Another Blatant Example of Bias Against Gold

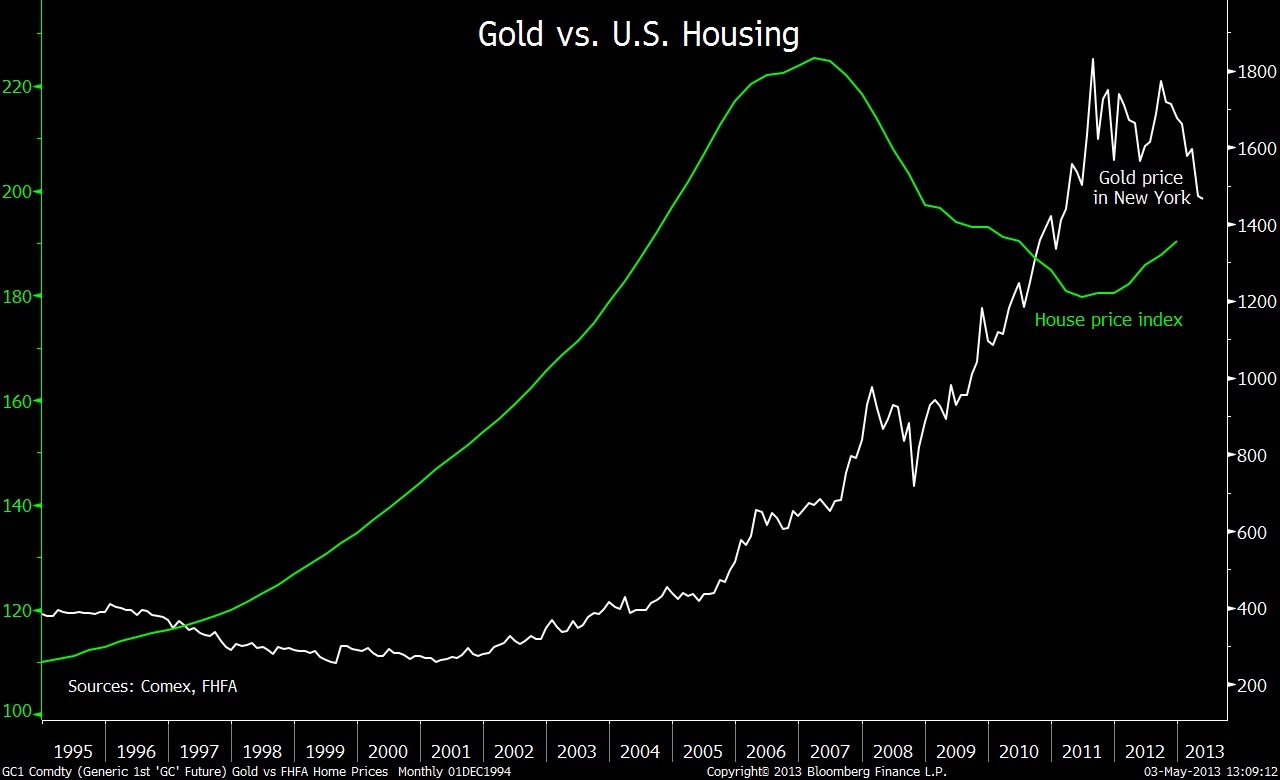

Barry Ritholtz, a blogger/fund manager who has been taking delight in Gold’s drop, highlighted a Bloomberg chart of the day which compares Gold against housing prices. The conclusion is that since 1995, housing has been a better inflation hedge. You’d be better off buying a house than Gold, according to the study.

Hold on a minute! As several comments in Ritholtz’s post noted, the two scales are totally messed up. Gold is up 4-fold while housing prices are up only 58%.

These types of comparisons and charts can be dangerous. First, anyone can pick any period to show that one asset is better than another. Second, one can manipulate the scales (as we see hear, though it was probably not intentional).

As for the question?

It depends on market cycles. Simply put, Gold will prove to be the better hedge until its secular bull market is over. That will come probably in the next five years. After that, both housing and equities will outperform Gold.

What about over the very long term?

In 1930, Gold was $21/oz while the average new house was $7,145. Today Gold is $1470/oz while the average new house costs about $190,000 (according to the chart). Over the past 80+ years, Gold is up 70-fold while housing is up 26.6 fold.