Update on Gold Juniors

GDXJ is the ETF for junior miners and in particular junior gold companies. This sector has been very strong in 2010 and has solidly outperformed its counterpart, GDX as well as Gold.

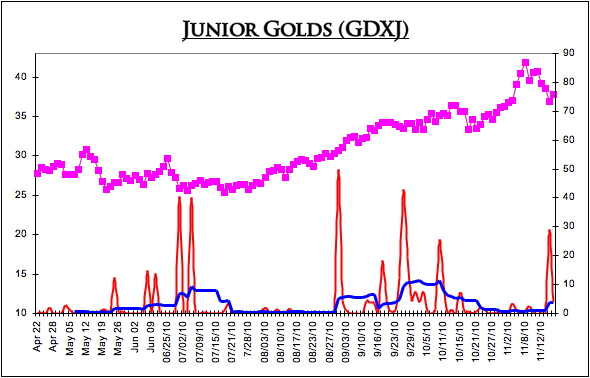

GDXJ made a key breakout in September and continued to soar into early November. The market soared above our target of $39 and reached $43. Now the market is in correction mode, having declined to $37 before bouncing yesterday. We see very strong support at $35 and $33 and anticipate a bottom in that range. Also note that there has been very strong accumulation in recent months and very little distribution despite the market falling from $43 to $37.

We also keep an eye on the ISE put-call ratio for GDXJ. Though the options market isn’t as large as what we see in GDX, it has provided good signals thus far. In the last two days there was a spike and another elevated reading. This is something we’ll continue to watch in the days and weeks ahead as it can help confirm a bottom based on technicals and price action.

If you missed out on the recent run, no need to worry because this is a bull market and the volatile junior gold stocks can have large corrections. For investors who are underinvested or missed the last run, now is the time to pay close attention. An opportunity in the next few days or weeks could be in your grasp. For professional guidance in riding this turbulent but profitable bull market, consider a free-14 day trial to our premium service.

Good Luck ahead!

Jordan Roy-Byrne, CMT