Another Catalyst for Gold & Silver Shares?

If you’ve followed our work you know how useful intermarket analysis can be when deciphering future movements and trends in the precious metals complex. Years ago when I would analyze Gold I would only follow Gold. Now I am aware of a wealth of markets that can be analyzed, which can help provide an outlook for precious metals.

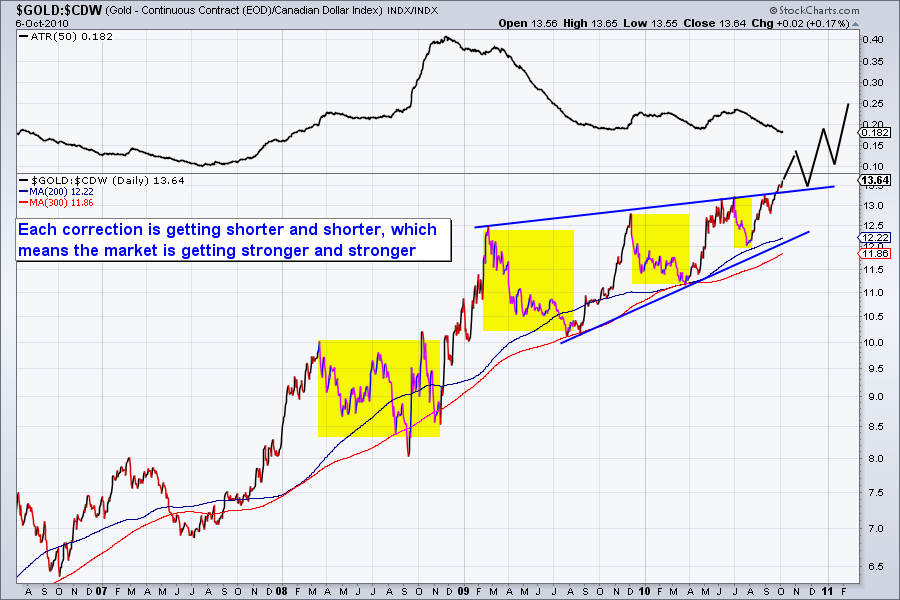

Today I am looking at the Canadian Dollar. Most Gold and Silver companies are Canadian companies. They earn and spend in Canadian Dollars. Thus, the US Dollar Gold price has much less of an impact then you’d think. It is the Canadian Gold price that matters. Below is a chart of the Canadian Gold price.

This setup looks potentially explosive. We see that the market has already broken above an 18-month rising channel or wedge. Normally a rising wedge is bearish but when it occurs when a market isn’t that extended (like we see here) it can have an extremely bullish outcome.

Two things we should note. First, note how each correction (since 2008) is getting smaller in terms of time. That means the market is getting stronger. Secondly, the market isn’t extended. It has only risen steadily by bouncing on and off the moving averages.

Earlier this year we discussed Gold/Euro and said it was going parabolic. The Euro has recovered, but not before Gold/Euro rose 30% in about three months!

Since most gold companies are Canadian, an explosive move in the Canadian Gold price would be a huge catalyst for many stocks both large caps and juniors.

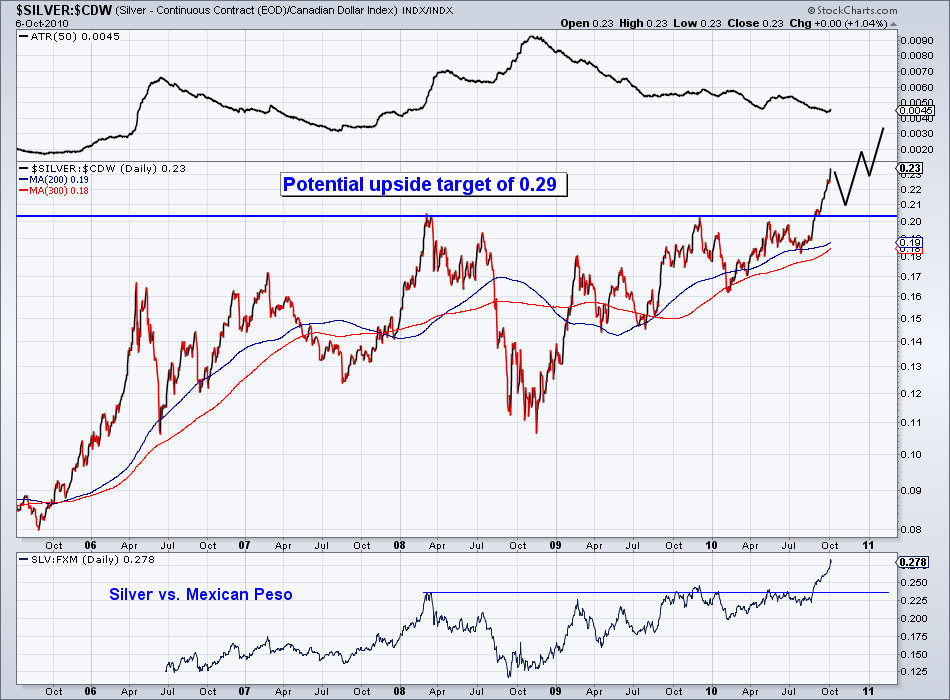

While we are at it, let’s take a look at the Silver. Silver in Canadian Dollars has made a very clean, multi-year breakout. We should see a snapback to previous resistance before a continued advance. Note that the ATR indicator at the top shows no signs of an overextended trend ripe for reversal. At the bottom we show Silver against the Peso. Many silver companies operate in Mexico. The Peso can have a small impact on these companies.

Every day we see or hear about the movements in Gold and Silver prices. If they are up, then we assume the stocks will be also. However, we need to keep in mind the various factors, which will influence the mining shares. As we’ve explained, traders and investors need to key on the Canadian prices of these metals. Those prices are what matters to the companies.

This is the type of analysis we do. While mainstream analysts and talking heads say that Gold is overbought, we say, time to look deeper. The metals may be overbought in the short-term but these charts show that there is potentially plenty of upside over the next six to nine months. If you are looking for professional guidance in navigating this historic bull market, then we invite you to consider a free 14-day trial to our service.

Good Luck!

Jordan Roy-Byrne

http://www.thedailygold.com/newsletter

Jordan@TheDailyGold.com