Gold and Silver Stocks to Lead Metals Higher

In early November we turned bearish on the precious metals with the expectation that the sector was about to begin a final plunge that would lead to a V shaped bottom. In our last editorial, we asserted that the bear market was in its final throes. Interestingly, the plunge in precious metals stocks may have ended in early December. Over the past several weeks the gold and silver stocks failed to break lower despite the negative sentiment and the prevalence of tax loss selling. While we aren’t sure if Gold has bottomed, we think odds are strong that the stocks have bottomed.

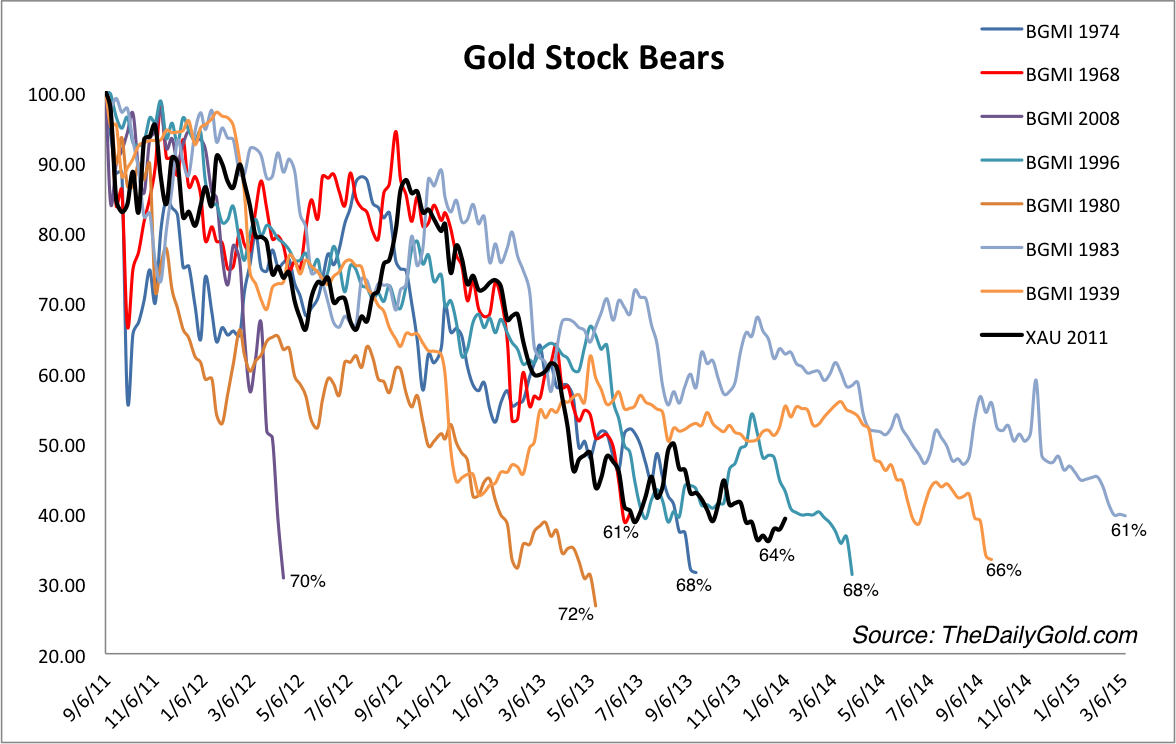

Our strongest argument is our bread and butter chart which displays all of the worst bear market in gold stocks. The current bear market is already the fourth longest and deep enough (64%) to be over. As we’ve previously noted, the three bears that lasted longer were only mildly oversold at this point in time.

