Newmont Guides Lower for 2011

Newmont Mining (NEM) reported its Q4 earnings yesterday. The company beat analyst expectations for both profits and revenue. Profits were up 46%. However, the company guided for lower production in 2011. Newmont shares took it on the chin, falling 6.3% on Thursday.

Those who are looking to large cap miners as a way to play Gold might want to think again. We’ve written many times regarding the inability of large miners to outperform Gold. This is true not just in the past 10 years but in the past 100.

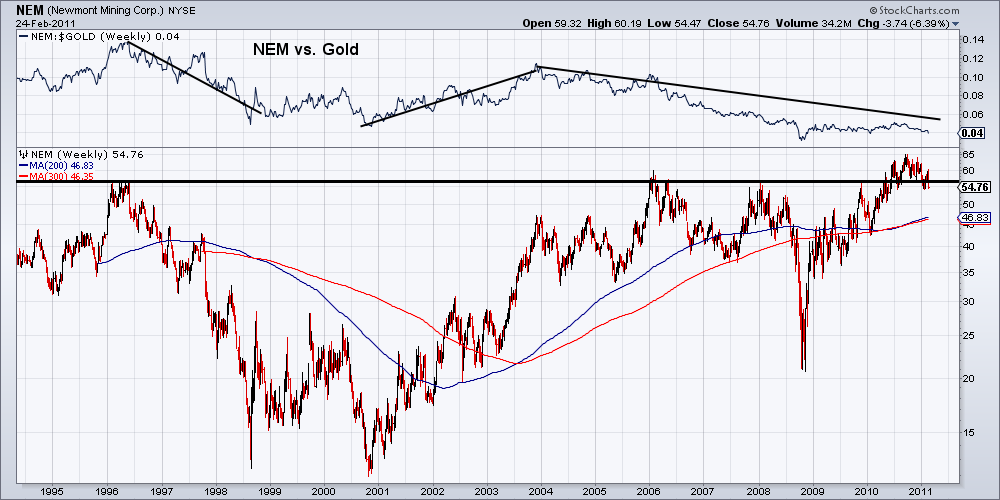

Below we show the chart of Newmont and we also show the stock priced against Gold.

Amazingly, Newmont today is at the same price it was in 2008, 2006 and 1996. In other words, Newmont has underperformed Gold badly. Sure, Newmont has done well the last few years, but given the law of numbers and the company’s track record, there is a small chance that the company can grow enough to outperform Gold.

This is why we believe that its better to own physical (e.g CEF, GTU, PHYS) than large caps.

To get leverage to Gold and Silver, one needs to invest in the mid-tier and junior companies. This is what we focus on in our premium publication. If you are looking to ride this bull market and achieve growth, you need to invest in the juniors and mid-tiers. Consider a free 14-day trial to our service.

Jordan Roy-Byrne, CMT

Jordan@TheDailyGold.com