STRONG DOLLAR? MAYBE NOT!

STRONG DOLLAR? MAYBE NOT!

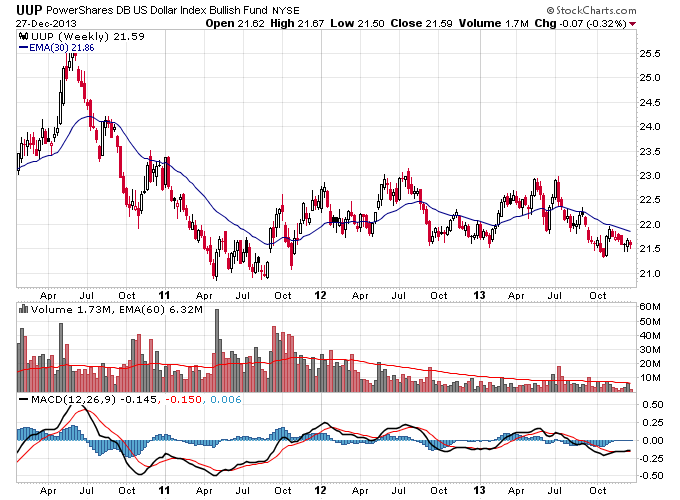

The dollar since then has undergone 3 separate rallies. The first one unwound all the bearish trades against the dollar in 2008 as it underwent a massive bounce during the financial panic. At the time this seemed counter-intuitive to many but in reality the bear trade on the dollar was the overcrowded trade. Next the dollar had a massive rally in 2010 as the market feared the Euro would disappear due to European debt issues. That rally was then unwound as fears over the Euro dissipated. Fear returned to the U.S. dollar in 2011 as money printing by the Federal Reserve became a main focus. I remember specifically how the bearish sentiment in the dollar was intense in April 2011 as Bernanke started holding regular news conferences. It didn’t look like Bernanke was going to be able to stop the dollar from breaking the 2008 low and going into a free fall.

But the markets as they always do fooled the majority at the extremes. Instead of free fall the dollar bottomed in mid-2011 just as silver went parabolic and other commodities were making important tops. Then gold finally made a major top later in 2011 as the dollar began rallying instead of falling.

Since April 2011 the the dollar has been in rally mode until about mid-2013, where it made a top and has been steadily falling since. This is where things get interesting as guess what also made a potential major bottom around the same time: gold. Many commodities are also holding their summer 2013 bottoms and a new bear market in the dollar could be a catalyst for commodities in 2014.

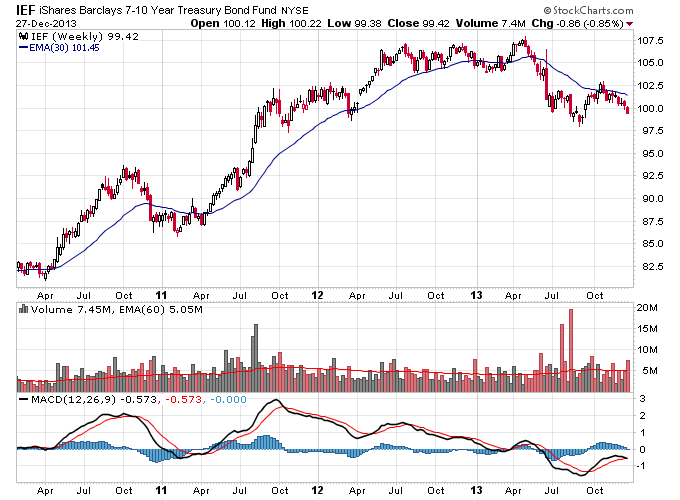

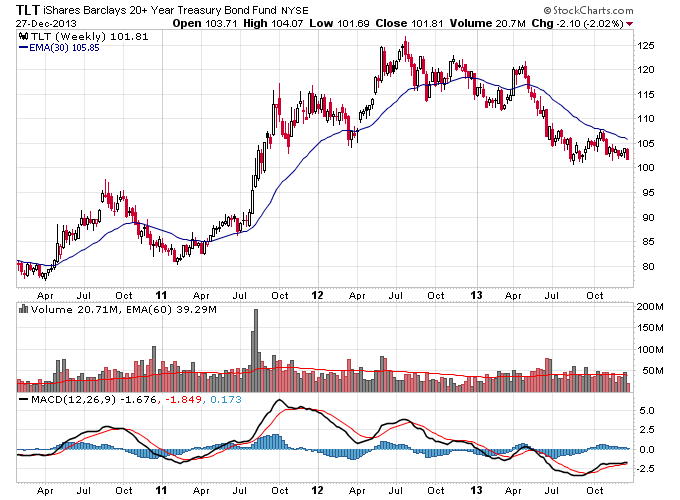

What’s also very interesting about the current trends in the market is this is the first time since the 70s possibly that both bonds and the dollar are trending lower at the same time. This runs very contrary to the current popular consensus that the U.S. is the “best house in a bad neighborhood”. If the dollar and bonds continue to fall in a Stage 4 decline then that popular opinion will be replaced by new fears for the dollar and renewed bullishness for anti-dollar trades, particularly commodities and precious metals.

The following Stage Analysis data below shows the trend in the dollar and bonds has been down for multiple weeks now. Sentiment surely has been re-balanced since 2008 as the majority of the market now views the U.S. dollar as at least as good if not better than other foreign currencies. So unlike back then the dollar has the ability to run lower as it doesn’t have excessive bearish positioning by market participants to prevent it from continuing to fall.

Stage Analysis

| Ticker | Stage | Weeks |

| IEF | 4 | 4 |

| UUP | 4 | 19 |

| TLT | 4 | 32 |

| Totals | ||

| Stage 1 | 0.0% | |

| Stage 2 | 0.0% | |

| Stage 3 | 0.0% | |

| Stage 4 | 100.0% | |

Connect with me on Twitter: @nextbigtrade

The original article and much more can be found at: http://www.nextbigtrade.com

The views and opinions expressed are for informational purposes only, and should not be considered as investment advice. Please see the disclaimer.