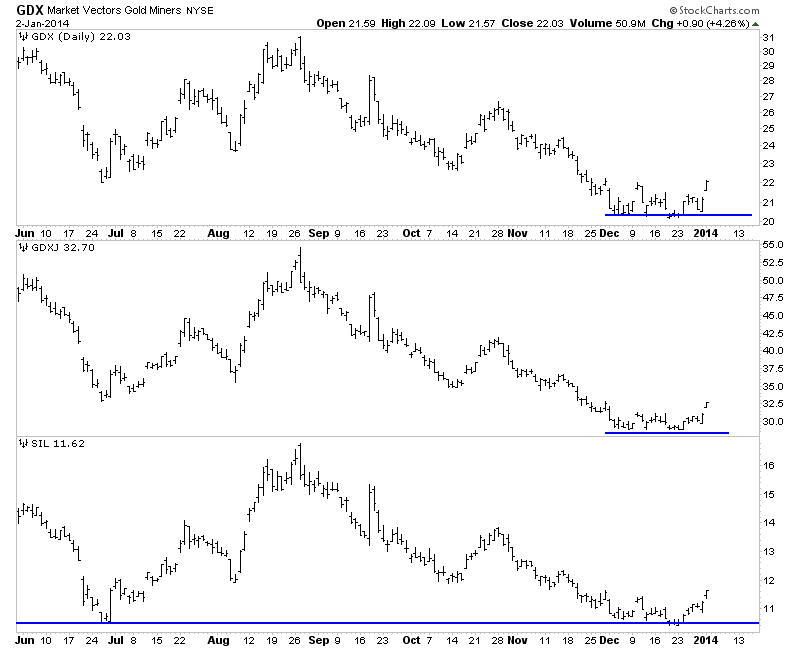

Next we show a plot of GDX, GDXJ and SIL. GDX and GDXJ made new lows at the start of December, tried to break lower several times and failed. Note that the silver stocks did not break below their June low despite three tests of that support in December.

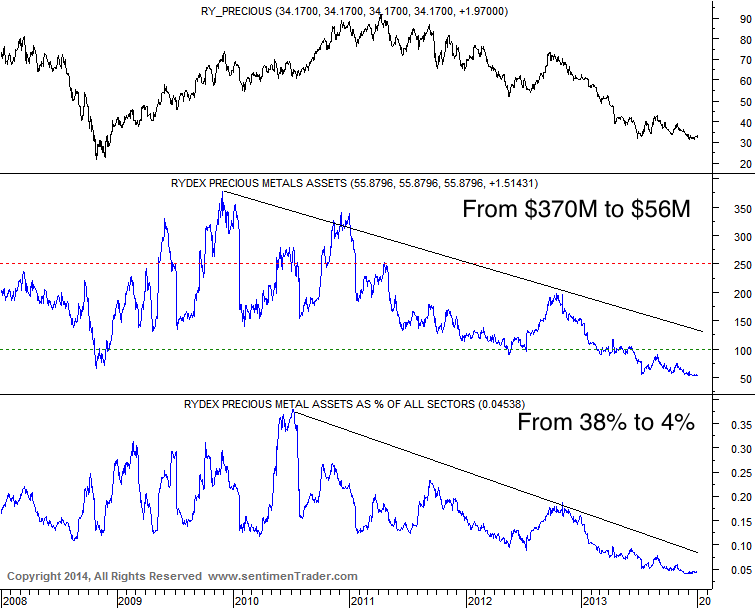

We know that sentiment towards this sector is off the charts negative. The chart below of the Rydex Precious Metals fund is from SentimenTrader.com Assets in the fund have dwindled by 85%. As a percentage of all Rydex fund assets, assets in the fund declined from 38% to now 4%.

Heading into December the gold and silver stocks, which were already extremely oversold and hated, were in position for a final plunge. The HUI had major support at 170-175 yet repeatedly failed to close below 190 throughout December, which was ripe for tax loss selling. When an extremely oversold and hated market fails to sustain a new low, we should take notice.

With regards to the metals, Silver has yet to make a new low while Gold made a new closing low before Christmas but reversed back above $1200. I wouldn’t rule out a new low in Gold. During the 2000-2001 major bottom gold shares bottomed in November while Gold bottomed a few months later in 2001. Gold shares led Gold down and Silver in 2011 peaked four months before Gold. Silver also bottomed before Gold during the 1976 bottom. It wouldn’t be a surprise for Gold to bottom last. The bottom line is the action in the stocks is very encouraging with respect to a recovery in the entire sector. In fact, most quality producers and juniors bottomed in June and have not made new lows. If you’d be interested in learning about the companies poised to rocket out of this bottom then we invite you to learn more about our service.

Good Luck!

Jordan Roy-Byrne, CMT