Gold’s Most Important Indicator is Turning Bullish

We have written about the importance of Gold outperforming the stock market for nearly a decade. In addition, we expanded this concept by including Bonds to construct a 60/40 Portfolio.

In recent years, the bull market in precious metals has not felt like one due to the stock market’s strength, which has limited capital flows in precious metals.

However, that is beginning to change as capital has already started to move out of the Mag7, tech, and conventional stocks in favor of Gold.

Gold against the stock market has broken out and reached a 4-year high, while Gold against the 60/40 conventional investment portfolio is breaking out of a 10-year-long base.

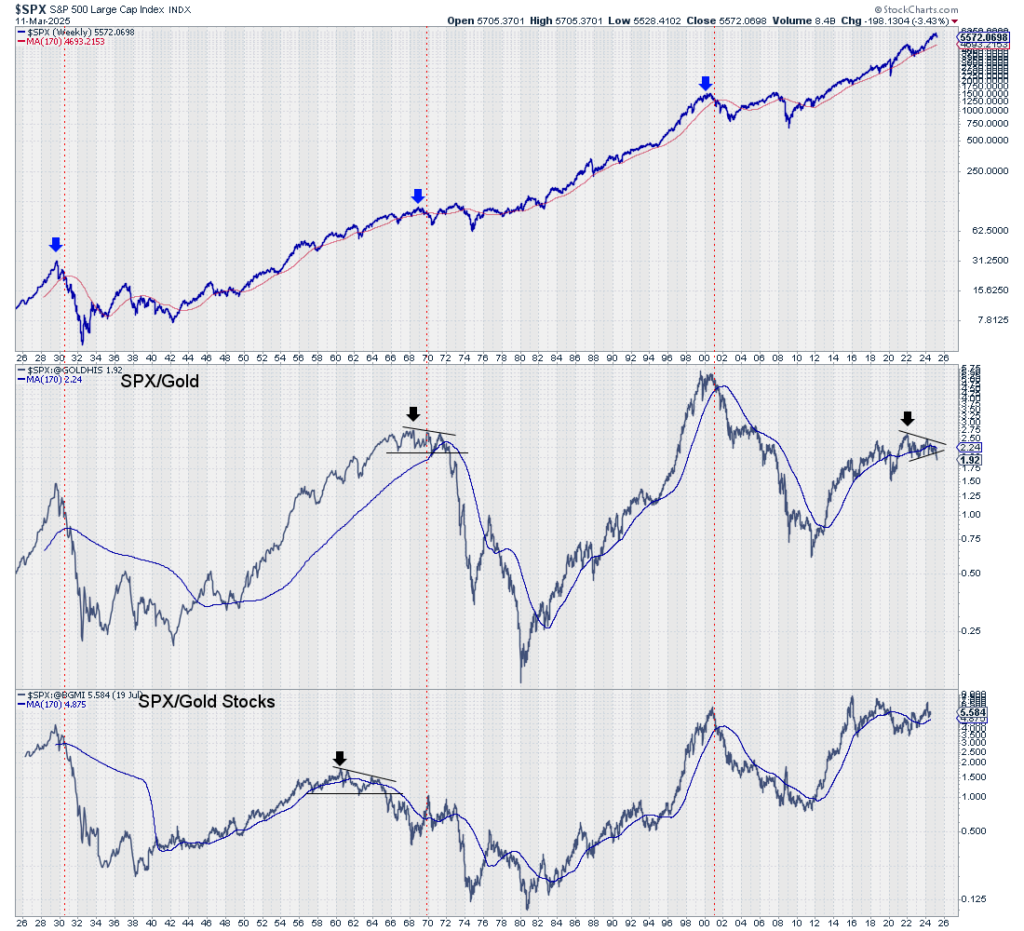

We begin from the perspective of the stock market.

We plot the S&P 500 below, along with the S&P 500 divided by Gold (middle) and the S&P 500 divided by the Barron’s Gold Mining Index (bottom). The red lines mark the points at which the S&P 500 fell below its 40-month moving average. The blue arrows mark the preceding secular peak.

The stock market is breaking down against Gold in a similar fashion to the early 1970s and in a similar fashion to gold stocks in the mid-1960s. We have written about how the gold stocks in the mid-1960s are the best comparison for Gold today.

