Analysts Have Overly Optimistic Earnings Estimates

Lance Roberts, as per ZeroHedge, notes the overly optimistic earnings estimates from Wall Street Analysts.

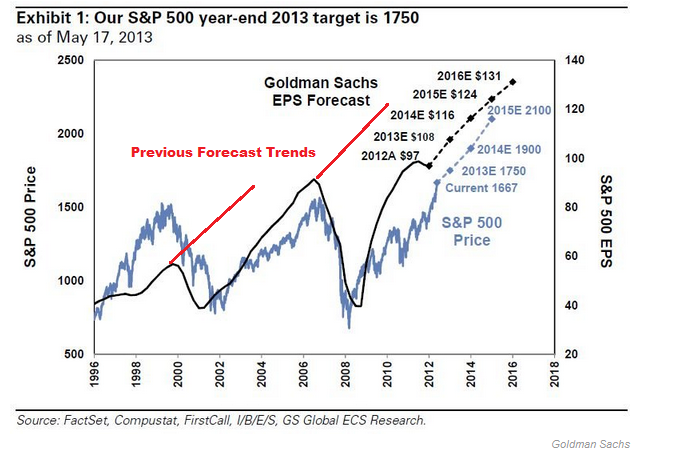

In 2000 after five years of earnings growth, analysts were projecting growth to 2004. That would have been 10 straight years of earnings growth. In 2007, with earnings already up six years in a row, analysts forcasted growth through 2010. That would have been nine straight years of earnings growth.

At present, analysts are forecasting earnings growth through 2016. Earnings growth was slightly negative in 2012 but aside from that they’d be looking at virtually uninterrupted earnings growth from 2009 to 2016. With margins at all-time highs, interest rates rising, taxes rising and top-line growth scant, it seems almost a certainty that earnings won’t continue to grow for another three to four straight years.