Posted on

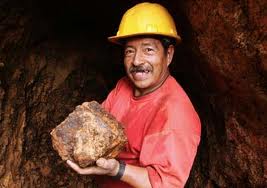

Gold and Silver Outlook in 2012

Lately we’ve been writing about the precious metals stocks. In particular we believe the equities have made a multi year bottom and look ready for a solid 2012 and 2013. Part of the reason is the action in the metals (Gold & Silver) suggests an important bottom is in place and a rebound is underway. … Continue reading