Gold & Silver Stocks are Overbought, but That’s Bullish

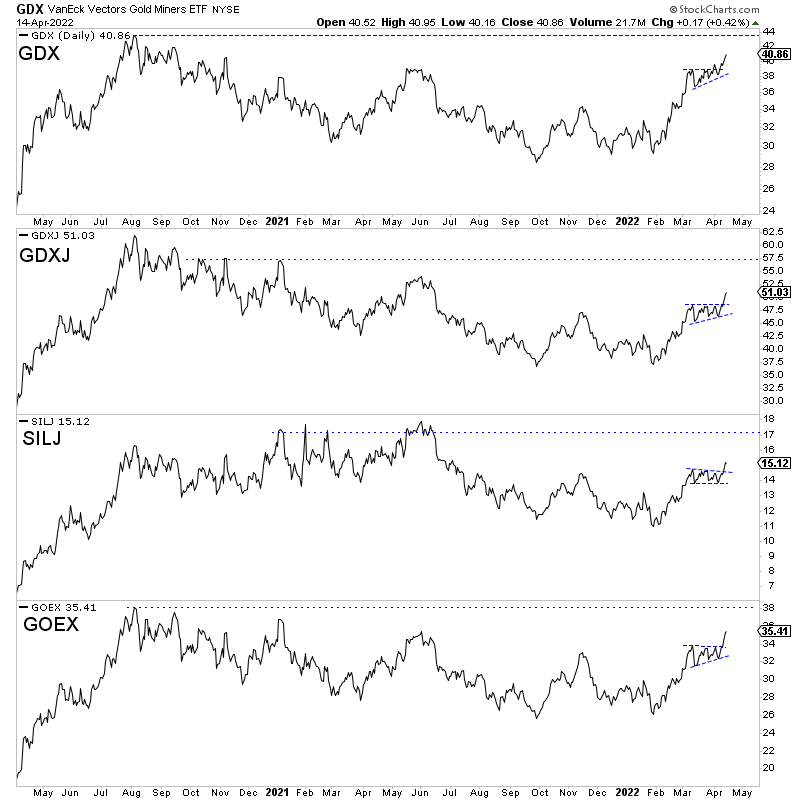

Gold and silver stocks had been consolidating bullishly while Gold and Silver corrected.

We documented it in recent weeks and even anticipated more consolidation and correction.

However, Gold was able to break resistance at $1960, which was enough to launch the already strong gold and silver stock ETFs into a fresh breakout.

The miners have broken out from bullish flag patterns, and odds favor that they will trend higher towards their upside targets, noted by the horizontal blue lines.

Early in a new bull market, overbought conditions and strong breadth are a good sign because it portends more strength in the immediate future.

As of Wednesday, 100% of the HUI Gold Bugs Index stocks and 100% of GDXJ’s top 33 holdings were trading above their 50-day moving average, with 94% and 96% trading above their 200-day moving averages.

These figures could scare someone away, but rather, early in a new uptrend, they are a bullish signal.

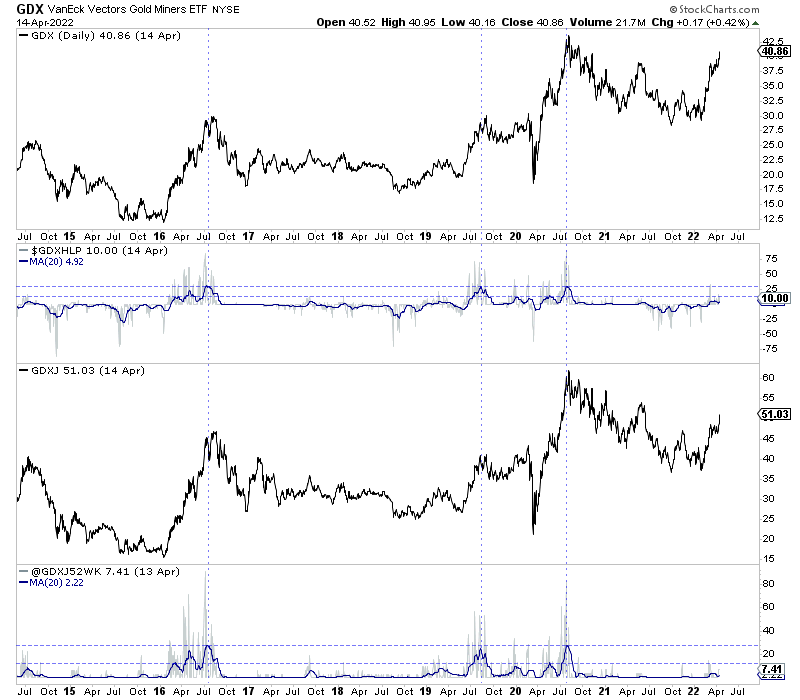

One excellent indicator for spotting interim and more significant peaks is the number of new 52-week highs, smoothed by a 20-day average.

The chart below plots GDX and GDXJ along with the number of new 52-week highs, smoothed by a 20-day average.

Significant peaks (2016, 2019, 2020) occurred with the 20-day average of new highs at 25% to 30%, and interim peaks (within uptrends) occurred at around 13%. The current 20-day average of new highs is 5% for GDX and 2.4% for GDXJ.

The gold stocks are overbought but not yet close to even an interim peak based on the above indicator.

In a bull market, overbought often becomes more overbought. Waiting for a correction is not necessarily the prudent approach.

There will be points to trim profits and hold positions, but this is not one.

Quality juniors are starting to move. The window to buy quality at cheap valuations is closing, but you still have a little time.

I continue to be laser-focused on finding quality juniors with at least 5 to 7 bagger potential over the next few years. To learn the stocks we own and intend to buy, with at least 5x upside potential after this correction, consider learning more about our premium service.