Gold & Silver Bull Analogs

Gold and Silver especially closed the week higher, with Silver surging to above $31/oz while Gold closed at a weekly higher high, above $2400/oz.

Gold is building on its cup and handle breakout, which has a measured upside target of $2900-$3000/oz.

Silver is gaining strength after breaking resistance at $29-$30/oz. This is the highest weekly close for Silver in over 11 years. It has a strong target of $34-$35/oz before major resistance at $50/oz.

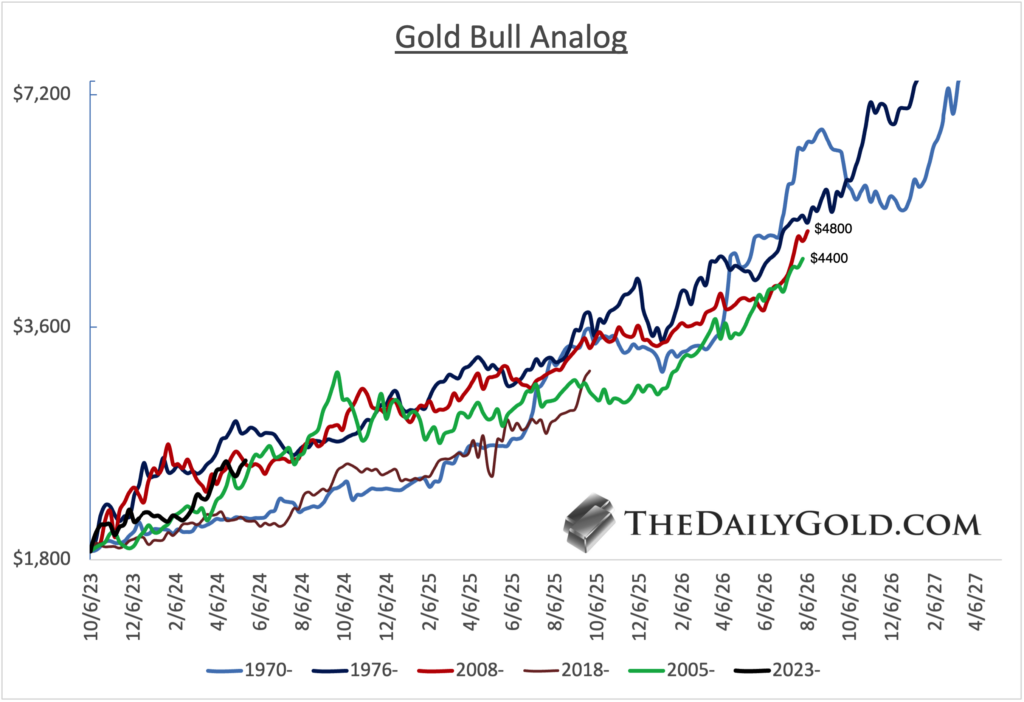

After three and a half years of correction and consolidation, Gold and Silver are in new bull markets and could reach price levels in the next few years, which would make some blush.

Gold’s cup and handle pattern has a measured upside target of $3000/oz and a logarithmic target of $4000/oz. If Gold followed the 2005 to 2008 and 2008 to 2011 cyclical moves, it would surpass $4000/oz.

I suspect this cyclical bull market will surpass those but fall short of the 1970-1974 and 1976-1980 bulls, in which Gold’s move was off the chart in both cases.

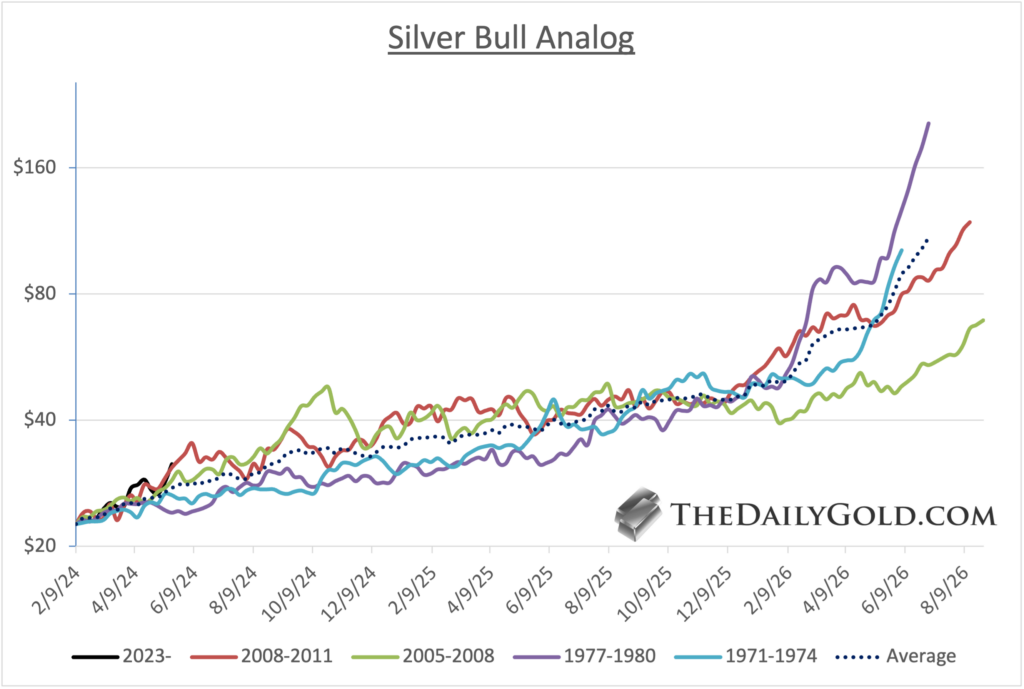

In the next chart, we plot the current move in Silver with its four strongest cyclical bulls and an average of the four.

Interestingly, all four bulls and the average accelerate higher from around $50/oz in early 2026. The sooner Silver reaches $50/oz, the longer its correction and consolidation could be before it breaks $50/oz.

Last month, we wrote: Gold is only two months into its most significant breakout in 50 years. This will carry Silver much higher. The outperformance from Junior gold and silver stocks is just starting.

It remains early in this new bull market, but bargains are going fast. This is the real sweet spot for juniors and silver stocks especially.