Potential Upside Target for GDXJ

As 2015 begins I’d like to briefly follow up on my most recent article in which I discussed the oversold condition in the miners. Breadth indicators as well as technical indicators (such as distance from the 200-day moving average) showed the miners reaching an extreme oversold condition in November and nearly again only a few weeks ago. Miners essentially were at their third most oversold point since 2001. The other two were during the 2008 financial crisis and during Gold’s spring collapse in 2013. The current oversold condition combined with the failure of most indices to make new lows in December could be the setup for a first quarter rebound.

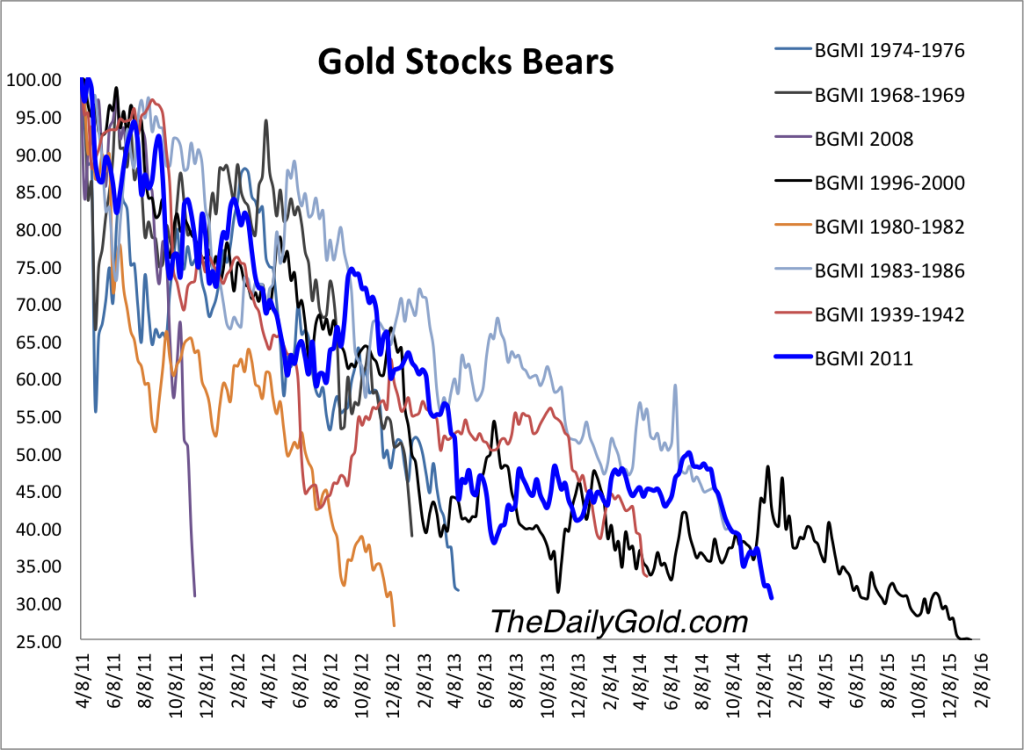

Before I get to GDXJ I’d like to show an updated bear analog chart for gold mining stocks. We use data from the Barron’s Gold Mining Index dating back to 1932. The current bear market is in blue. Other than during the final weeks of the 1996-2000 bear market gold stocks (according to this chart) could be at their most oversold point in history. It certainly is very close. Bull markets began from similar points. Three times the 1996-2000 bear became this oversold. Twice it rebounded and the final time it consolidated for weeks before falling to its bear market low in the second half of 2000.

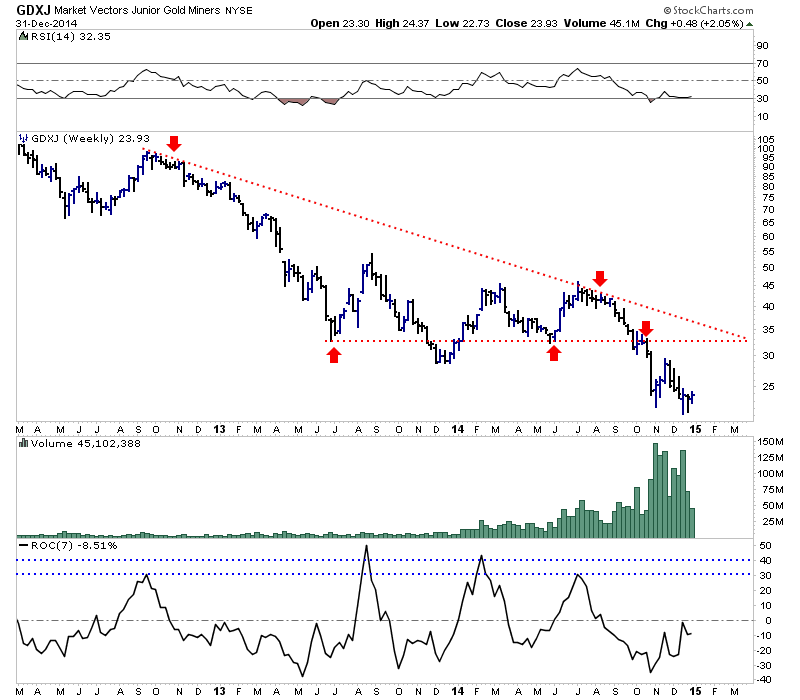

Below is a weekly bar chart of GDXJ. Note the confluence of trendline and lateral resistance just below $33. The 50% retracement of the recent 53% decline (June to December) is $33. Clearly $33 figures to be important overhead resistance. GDXJ closed Wednesday pennies below $24.

At the bottom of the chart we plot a rolling 7-week rate of change for GDXJ. Over the past two years GDXJ has gained at least 30% within seven weeks on four different occasions. Twice it gained at least 40%. A 40% advance from Wednesday’s close would take GDXJ to $33.50.

Whether or not a new bull market is about to begin does not change the near term outlook. Gold and silver miners (and juniors especially) became extremely oversold and are ripe for a good rebound. It appears to be an excellent long opportunity for traders as well as an opportunity for investors to start scaling into long positions. Consider learning more about our premium service which includes a report on our top 10 juniors to buy for the coming bull market.

Good Luck!

Jordan Roy-Byrne, CMT

Jordan@TheDailyGold.com