Argonaut Gold Mentioned in National Post

Here is the mention:

We used the FP Infomart’s Corporate Analyzer to search through 409 metals and mining companies to identify those with some production, sales and earnings, whose shares have been climbing steadily – up at least 15% over the past year, 10% over the past 40 weeks and 2% in the past 13 weeks. To ensure the companies were big enough to be liquid yet small enough to be nimble, we required our candidates to have a market capitalization of at least $100-million but no more than $1-billion.

The search turned up three companies: Argonaut Gold Inc., Foraco International SA and La Mancha Resources Inc.

Argonaut Gold Inc. (AR/TSX), which went public at the end of 2009, now trades around $7, up from the $4 level a year ago, giving it a market capitalization of $640.9-million. It has no debt.

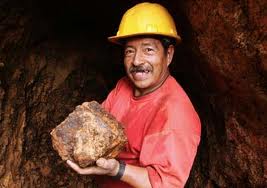

Based in Reno, Nev., it holds an assortment of mines, properties and prospects throughout Mexico. Among them is the producing El Castillo (The Castle) open-pit gold mine in Durango state; San Antonio, an advanced exploration gold project in Baja California Sur state; the formerly producing La Colorada gold-silver property in Sonora state; and about a dozen more prospective properties in Mexico.

Six analysts follow Argonaut and all see the stock as a buy. Their average 12-month target price is $9.53.

“Argonaut continues to be one of a select few gold mining companies that has consistently achieved operation results,” said John McClintock, an analyst at Mackie Research Capital. In a November report, Mr. McClintock, who calls the stock a buy and has a $10.30 target price, estimates Argonaut’s production should grow to 199,900 ounces in 2013 from 70,800 ounces in 2011. Earnings should grow to $1.10 per share from 28¢ over the same period, he said.