Gold & Silver Morning Commentary

Gold and Silver are steadily higher this morning on the back of more Euro strength and US$ weakness. Although, the US$ has pared its losses in the afternoon session in Europe. An oversold condition in the Euro is occurring as the currency nears major long-term support. That, along with speculation that European leaders will be able to find a solution to Greece’s budget woes, is helping the Euro and in turn, Gold and Silver.

In other news, Australia’s jobless rate fell last month while Chinese property prices increased the most in the last 21 months. That helped Gold in the Asian session.

Marc Faber, the noted contrarian investor and Gold bull, said, in an interview with Bloomberg, that he wouldn’t rule out $950-$1000/oz on Gold but that he doesn’t expect any more downside.

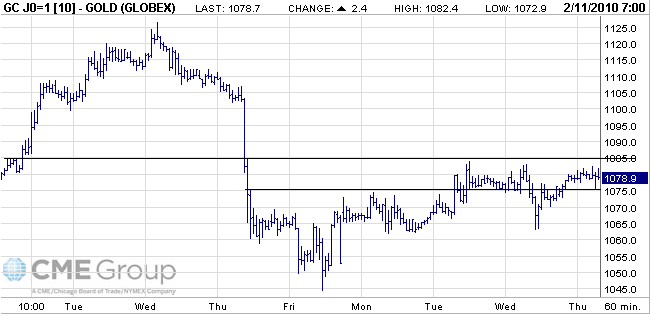

Turning to the short-term chart we see that Gold is in a range between $1075-$1082. A break of $1082 and we can expect a move down to $1065, which is solid support. If Gold can reach $1085 it would likely climb back to $1100.

For Silver, $15.40 looks to be a key pivot point for this week. The market has strong support at $15.00-$15.10 and resistance at $15.60. A move beyond $15.60 would take the market to $16.20.

All for today.

-Jordan Roy-Byrne, CMT

[ad#WSCS Ad#2]