Gold Breakout & Upside Targets

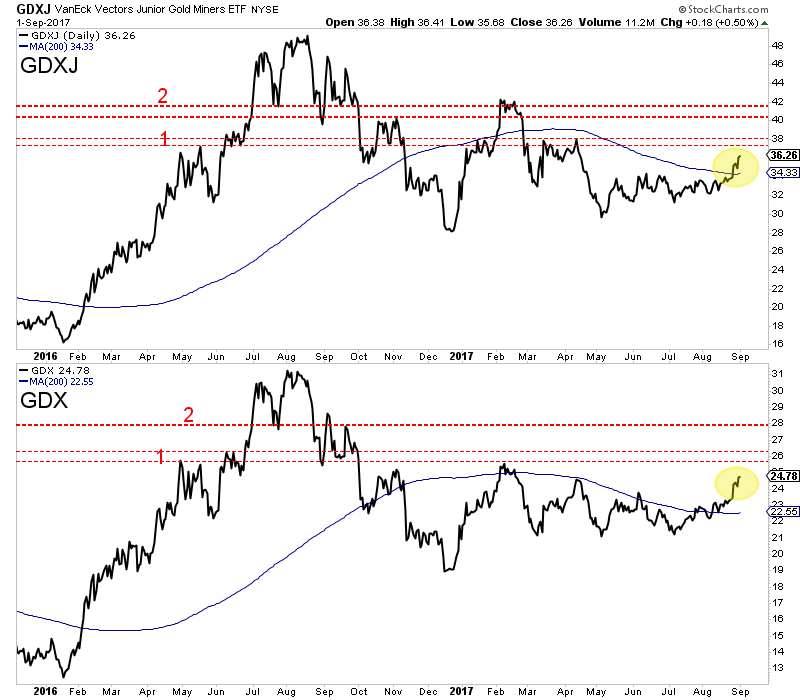

Gold cleared $1300 early in the week and padded its gains on Friday even amid a bullish weekly reversal in the US Dollar. Gold’s breakout was validated by a strong monthly close on Thursday and then a strong weekly close Friday. As predicted, the miners perked up with the breakout in Gold. GDX and GDXJ gained nearly 6% and 7% respectively for the week. Look for the miners to continue to trend higher as Gold attempts to retest its 2016 highs around $1375/oz.

The miners (GDX and GDXJ) have more immediate upside potential. The daily line charts show two levels of resistance. The first level is around $26 for GDX and $38 for GDXJ while the second level is $28 for GDX and $40-$41 for GDXJ.

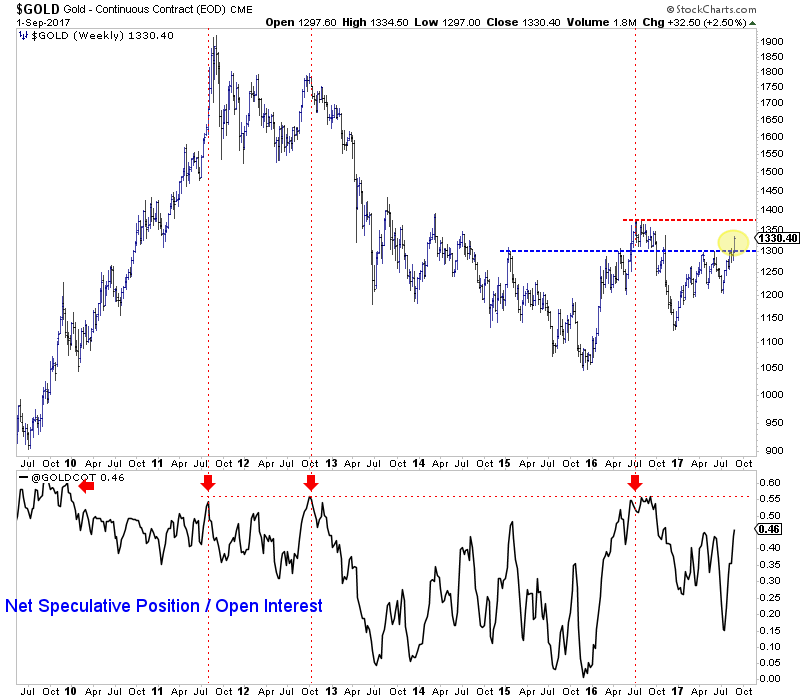

While Gold closed well above $1300 at $1330/oz, it faces resistance at the 2016 highs around $1375/oz. The net speculative position has reached 248K contracts or 46% of open interest. As the chart below shows, the 2016, 2012 and 2011 peaks in Gold all coincided with a net speculative position of 55% of open interest. If current trends continue, the net speculative position could reach 55% as Gold tests $1375/oz.

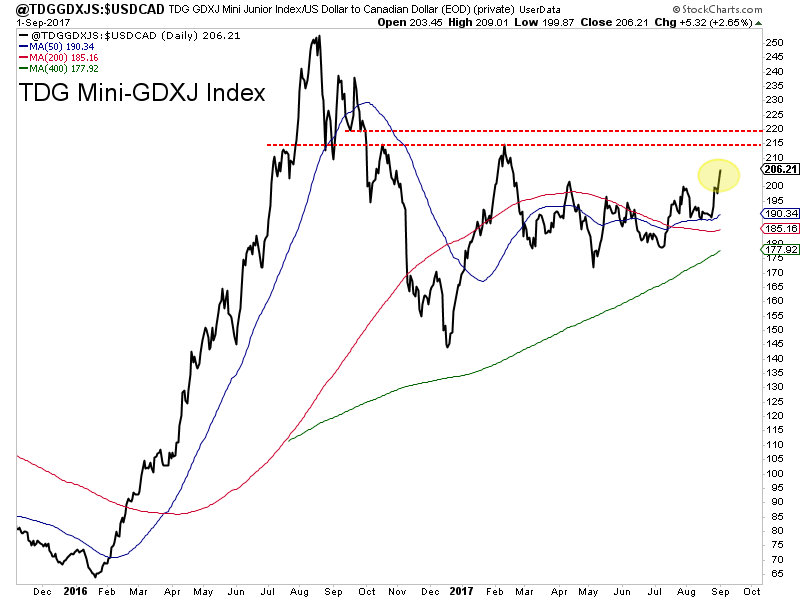

Circling back to the stocks, we see that our mini-GDXJ index, which consists of 26 stocks and has a median market cap of ~$100 Million closed the week at a +6 month high. The exploration juniors have led the entire sector this year and we expect that to continue. The price action is healthy as the index is trading above its 50-day, 200-day and 400-day moving averages which are all sloping higher. The index closed at 206 and should reach resistance at 215-220. A correction from there (perhaps in October) could setup a push to the 2016 high.

The breakout in Gold through $1300/oz has sparked the miners and juniors and we expect additional gains in the short-term as Gold has room to run. That being said, do note that the net speculative position in Gold is fairly high. It could reach an extreme level if Gold tests major resistance around $1375/oz. To find out the best buys right now and our favorite juniors for 2018 consider learning more about our premium service.

Jordan Roy-Byrne CMT, MFTA