On the Verge of an Inflationary Surge

I’m going to start off by stating that I don’t think Bernanke is going to “get away” with the insane monetary policy he’s chosen. Printing trillions of dollars, cutting rates to zero, trying to manipulate the bond market and generally tampering with the natural market forces is going to have consequences.

There is a price that will have to be paid for this madness. Just like there was a price we had to pay for Greenspan’s reckless attempt to avoid a recession when the tech bubble burst. Greenspan certainly bought some time and a brief period of illusionary prosperity. But he did it by creating a housing and credit bubble. When those burst, as all bubbles do, the fallout was much worse than if we had just weathered the recession to begin with.

Ultimately all of Greenspan’s and Bernanke’s efforts have just loaded the nation with a monstrous debt burden that we will never be able to repay and soaring unemployment that isn’t going away anytime soon.

Now I’m afraid Bernanke has probably let the inflation genie out of the bottle with his reckless actions. That means surging commodity prices. The fact that almost all commodities resisted the stock market decline on Friday is an ominous warning sign.

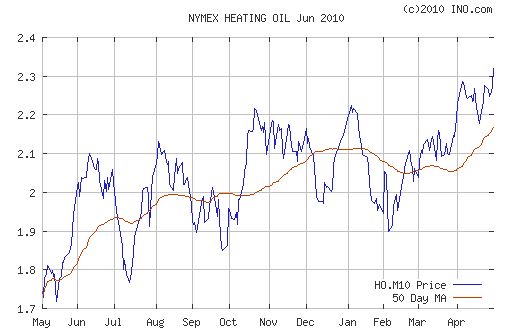

Both heating oil and gasoline broke out of recent consolidations on Friday despite huge selling pressure coming off the stock market.

It now looks like we’ve probably seen the cycle low in oil.

If oil follows the gasoline and heating oil markets to new highs (and I think it will) I’m afraid we are going to get a strong surge higher. And if we did just see the cycle low a few days ago this push could last some time as the average cycle in oil has been running roughly 50 days trough to trough.

Gold has also broken above the recent resistance level with follow through this time.

[ad#Gold Color Ad- 300×250]