Stock Market is Due for a Bounce

The equity market is very oversold and due for a bounce as many indicators are hitting extremes. We expect a bounce but do want to note that crashes do happen when the market is very oversold.

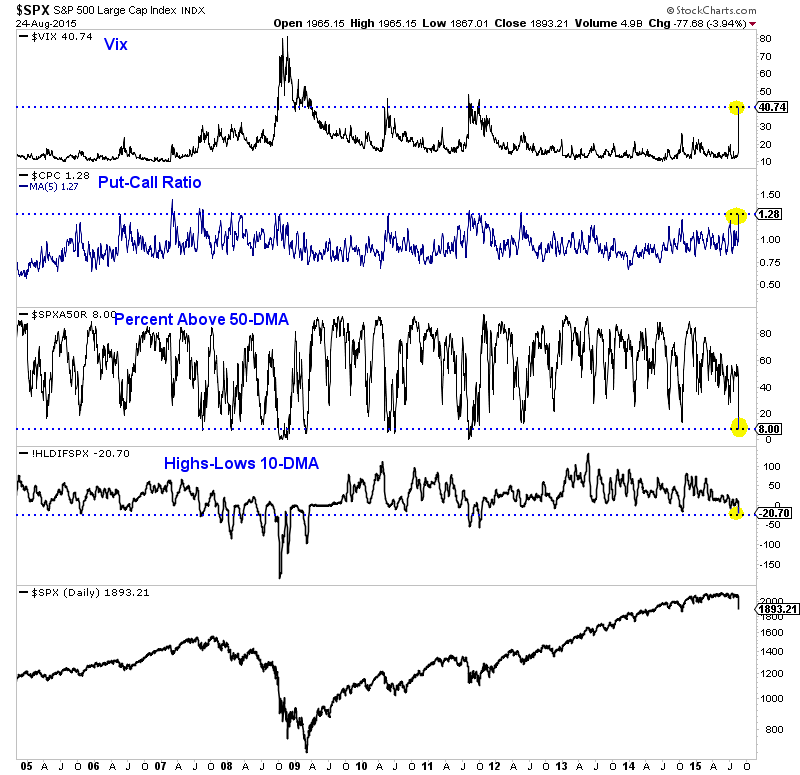

We plot the Vix, the put-call ratio (5-day moving average), the percentage of stocks trading above the 50-day moving average and the 10-day moving average of new highs minus new lows.

The Vix hit a 4-year high while the put-call ratio hit a 3-year high. Only 8% of stocks are above their 50-dma. That is the lowest in 4 years. The difference between new highs and new lows is at a 4-year low.

The market closed at 1893. Look for the 400-day moving average at 1996 to be resistance on any sustained rebound.

Click the image to enlarge.