A Few Positive Fundamental Developments for Gold Miners

For the most part positive fundamentals (for gold mining companies) refers to rising Gold prices. However, this neglects the things under the surface which can affect margins as much as headline prices and in some cases more.

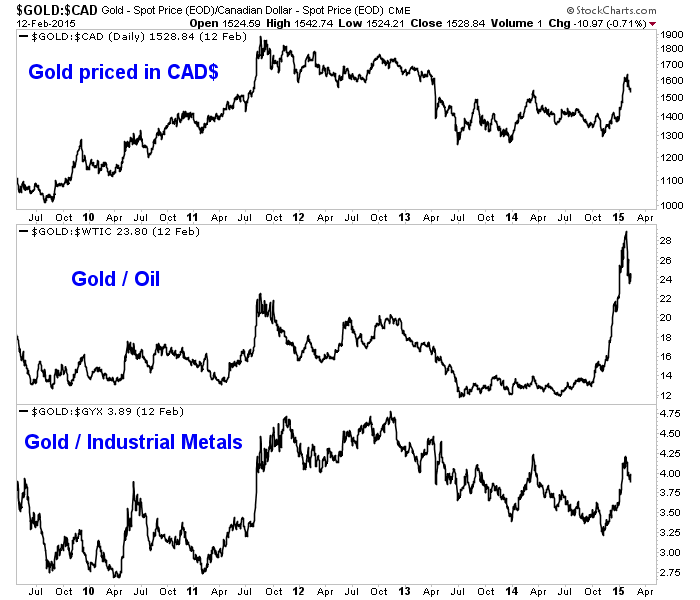

In the chart below we plot Gold priced in Canadian Dollars, Gold against Oil and Gold against Industrial Metals. Before we get to the chart let me explain why these ratios are important. First, the vast majority of gold mining firms are headquartered in Canada. The loonie is their local currency. The Canadian Gold price for firms that operate mines in Canada or explore in Canada can be more important than the US$ Gold price because their costs are in Canadian Dollars and not US$’s. Thus, a weak loonie rather than a weak US$ is a benefit.

Second, the Gold/Oil ratio is important because energy costs can account for 25% of a miner’s costs. Mining is an extremely energy intensive activity.

The chart below shows that the Gold price in Canada has surged while the Gold/Oil ratio has exploded. We also plot Gold against Industrial Metals as a proxy for other industrial related mining costs. That ratio has increased materially in favor of Gold but not to the degree of the other ratios.

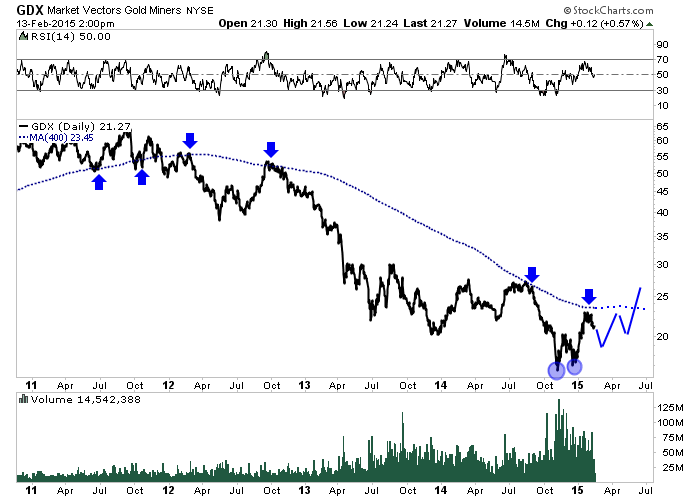

As evidenced by GDX, the miners formed a strong double bottom and rebounded to the 400-day moving average which is key bear market resistance. The miners did not have that type of support at other lows (such as in June 2013 and December 2013). Moreover, the miners did not have improving margins thanks to plunging energy prices and a much weaker local currency.

The miners have made progress in recent months but the bear market won’t be over until GDX can clear its 400-day moving average. The good news is the miners formed a bullish double bottom after reaching arguably their second most oversold point (from a long-term sense) in the last 70 years. That was followed by the positive developments discussed above and word that the likes of Jeff Gundlach and Jim Rogers became investors in the sector. A new bull market lies ahead sooner rather than later but investors and traders need to maintain their discipline and patience. Consider learning more about our premium service including our current favorite junior miners which we expect to outperform.

Good Luck!

Jordan Roy-Byrne, CMT