Brace for More Downside in Gold & Gold Stocks

The Fed has ratcheted up tough talk and is conditioning the market for an interest rate hike sooner rather than later. Fed Futures yesterday signaled as high as an 81% chance of a rate hike in March.

For months I’ve written about and showed you the strong history of Gold making major bottoms at the start of Fed rate hike cycles. If the Fed hikes in March, Gold will rebound in the spring and the summer.

Here’s the issue right now.

It’s two months until March, and Gold and gold stocks usually bleed right before the Fed executes the hike. In the two months before the previous three rate hike cycles, Gold declined 11%-13%, and the HUI declined a minimum of 25%.

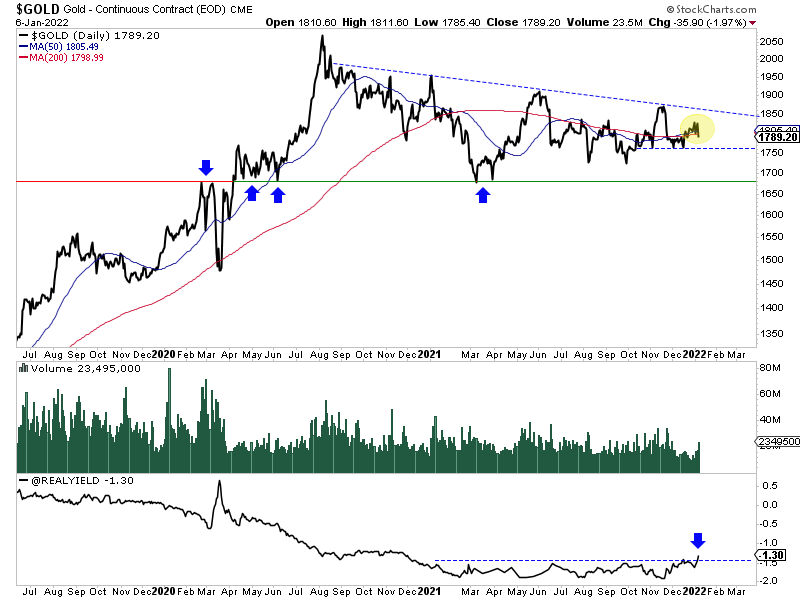

Should Gold break $1760 on a daily basis and especially $1750 on a weekly basis, then it is likely headed for a retest of the March 2021 low.

Note the real 5-year yield at the bottom of the chart. It has broken out to a new 52-week high. That aligns with our technical outlook.

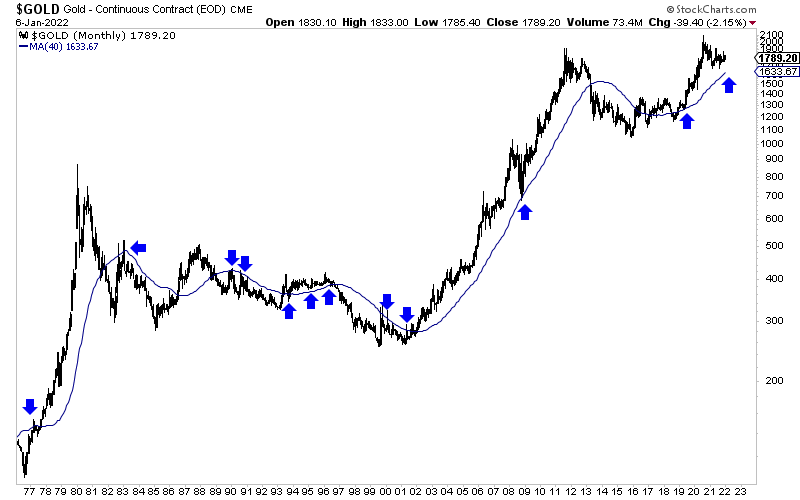

Stepping back from the immediate prognosis, we should note the position of the 40-month moving average, which has been a key indicator for Gold throughout its history.

The 40-month moving average could reach $1660 by the start of March. A 10% decline from the most recent high of $1830 puts Gold around $1650. There is a confluence of potential targets not far from that 2021 low of $1670.

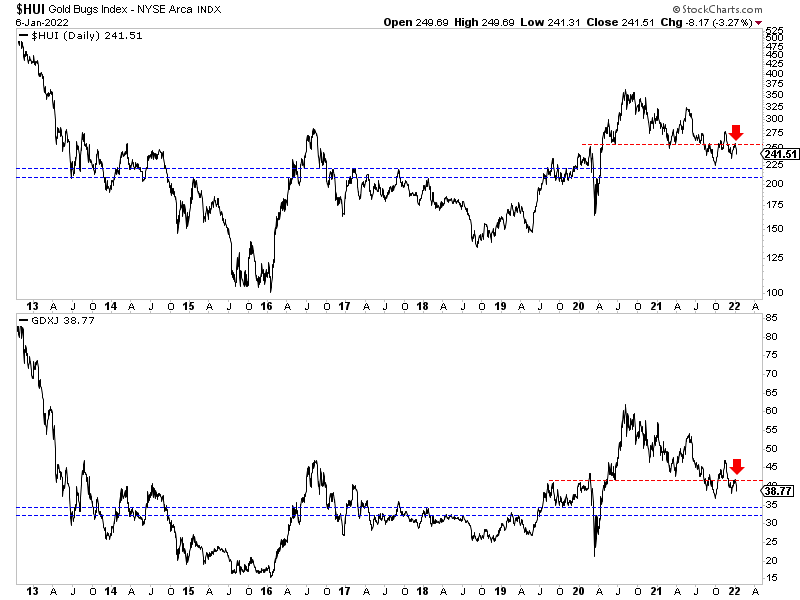

Turning to the gold stocks, we plot the HUI (top) and GDXJ (bottom) below.

After failing at their 50-day moving averages and lateral resistance (red arrows), both indices are now threatening to retest their autumn lows (around 225 and 37). There is also a strong confluence of support at 206 and 34-35.

As we noted in a recent editorial:

In short, should the metals break lower before the actual hike, it creates a very bullish setup for the balance of 2022.

With that said, you have to put yourself in a position to take advantage and make sure you buy the right companies. I suspect that March and April will be the time to buy future 5 and 10 baggers.

I continue to be laser-focused on finding quality juniors with at least 5 to 7 bagger potential over the next few years. To learn the stocks we own and intend to buy, with at least 5x upside potential after this correction, consider learning more about our premium service.