Fund Managers Rising Cash

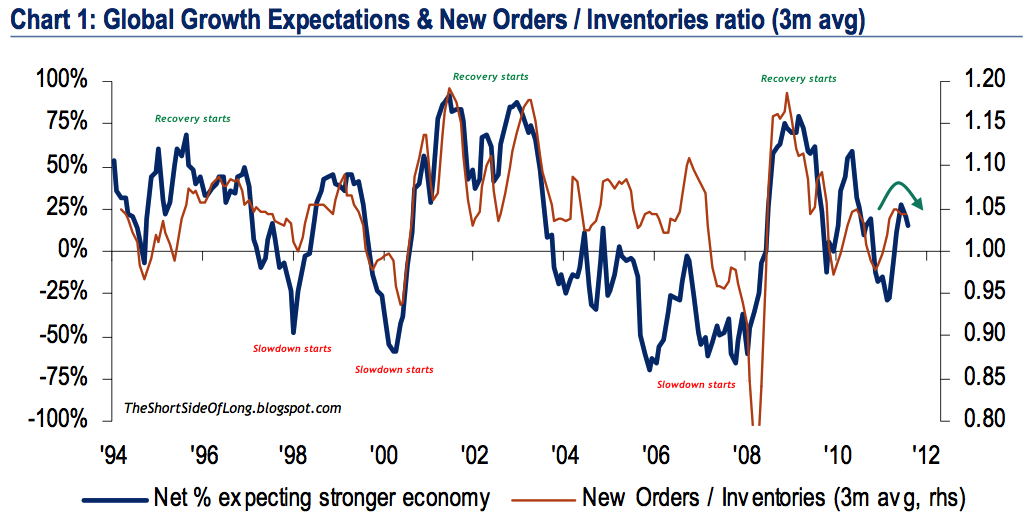

- Global growth and inflation expectations

- Only handful of managers are taking higher risk

- Fund managers continue to rise cash & bond levels

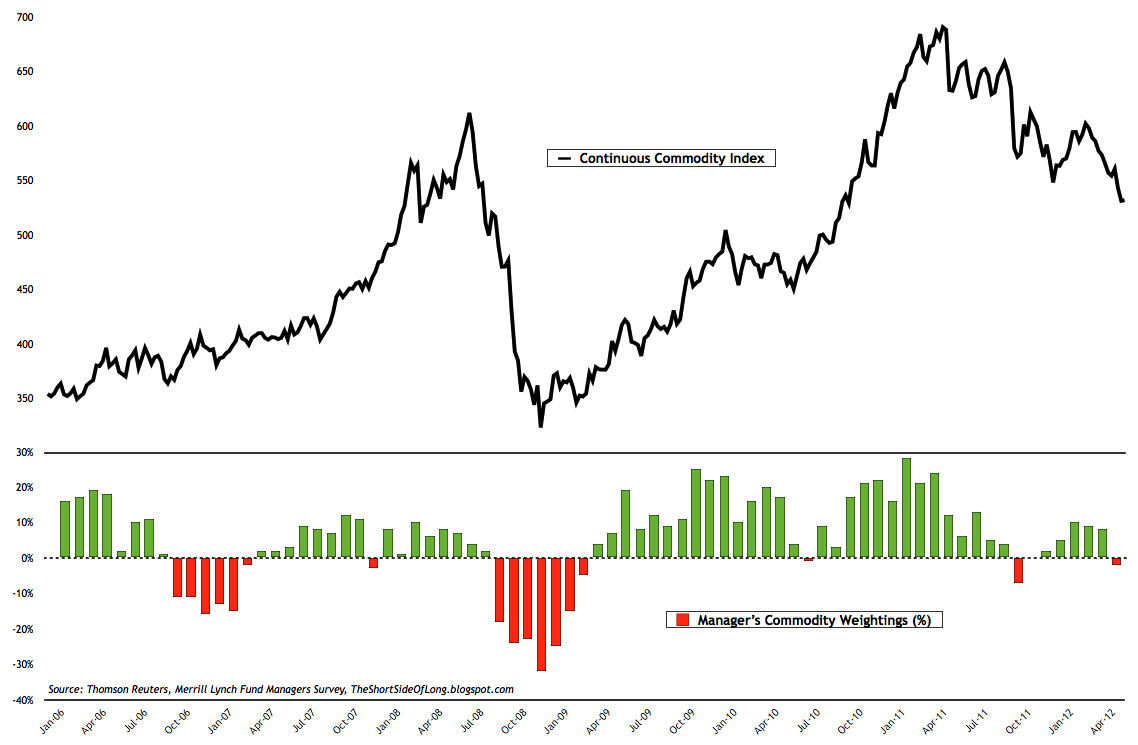

- Commodities are now underweight by fund manager

The survey also reported that, against trend seen in global expectations, net percentage of managers thinking that the Chinese growth will improve rose to an 18-month high reading of above 10%. Major Chinese growth recoveries occur when we see close to net 50% of managers expecting the growth to improve and unfortunately we aren’t even close yet.

Moving forward, interestingly the sharp drop in growth expectations also showed a sharp drop in inflation expectations too. The report went onto say that “a net 2% expect inflation to rise in 12 months, down from 21% last month. This paves the way for policy easing.” Merrill Lynch went onto to summarise the growth outlook by stating the following:

“After peaking in March, global growth expectations are down for a second month and only 9% see above-trend growth over the next 12 months. But no recession is forecast, and China growth optimism rose to an 18-month high. Inflation expectations dropped sharply and hopes of policy easing continue to rise modestly: 56% now expect Fed QE3 and 65% expect further QE by the ECB.”

Fund managers continued to raise cash in May. Managers weightings towards cash allocations jumped higher this month towards a net 28% overweight, which is up from a net 24% overweight last month. We are now once again reach close to one standard deviation highs, which means fund managers remain fearful.Average cash balances remained the same to previous month at 4.7%. From a contrarian point of view, reading above 5.0% should be considered as a major buy signal. In 2008 the cash balance reading peaked at 5.5% in December. In 2011 the cash balance reading peaked at 5.2% in August. Both proved to be close to a major bottom in all risk assets, including equities.

While the chart doesn’t show exposure to global equities, the survey went onto show that is has modestly been reduced. Merrill Lynch stated that “equity allocations declined to a net 16% overweight from 26% overweight last month as investors took risk off the table. The current allocation to equities falls roughly in the middle of the range relative to history.” So in other words, equity managers are not yet in panic mode, but do keep in mind that the survey was done between 4th and 10th of May, which means as selling intensified, managers could have cut their weightings further.

