Why Gold and Gold Shares have Consolidated for Five Months

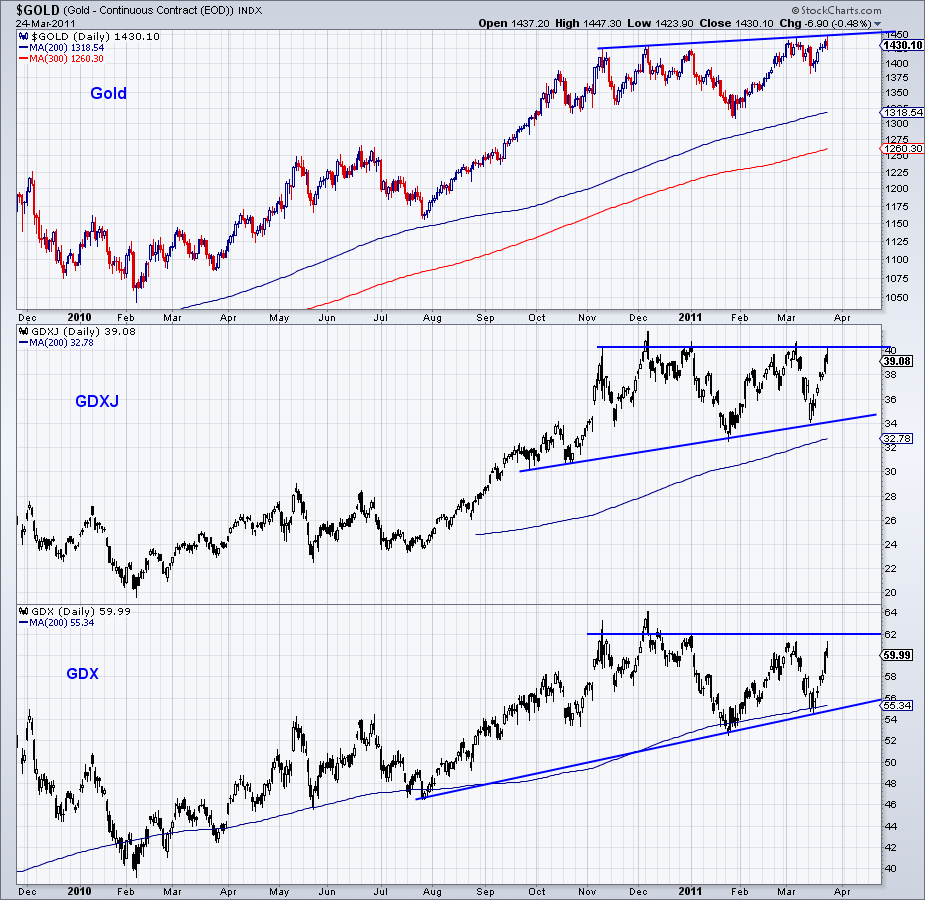

Yes Gold has been flirting with all-time highs. Sounds strong, right? Wrong. In reality, Gold has been in a consolidation or running correction since October of last year. In recent weeks Gold has flirted with all-time highs but hasn’t been able to achieve a sustained breakout. Meanwhile, as the chart shows, the gold stocks (GDX, GDXJ) have been in the same consolidation. Yesterday, as GDX and GDXJ neared resistance they were rebuked.

Don’t get me wrong. The price action in GDX and GDXJ is long-term bullish and seasonal analysis also favors a short-term bullish stance. That may not guarantee higher prices tomorrow or next week but it will be obvious six or twelve months from today. That being said, its important to understand why these markets have been in consolidation.

In Gold’s case, it doesn’t perform as well when conventional investments are strong. As soon as equities gained favor Gold lost some strength. Also, a weak dollar is usually more a catalyst for Commodities and not Gold. Gold tends to perform best when conventional markets are not rising.

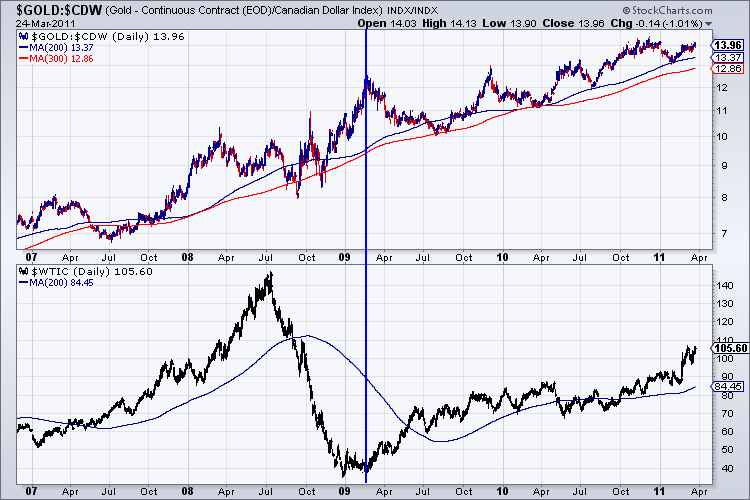

As a result of the vertical rise in Silver, gold stocks have taken a backseat to silver stocks. However, there are some fundamental considerations here. We show two in the chart below. The first row is Gold in Canadian Dollar terms and the second is Oil. Since the February 2009 peak, the Canadian Gold price is up only 12% while the US Dollar Gold price is up roughly 40%. Gold is much higher than it was back in 2007-2008 but Oil has climbed steadily higher and is now at an all time high aside from a period of three months in 2008.

Remember that most mining companies are Canadian companies. The Canadian Gold price is more important than the US Dollar Gold price. Oil comprises 25% of the cost of mining.

This is why the inflation trade is not always positive for Gold. (Sometimes, as we see now, it is positive for Silver). Money moves into Commodities and equities and Gold underperforms. Some will worry about a peak in the stock market or a falling Oil price but these things will become catalysts for Gold and gold stocks.

What happened in 2010? We had a deflation/sovereign debt scare and most markets sold off materially. Yet, Gold hit a marginal new high in US Dollar terms, Silver held strong and the mining stocks also held up reasonably well.

Treasuries have already bottomed and that is a sign of a pause or correction in the inflation trade. Look for the stock market to peak shortly and the US Dollar to put in a bottom. This will scare out some weak hands but in reality it will set the stage for the next breakout in Gold and gold stocks (as it did in, among other years 2002, 2009 and 2010).

Jordan Roy-Byrne, CMT

Jordan@TheDailyGold.com