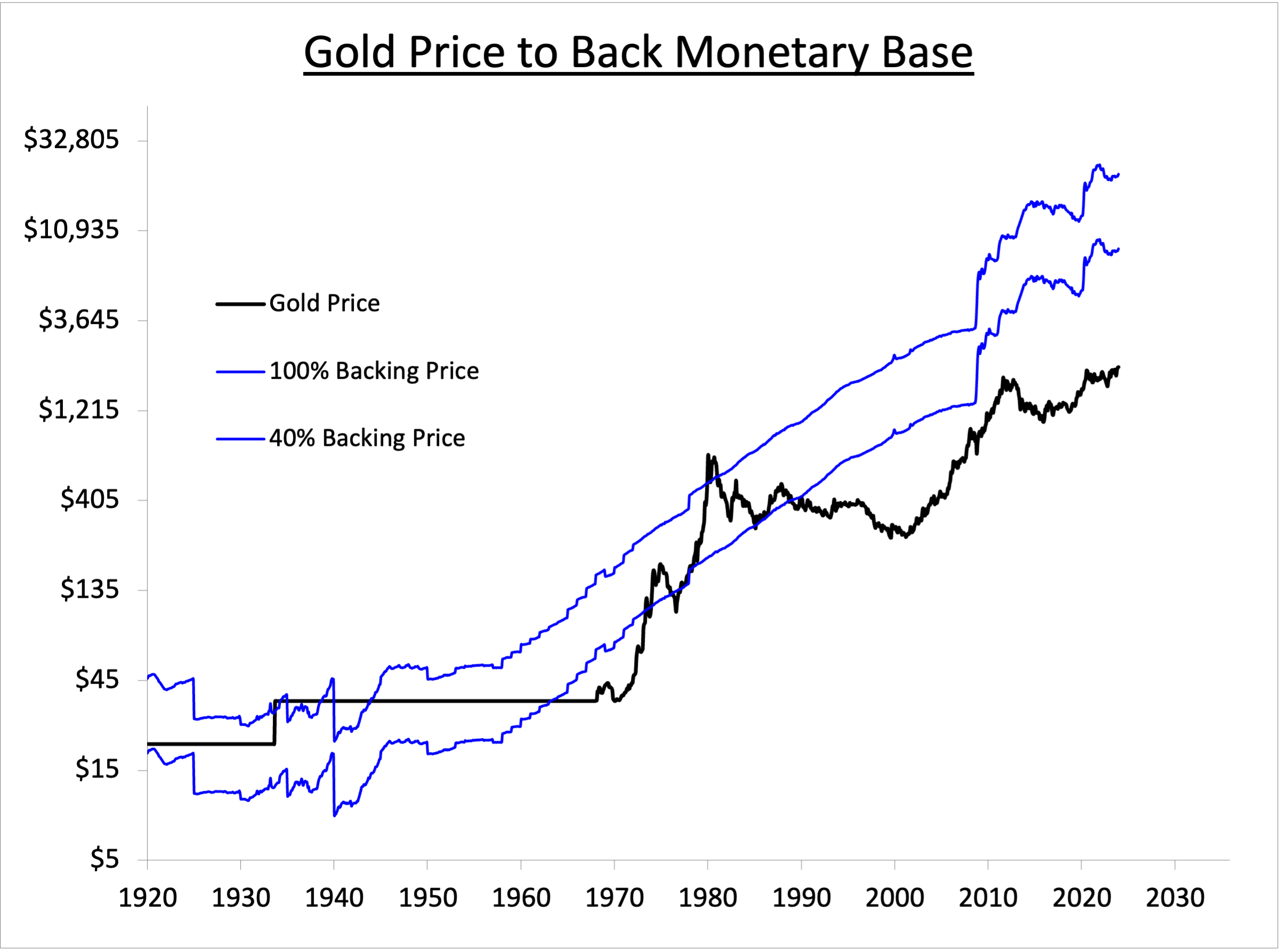

Next, look at the Gold price required to back the US monetary base. This is calculated based on the fluctuations in the Gold price, the monetary base, and US gold reserves.

Note that the two historic peaks in the price of Gold (in the 1930s and at the end of the 1970s) occurred at 100% backing of the monetary base. Gold would have to reach nearly $22,000/oz for that today!

During the global financial crisis in 2008, Gold reached a 30% backing of the US monetary base. For 30% backing today, Gold would need to rise to $6,500/oz.

The catalyst for the next move in Gold and the broader precious metals sector will be the next downturn in the stock market.

In the chart below, we plot the stock market along with Gold, Silver, and Barron's Gold Mining Index.

