Two Charts that Could Foretell the Future

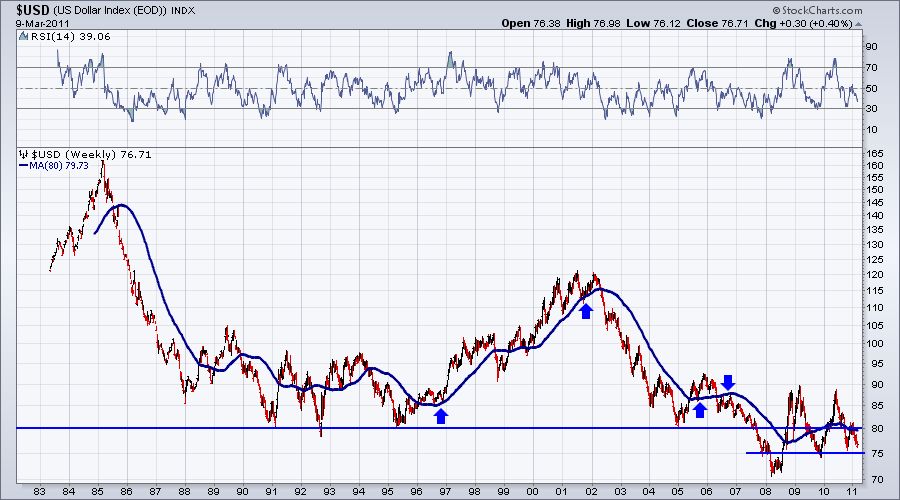

The US Dollar index found support at 72 and has held that low for the time being. Yet, the buck was unable to hold both strong rallies of the past two years. Now it has fallen below 80 and is threatening support at 75. In the short-term we feel the greenback can hold its own for a while. However, this is a very ominous looking chart. The US$ needs to find its legs soon or 2011 and 2012 could be ugly.

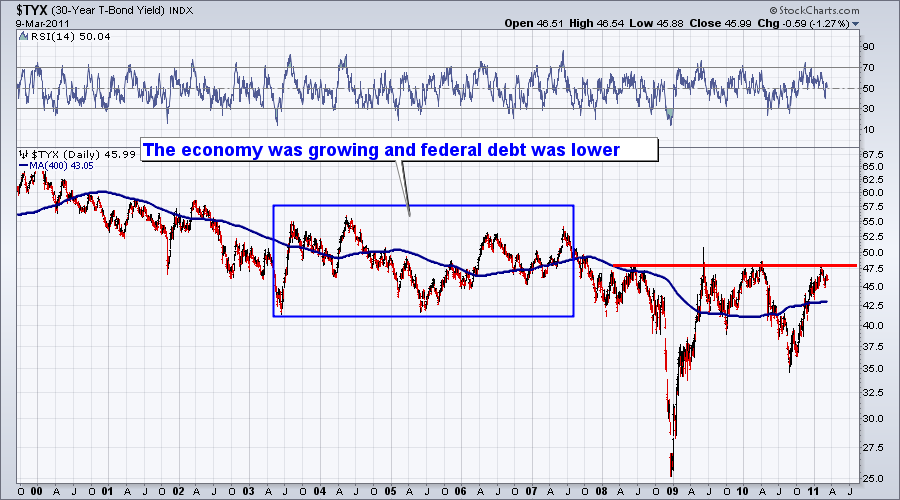

Likewise, interest rates are again on the cusp of a major breakout which of course means Treasuries are on the cusp of a breakdown. Rising rates would be bad for the economy, conventional investments and could trigger increasing inflation. The economic recovery has been weak and subpar. It is a pipedream to expect the nations of the west to grow out of their debt burden. If/when rates rise, it will force governments to tighten their belts and central banks to continue to monetize.

If we do get a bounce in the greenback and Treasuries, it could be a tremendous opportunity to get involved or increase positions in Gold, Silver and other Commodities.

If you are looking for more info or specific forecasts, consider a free trial to our premium services: Gold & Silver Premium & Commodities Premium.