Near-Term Targets for Gold, Silver and Mining Shares

It’s amazing. Suddenly, everyone is bullish again. Two months ago you couldn’t give away mining shares or Silver. No one wanted to buy. After back to back weekly gains (for essentially the first time since January) the gold bugs are back and proud. Bullish calls are coming out of the woodwork. This is good and all but as analysts our job is to stay ahead of the market, rather than react to or follow it, as so many professionals do. That being said, today we give you a quick synopsis of where things stand and the potential risks coming into play.

Below we chart Gold and Silver in weekly form. Gold has a bit of resistance at $1700 but strong resistance at $1800. Silver has initial resistance at $32.50 followed by stronger resistance at $35.00 and $37.50. The numbers reflect public opinion readings (source: sentimentrader.com).

While we believe the rebound has more room to run we have to note the sudden large increase in bullish sentiment. As you can see, public opinion in Silver has surged from only 32% to now 70% bulls. Two months ago only 47% were bulls on Gold. Now its 70%. Commercial short positions have increased by a similar degree. In Silver, commercials are now short 38K contracts, which is a large increase over 23K contracts from two weeks earlier. In the same period, the net short position of commercials in Gold increased from 140K contracts to over 200K contracts. Again, Gold and Silver have more room to rebound but be wary of the increase in bullish sentiment and overhead resistance levels.

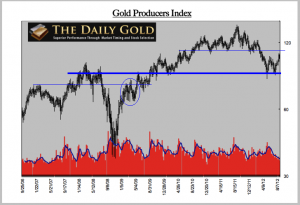

Meanwhile, on the equity side, GDX last closed at a key pivot point. A break past $48 would take the market to at least $52-$53, where the 50% retracement and 80-week moving average lie. The W bottom pattern is nine points deep so there is a potential measured target of $57, which marks the 2012 highs and strong resistance from the first quarter.

To conclude, the trend in the precious metals complex is up and remains healthy though a great deal of speculative money has come aboard in recent weeks. In addition, one should understand that precious metals markets are in recovery mode and not impulsive advance mode. There is a long way to go before the next major breakout. These markets will have to grind through the supply created from the previous downturn. Moreover, October is typically a bad month for precious metals. However, we are in September and according to the charts, this rebound has more room to run. If you’d be interested in our professional guidance in uncovering the equities poised for big gains, then we invite you to learn more about our service.

Good Luck!

Jordan Roy-Byrne, CMT

Jordan@TheDailyGold.com