More Weakness Ahead for the Miners

No pain, no gain. That is one comment regarding this seemingly terminal bottoming process in the precious metals complex. Multiple times as soon as conditions have strengthened enough for us to anticipate a breakout, the miners have put in a bearish reversal. At the same time, the metals and especially Gold have failed to gain any real traction. Throughout the past year we’ve been looking for that final low in Gold but it has eluded us multiple times. The recent reversal in the gold and silver miners coupled with a continued technical downtrend in Gold suggests that more pain is coming before sustained gain.

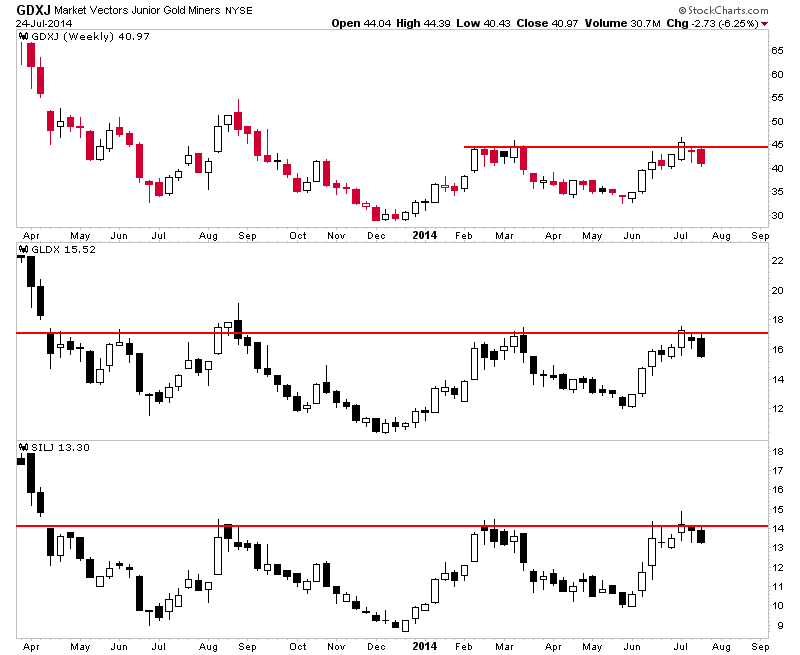

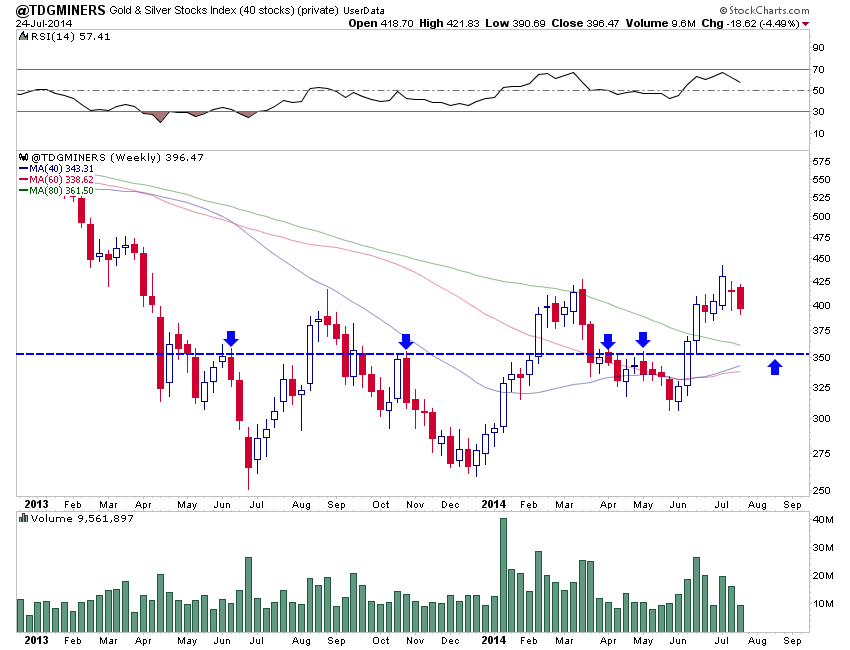

Gold and Silver miners have made some progress over the last year. As evidenced by our top 40 index, the best companies have bottomed with little question. The various indices put in a higher low at the end of May and rebounded with gusto. Daily momentum hit levels not seen since 2012. Meanwhile, the miners have outperformed the metals and closed the recent quarter at the highs. That did not happen in past quarters. However, the miners failed to break resistance and are now reversing their course yet again. We plot GDXJ (large juniors), GLDX (explorers) and SILJ (silver juniors). Note how they’ve reversed a near breakout two weeks ago.

