S&P 500 to test Important Support

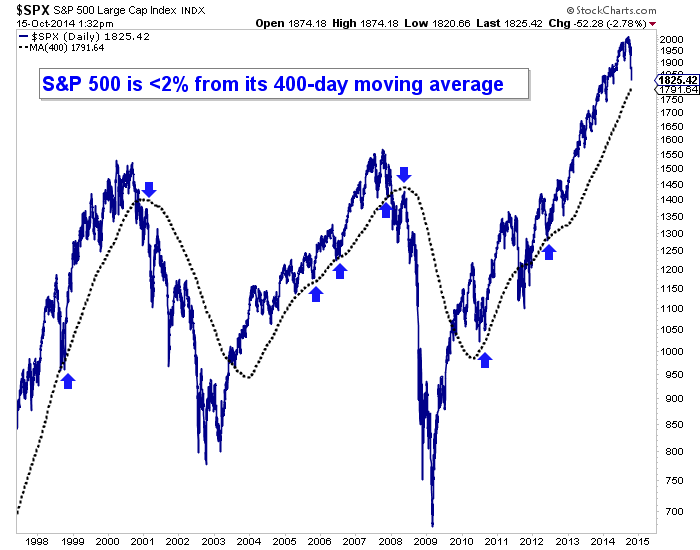

The 400-day moving average has been a very important pivot point over the past 20 years for the S&P 500. It has helped to mark bull and bear markets by way of marking support and resistance.

The S&P 500 is now less than 2% from testing its 400-day moving average. It has been 2+ years since the S&P 500 tested its 400-dma. Note that from 1998 to 2000 the S&P did not test its 400-dma and for almost 18 months (mid 2006 to end of 2007) the S&P did not test its 400-dma. The bottom line is if the S&P 500 falls below its 400-dma, it will have fallen into a bear market. My opinion is that is inevitable but not imminent. The S&P 500 is likely to rebound upon the first test of the 400-dma.