The survey shows that overall risk appetite among fund managers continues to decline for the second month in the row. A net % of fund managers taking higher than normal risk dropped to -35%, down from -21% last month. In the chart above, readings at -40% or below tend to signal extreme readings. Investor perceptions of liquidity conditions are also declining, with a net 23% of managers viewing current conditions as positive, down from 36% of managers last month.

Merrill Lynch survey also showed that cash is not the only popular safe haven investment right now. Bond allocations also rose in May, as risk appetite waned. A net 33% of fund managers are now underweight bonds, which is down from a net 48% of fund managers only a month ago. Despite a powerful rally in the Bond market, majority of fund managers still seem to be only modestly exposed to this asset class, even with ongoing Eurozone worries.

Nothing new to report.

The survey also showed that fund managers reduced their allocation to commodities this month as well. A net 2% of fund managers are now underweight commodities sector, as opposed to net 8% overweight in April. Commodity prices suffered further declines after the survey was concluded, so it is also very possible that fund managers reduced their commodity weightings even further as well.

Relative to the survey’s history, which spans for over a decade, global fund managers are very underweight the Materials Sector, with mining companies being out of favour. The survey went onto report that “the current allocation to resources is low at net 10% of fund managers being underweight this sector.” This signal is now very similar to last months, but has yet to produce a buy signal. Also to point out is that majority of mining companies drifted lower since the survey was down, so there is a chance managers have reduced weightings here even further.

- I still own S&P 500 Calls from earlier in the week, so I will not be doing anything in the Equity market for now.

- I also still own SLV Calls from last week, so I will not be doing anything in the PMs market for now either.

- I am still looking at Agricultural commodities, with RJA being my favourite way to own this sector. I haven’t done anything yet.

- My further action depends on Western central bank further actions. Weak action will make me reduce my core holdings and close out Calls.

- Other assets on my watch list are Australian Dollar, Russian / Brazilian equity ETFs and Gold Mining stocks.