|

In this issue…

– Editorial

– Podcast & Sentiment Charts

– Sponsor News

– Top 5 Stocks Report

Editorial…

This week we discuss whether a bear market in the stock market would hurt the gold stocks. The relationship between gold stocks and the broader market is historically inconsistent. There are several examples of each scenario: both crash, both rise, gold stocks rise when the market is in a bear market. In the editorial we examine history and it clarifies what could lie ahead, if the broad market begins a bear market and the economy falls into recession.

Podcast & Sentiment Charts…

Yesterday we were interviewed by Kerry Lutz of the Financial Survival Network. We discuss Gold, its recent performance and what lies ahead.

Interview is here.

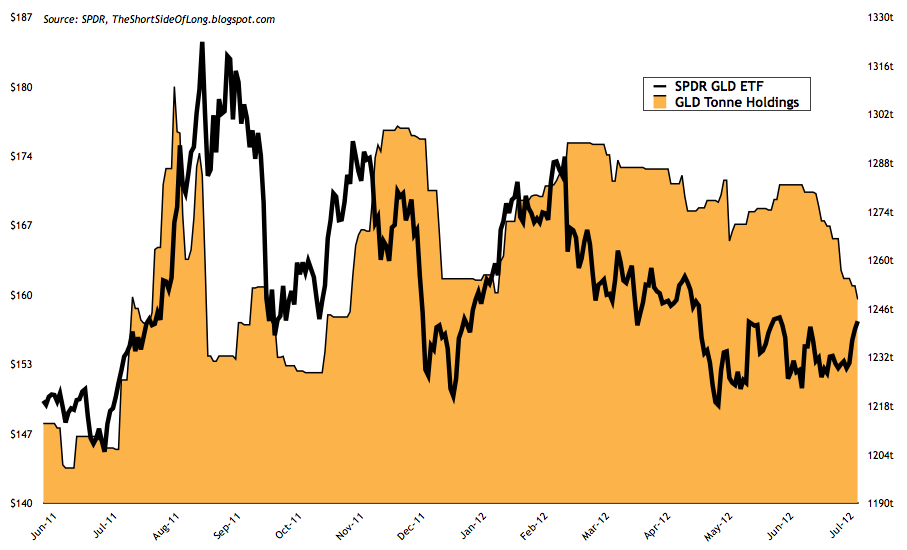

Also, while we are on the subject of Gold, take a peak at these two charts. First, note how retail money is bailing out of GLD even as Gold has made higher lows. Who do you think is buying now?

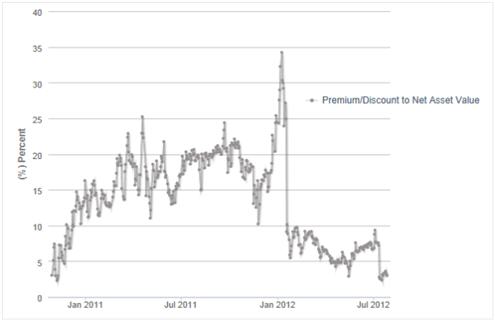

This chart shows the premium/discount to NAV of PSLV, a the Sprott Silver Trust. Its trading at its lowest premium to NAV in a while.

Sponsor News…

Huldra Silver reported a super high-grade assay at Treasure Mountain. I would also like to direct your attention back to this release, a progress update.

Commissioning of the 200 tonne per day mill in Merritt is scheduled to begin on August 7, 2012. During the mill commissioning the tailings pond and civil works will be completed. All construction is scheduled to be substantially complete before the end of August….There are currently over 100 of engineers, contractors, management and employees working on the mill completion project.

Huldra Silver is on track to become a new Silver producer. Their long-term success will be dependent on exploration and expansion potential.

Top 5 Stocks Report…

This is just a reminder that if you subscribe today, you will receive our top 5 report, focusing on our top 5 companies for the next 12-18 months. We believe our new top 5 is an excellent starting point for any precious metals portfolio. Our top from 2011-2012 is up an average of 17% while GDXJ is down 46%! If that is what we can acheive in a cyclical bull market, then imagine the potential in a cyclical bull market! We are very confident that if Gold returns to a cyclical bull market in 2013 and beyond, then each of these companies could produce fantastic returns. Subscribe to our Premium Service, and you not only get this 24 page report but you get a 6-month membership, our favorite companies beyond the top 5, and much more.

Wishing you health and profits,

Jordan

Reply Unsubscribe to Unsubscribe

Disclaimer: Sponsor Companies are only sponsor companies of TheDailyGold.com. Do not construe sponsorship with a recomendation. We are not a registered investment advisor and information and analysis provided is for informational and educational purposes only.

|