Gold and Oil Should Outperform as the Dollar Continues to Fall

Some financial commentators have picked up on the fact that the dollar has failed to get a safe haven bid so far during the turmoil in the Middle East. This isn’t normal, especially considering the problems one of the main alternatives to the dollar, the Euro, has had over the past year or so. The dollar was the recipient of two separate flights to safety over the last 3 years, one during the financial crisis in 2008, and one during the Euro crisis in 2010. But since peaking in 2010 the dollar has steadily trended lower, even during the current crisis in the Middle East.

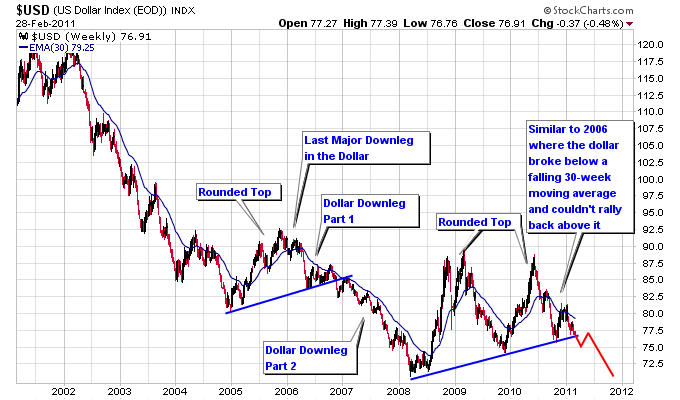

The chart below takes a long term look at the dollar, and shows the last major downleg from late 2005 to early 2008. Notice how the current chart pattern in the dollar is similar to the rounded top the dollar formed in 2006, before breaking down into Part 2 of the downleg. The dollar is also currently declining below a falling 30-week moving average, just like it was in 2006 before it broke the support line and started to accelerate its trend lower.

During Part 1 of the last major dollar downleg, from November 2005 to November 2006, the broad market including the S&P 500 and Nasdaq went higher along with commodities, gold, and oil. Clearly all asset classes, including stocks, were benefiting from the decline in the dollar.

The same thing has happened so far during the current dollar downleg from the June 2010 high. The major indexes are up strongly along with commodities, gold, and oil.

During Part 2 of the last major dollar downleg, from November 2006 to March 2008, the major indexes actually fell while the dollar lost 15% of its value. This was in part due to the financial sector topping in early 2007, but is still a dismal performance when combined with the value lost in the dollar. Commodities on the other hand, and more specifically gold and oil, performed exceptionally well and handily made up for the value lost in the dollar.

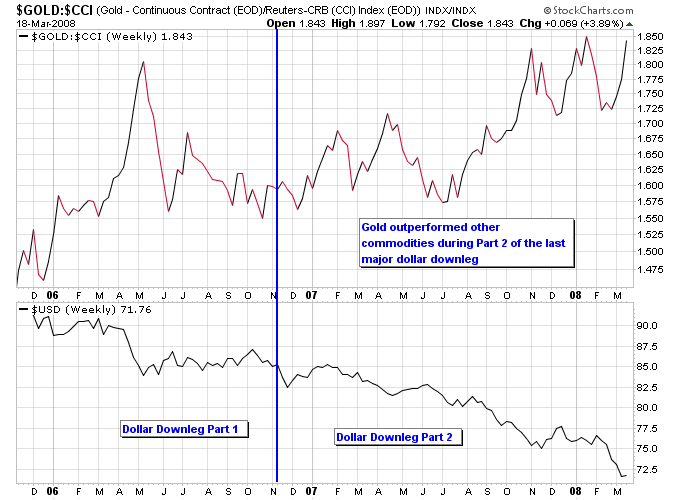

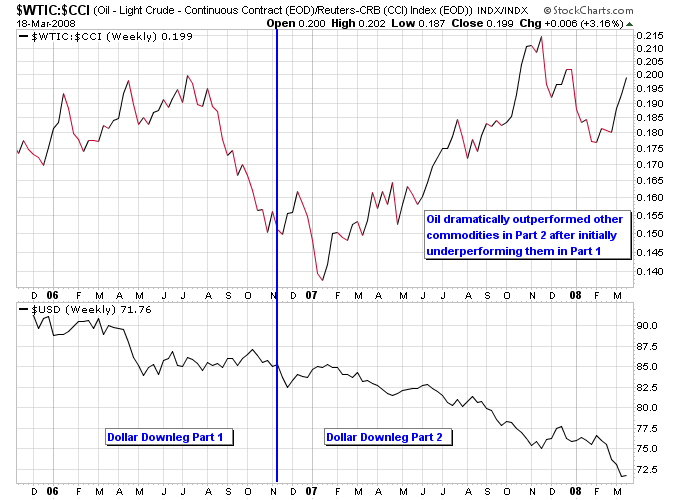

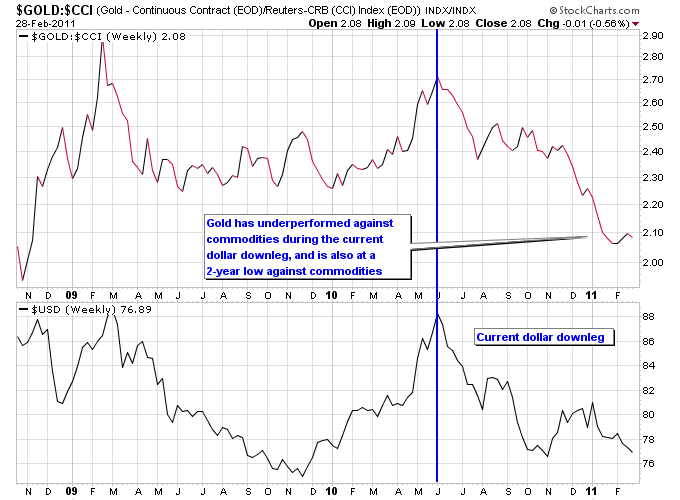

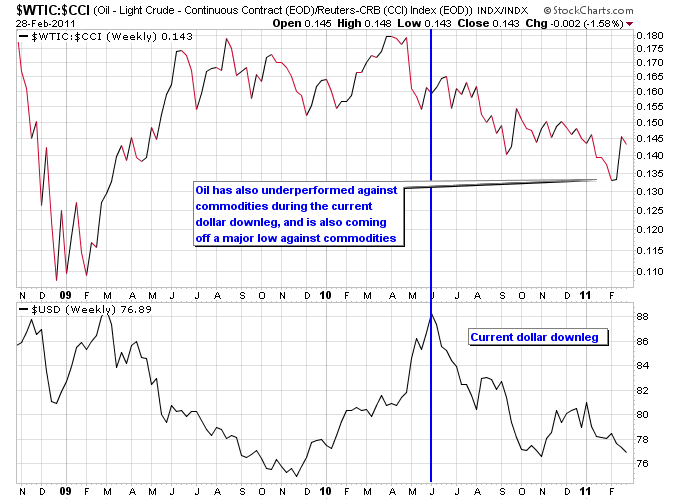

The outperformance by gold and oil over general commodities in Part 2 of the last major dollar downleg can also be seen in the next two ratio charts comparing gold and oil to the commodities index. Notice that oil initially underperformed commodities during Part 1 of the downleg but came roaring back and outperformed dramatically in Part 2.

In the current dollar downleg so far, both gold and oil have underperformed general commodities and are also coming off of 2-year lows against commodities.

Given the undervaluation of gold and oil against commodities currently, they could easily switch gears and outperform commodities if the dollar breaks support and continues to trend lower.

Source: Gold and Oil Should Outperform as the Dollar Continues to Fall