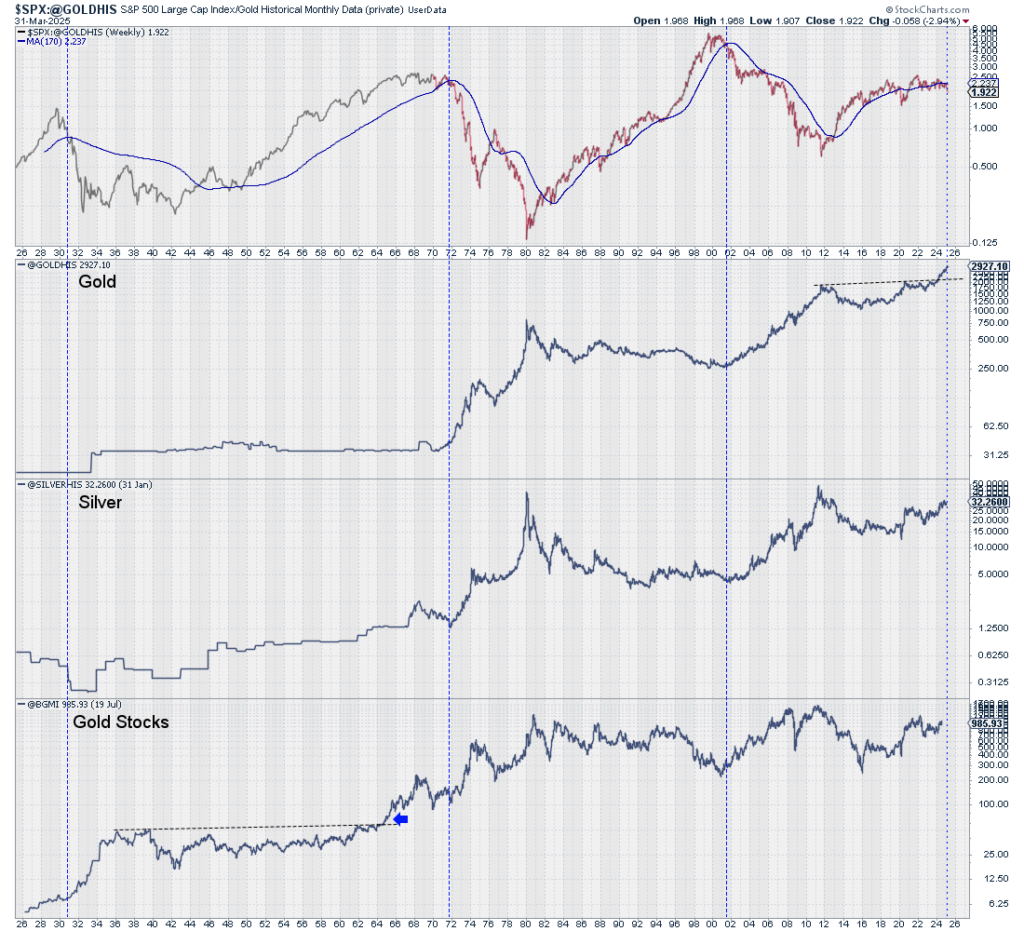

The next chart plots the S&P 500 against Gold (top) along with Gold, Silver, and Barron’s Gold Mining Index.

The vertical blue line marks the point where the S&P 500 to Gold ratio lost its 40-month moving average. As you can see, this is an incredibly bullish development for the entire precious metals sector as it confirms a new secular bull market.

The blue arrow marks the point when the gold stocks to S&P 500 ratio lost its 40-month moving average and broke down convincingly. Again, this is a better comparison for Gold today than in the early 1970s.

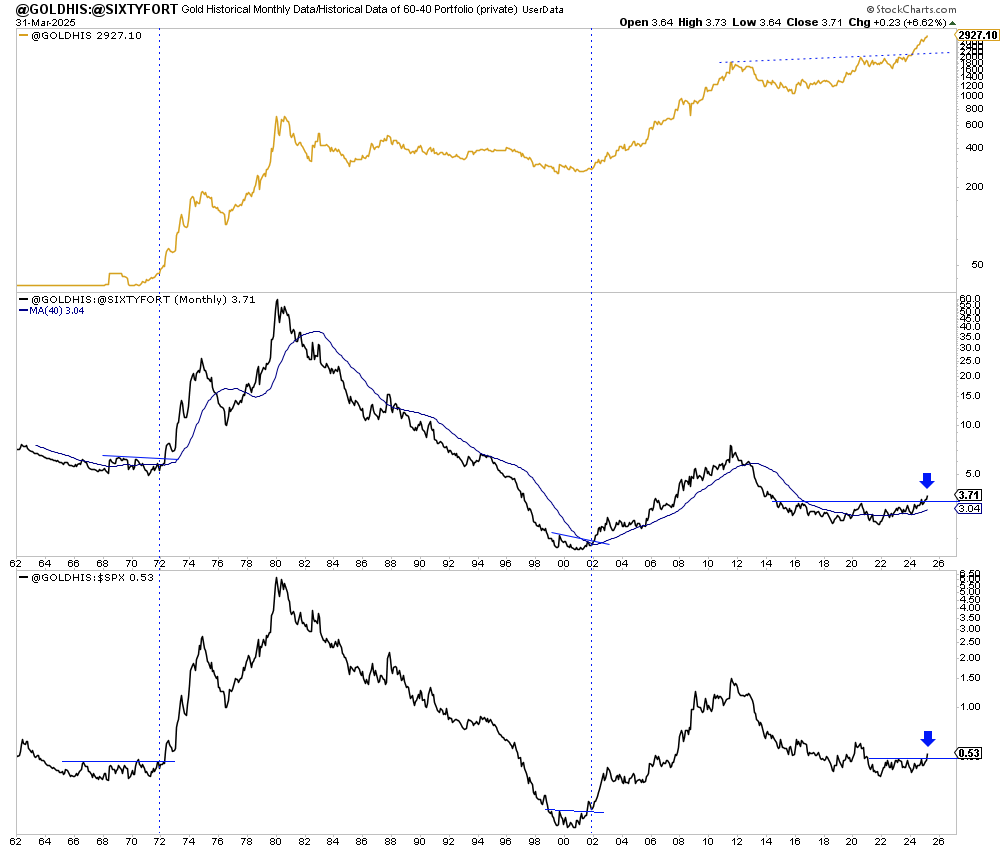

Finally, let’s view things from the perspective of Gold.

We plot Gold, Gold against the 60/40 Portfolio (middle), and Gold against the S&P 500 (bottom).

The charts show monthly data.

We should have weekly confirmation of these breakouts in a few days, leading to eventual monthly confirmation.

There’s no two ways about it.

This is incredibly bullish for the entire sector. It confirms the new secular bull market, which will run for many years.

Do not miss out, and do not delay.