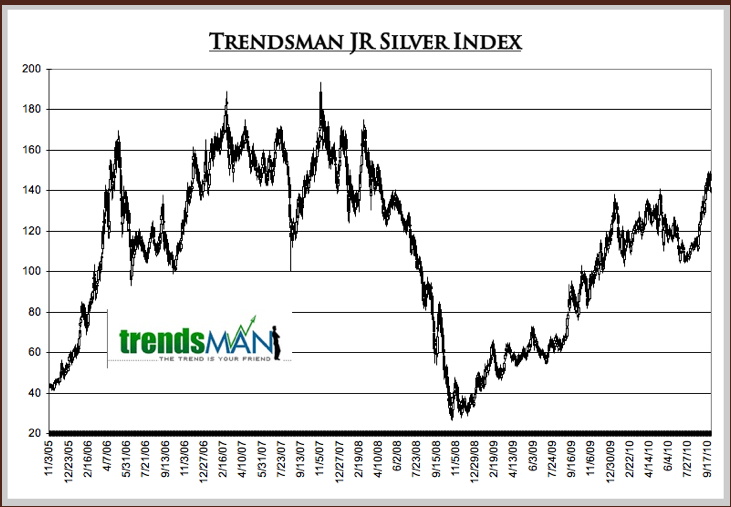

Premium Sample: Silver Juniors Remain Undervalued

Below is a chart of our junior silver index, which contains 10 stocks. Today, Silver closed above $22, slightly above its 2008 high. The cost of Oil is well below where it was when the silver stocks last peaked. Yet, the junior silver stocks are roughly 25% below their highs. In terms of real value, in a fair world, the junior index would be trading ABOVE its 2007-2008 highs.

Let’s take this a step deeper by looking at the factors that are important for Silver stocks. Since Silver companies are Canadian companies, we look at the Canadian price of Silver. Oil is a cost in mining so we look at the Silver/Oil ratio. Base Metals tend to makeup a fraction of the output of Silver companies, so we look at the price of base metals.

First, the Canadian price of Silver is about 10% above its 2008 high. Secondly, the Gold/Oil ratio is above where it was at the 2007 peak and sans the spike in early 2009 is basically at a 11-year high. Base metals prices are about 20% below their peak in 2007.

This analysis shows that the silver stocks, as a whole, should be trading higher than they were when they peaked in Q2 2007. Despite the recent surge in the silver juniors, they remain well below their 2007 peak. Hence, there is value to be had. It may not reveal itself instantly but likely will by the time we are six to twelve months in the future.

This is only a small sample of our 24-page Silver update sent to subscribers Thursday. If you’d like to learn more about the work we do, then consider a free 14-day trial subscription.