The message of the miners, as we posited last week is that Gold’s final bottom is ahead rather than behind. Had the miners blasted through resistance then it would have indicated a final bottom for Gold was in place. This view is also confirmed by the action in Gold itself. Gold peaked at $1346 and thus failed to come close to its March high at $1392. Last week Gold formed a bearish reversal and engulfed the previous three weeks of trading. A lower high and strong weekly reversal in Gold is a warning that more downside potential lies ahead.

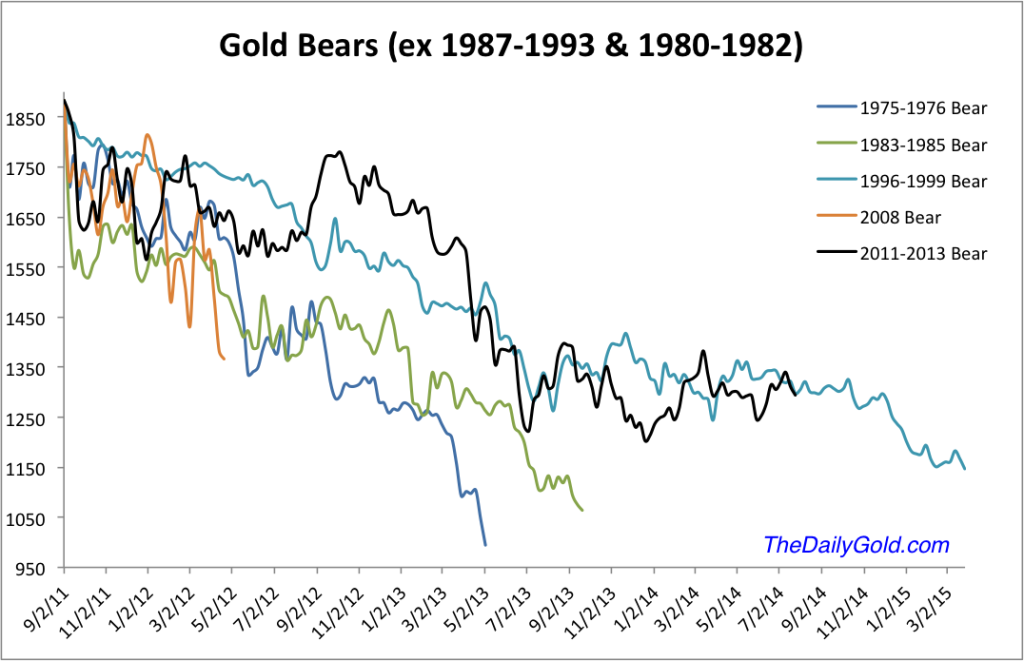

The Gold bears analog chart below (which excludes the most extreme bears in price (1980-1982) and time (1987-1993) shows that the trajectory of the current bear is similar to that of the 1996-1999 bear. In other words, this current bear is in line with history. The most severe bears in price tend to be the shortest while the most severe bears in time tend to be the smallest in price. The current bear is somewhat more severe in time than price.

The key support levels to watch in Gold on a weekly basis are $1250 and $1200. A close below $1250 would bring about a test of $1200 while a break below $1200 could usher in that final capitulation that has eluded us.

With regard to the miners (GDX, GDXJ, etc), keep an eye on the 200-day moving averages as well as the May lows. GDXJ would have to decline 10% to test its 200-day moving average and 20% to fall below its May low. Last week we noted 370 as support for our top 40 index seen below. The weekly chart shows long-term moving averages coalescing near a key pivot point of 353. That is about 11% downside.

This has been a difficult and confusing last year due to the disparity between the leading gold and silver stocks and the metals themselves. More hints of a bottom have come with each successive advance yet Gold in particular has not obliged. Our top 40 index shows that the worst was over for most quality companies a year ago. The index is up roughly 60% from that point and has endured two big corrections while making higher highs and higher lows. Select companies have vastly outperformed the metals.

However, we must give the Gold bears credit. They’ve been on the right track with respect to the metal. The risk has flipped again as Gold has likely started its final decline. This figures to pull the mining stocks down one last time before their fledgling bull market begins in earnest. The stocks that hold up the best during the selloff could be primed for leadership in the fall. We invite you to learn more about our premium service in which we highlight the best junior companies and trade and invest a real portfolio for subscribers benefit.

Good Luck!

Jordan Roy-Byrne, CMT

Jordan@TheDailyGold.com