Gold Breaking Down, But Multiple Non-Confirmations

Gold is breaking down technically. There’s no denying it.

Gold has already closed at a fresh 52-week and 2-year low in daily and weekly terms. It needs to close above $1715 at the end of the month to negate a monthly breakdown.

However, recent weakness has not been confirmed by similar markets.

Gold has made a lower low in September. The miners have not. Silver is up 7% this month, while Gold has lost 3%.

Most importantly, unlike in 2013 (and few have looked beyond the nominal chart), Gold has yet to make a new low against the stock market.

In our most recent article, we wrote about how gold stocks look their worst at major bottoms, and we showed how the Gold to S&P 500 ratio had already bottomed or was making higher highs at each Gold bottom.

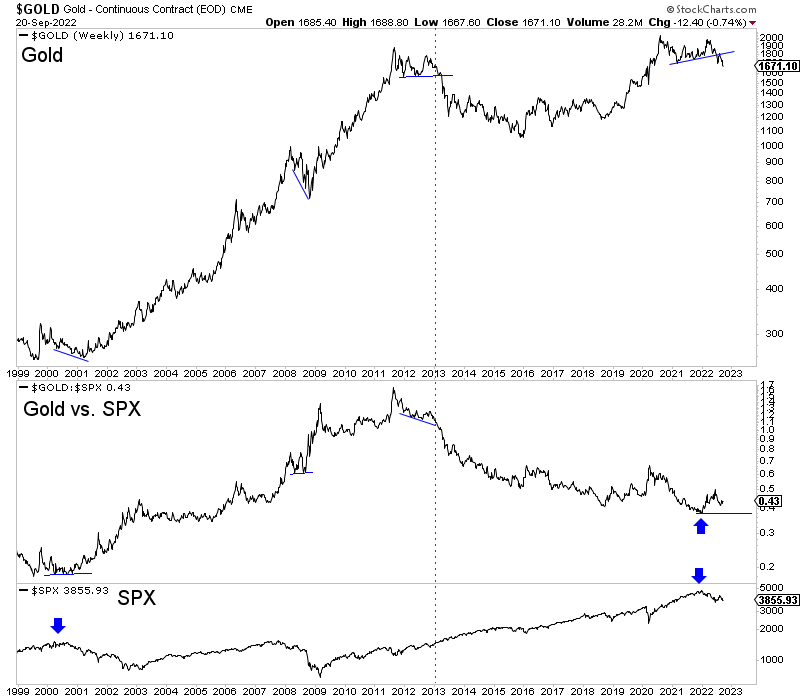

In the chart below, we plot Gold, the Gold to S&P 500 ratio, and the S&P 500.

Note the positive divergence in the Gold to S&P 500 ratio at the time of the 2001 and 2008 bottoms. Compare them to 2013, when the Gold to S&P 500 ratio made lower lows in 2012 and began to crash in early 2013 before Gold lost support at $1550.

Furthermore, note that the bottom in the Gold to S&P 500 ratio in 2000 and presumed bottom at the tail end of 2021 coincided with major market peaks (blue arrows). Moreover, from mid-2012 through 2013, the S&P 500 did not even correct more than 9%!

With all that said, we must consider the entire context.

Gold is breaking down technically, and unless there is a big upside reversal into October, the path of least resistance is lower, and Gold can drop another $100/oz from here.

The likelihood of a recession, lower lows in the stock market, and the end of Fed tightening will lead to a major bottom in precious metals and a huge move higher into and in 2023.

Gold can move lower before that happens but, one must note that there are some non-confirmations now and, positioning is skewed heavily towards more tightening and lower metals prices. Any blip of bad news on the economy or small unwinding of those positions can create a big rebound.

I continue to focus on finding high-quality gold and silver juniors with at least 5 to 7 bagger potential over the next few years. To learn the stocks we own and intend to buy, with at least 5x upside potential after this correction, consider learning more about our premium service.