As you can see, when the stock market falls into a secular bear, the entire precious metals sector begins a secular bull market that lasts at least a decade.

Let’s recap.

Gold has a powerful, bullish technical setup that has the potential to lead to the most explosive breakout in a half-century. There are strong technical targets of $3,000/oz and $4,100/oz.

This breakout and the next downturn in the US stock market could usher in a new secular bull market in precious metals. Gold, Silver, and mining stocks have the potential to rise for a decade, as they did in the 1970s and 2000s.

If you are reading this, you know how cheap and hated the gold and silver stocks are. These are the prerequisites that lead to spectacular upside.

Gold, Silver, and the mining stocks are poised to move much higher, but my focus is on the junior mining sector, where select companies could rise 5-fold, 7-fold, or even 10-fold over the next 24 months!

Expert Analysis & Guidance with a Track Record

I'm Jordan Roy-Byrne, CMT, MFTA, the editor and publisher of TheDailyGold Premium. I'm a Chartered Market Technician, a Master of Financial Technical Analysis, and a member of the Market Technicians Association.

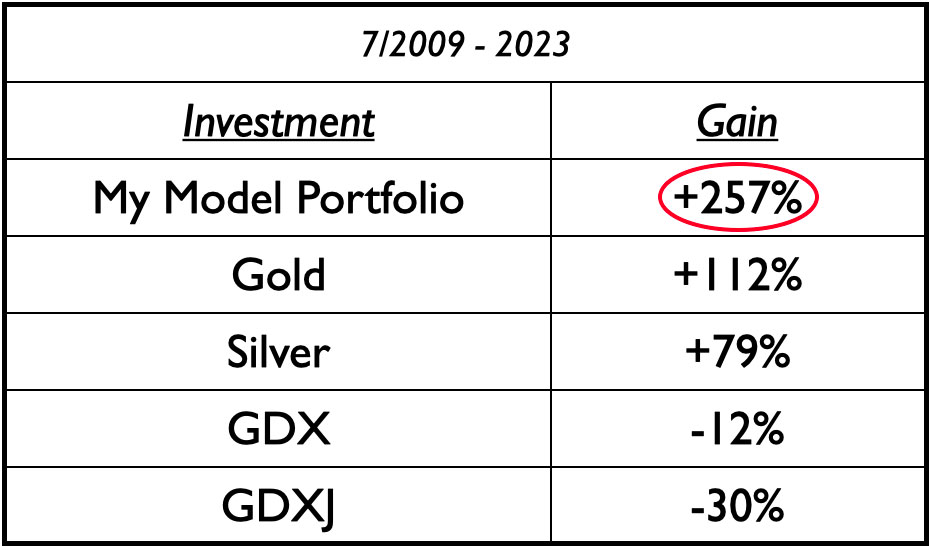

More importantly, I invest my own money and inform subscribers what I am buying and selling. My model portfolio is a real brokerage portfolio, which provides complete transparency and accountability to subscribers.

Since I started my newsletter in 2009, my portfolio of gold and silver stocks has doubled the performance of Gold, tripled the performance of Silver and outperformed the benchmark GDXJ by 400%.

Had you subscribed, you would have had the opportunity to:

Buy a junior gold developer that gained 295% in 9 months

Buy a junior silver explorer that gained 457% in 9 months

Buy a junior producer and developer that gained 389% in 12 months

Buy a junior silver developer that gained 657% in 9 months

Buy a junior gold producer that gained 210% in 9 months

Buy a junior gold explorer that gained 165% in 5 months

How to Pick Winners Like These

There are 100s of companies to choose from. Therefore it's essential to narrow your focus to the fraction of companies that have the best chance to make you the most money.

First, when it comes to junior producers, you need to look for production growth and production growth potential.

Strong production growth often results in a higher valuation in the future. That is a one-two punch for explosive rise in the stock.

The holy grail is exploration success driving organic production growth.

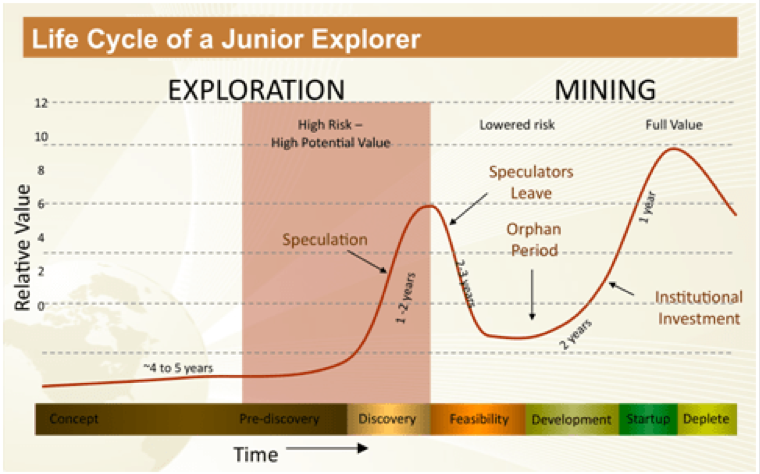

Second, you need to understand the life cycle of a typical junior exploration and junior development company.

The following chart details the life cycle of your average junior company.

As you can see, timing matters, and there are two buy points.

The best time to buy a junior exploration company is when it makes an economic discovery or when it is in the process of growing or adding value to that discovery.

The best time to buy a junior development company is when the company is at the bottom of the curve and getting ready to build the mine.

Finally, you need to learn how to execute buying and selling, which is extremely important.

You should always cut your losses before they become significant losses. We use a mental stop loss of 20%-25% on our positions.

Also, you should let your winners run, but periodically "trim" these positions when they become too big as a percentage of the portfolio.

Obviously, this is a lot of work, especially if you want to do it right. That’s why today I’m offering you a subscription to...

Your Premium Subscription Includes:

Your Weekly Update Includes:

- Update Summary

- Top 10 Company Table

- Watch List Company Table

- Model Portfolio

- Company Report/Notes

- Subscriber Q & A

- Technical & Macro Analysis on Gold, Silver, GDX & GDXJ

What Subscribers are Saying...

I can honestly say Jordan Roy-Byrne has developed not only one of the most analytically accurate, but also has hit the high water mark by making his analysis feel personalized.

I have subscribed to many investment services over my lifetime. In addition to a detailed weekly report, he often sends additional emails with daily observations of not only the physical metals and miners, but also related metrics such as the market and currencies. His service is a great integration of history and future probability that has not only helped me make money, but also avoid losing. It truly is a 5 Star Service at a great price.

Donovan P. CPA & Attorney

He is one of the best in this industry at finding stocks that can rise 500%-1000%.

I have been following Jordan’s work for the past six years and can say he is absolutely one of the best analysts in the field. I am continually impressed by the volume and quality of content Jordan puts out on a weekly basis. His reads on both the fundamental and technical picture allow readers to understand the market and his company analysis and stock selection are excellent. Understanding the nuances and particulars of this sector requires a steep learning curve. It can take years to fully acclimate yourself. Best to learn from Jordan and let him do the work for you!

Collin Kettell, Partner & CEO Palisade Capital

When it comes to the precious metals sector, Jordan is one of the only people I go to for guidance and analysis of the market.

I have read Jordan’s work for 8 years and have benefitted from his timely calls for a long time, including in 2019. His understanding, through his extensive research, convinced me to make large bet in precious metals in 2018 with positions in the Gold ETF, Central Fund of Canada ETF, NovaGold Resources and First Majestic Silver. All of these bets paid off handsomely, especially the mining stocks.

As a private investor running my own family office and co-investing up with other HNWIs, my primary goal has always been to make a profit for myself and my clients. Performance is everything. He understands the market so well (including its history) and knows its pulse better than most.

Tiho Brkan, Fund Manager for High Net Worth Individuals

Jordan has provided superior STOCK-PICKING abilities over the longer-term.

I am simply a pure market-timer for a broad basket of gold stocks and precious metals. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity.

Dr. Jeffrey Kern, Developer of SKI Gold Stocks Trading System

Every week, I spend hours upon hours researching junior mining stocks.

I’m looking at their financials. I’m looking at their production potential. I’m investigating exploration companies for their drill results to see if any projects look promising. I’m talking to my sources in the industry. And I’m applying my technical analysis to supplement the fundamentals.

I’m looking for companies with potential to gain 3-fold to 5-fold over the next 24 to 36 months.

So when I buy a new stock, you can be confident it’s a company with significant upside potential.

What’s that worth?

If I charged by the hour, this level of research would cost hundreds of dollars.

Luckily, you don’t have to pay that much.

You can get a 6-month subscription today for just $149.95. That’s less than $1 a day.

What’s more, just one winning stock could produce more than enough profits to cover your low subscription fee.

I’ve got multiple miners on my radar that are extremely promising. So go ahead and subscribe today to make sure you don’t miss out.

You now have a choice...

You can leave this page and try to pick junior mining stocks on your own.

Or you can subscribe and take advantage of my expertise to help you make market-beating gains without spending hours to try and figure out the market on your own.