Gold & Silver COT Update

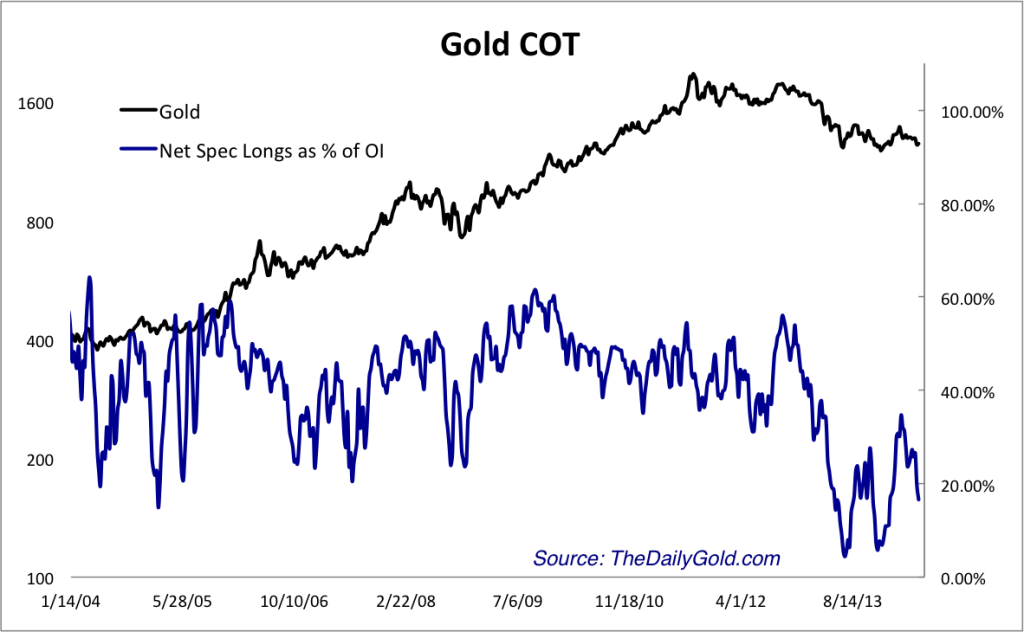

We’ve seen improvement in the Gold COT in recent weeks but it remains a good distance from the previous double bottom.

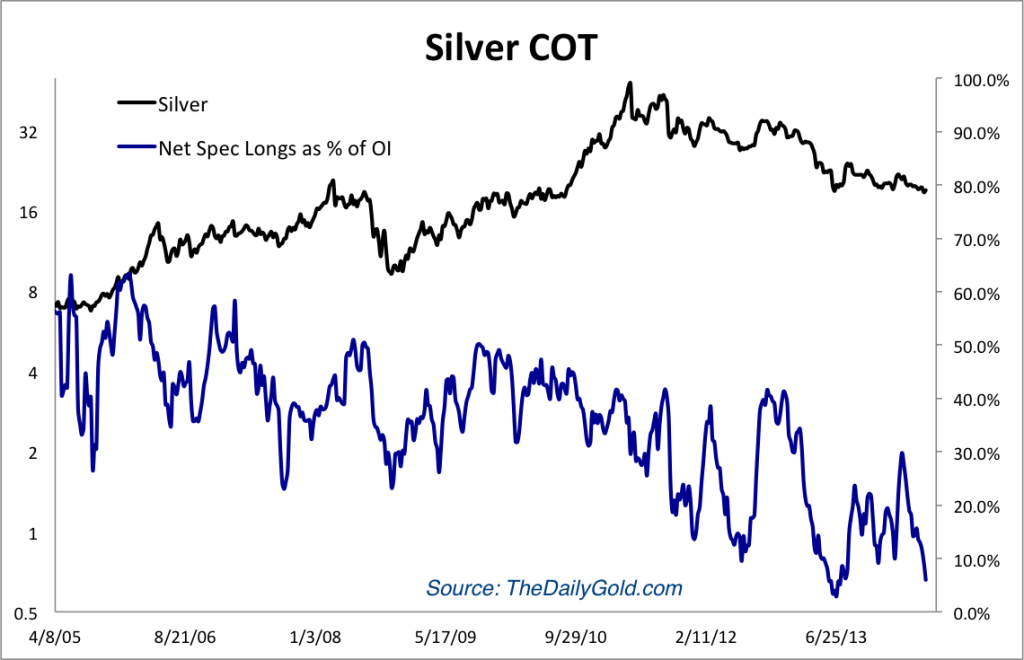

The Silver COT argues that Silver is much closer to its bottom than Gold. The net long spec position is now only 6%. However, it remains above the 2.9% low of a year ago.

Sticking with Silver, here are the gross short positions in nominal form and as a percentage of open interest. Nominal gross short positions reached a new all time high last week at 58K contracts. That figure surged this week well past 60K contracts. The second chart shows that gross shorts as a percentage of open interest are just a hair short of the December high, which we think was an all time high.

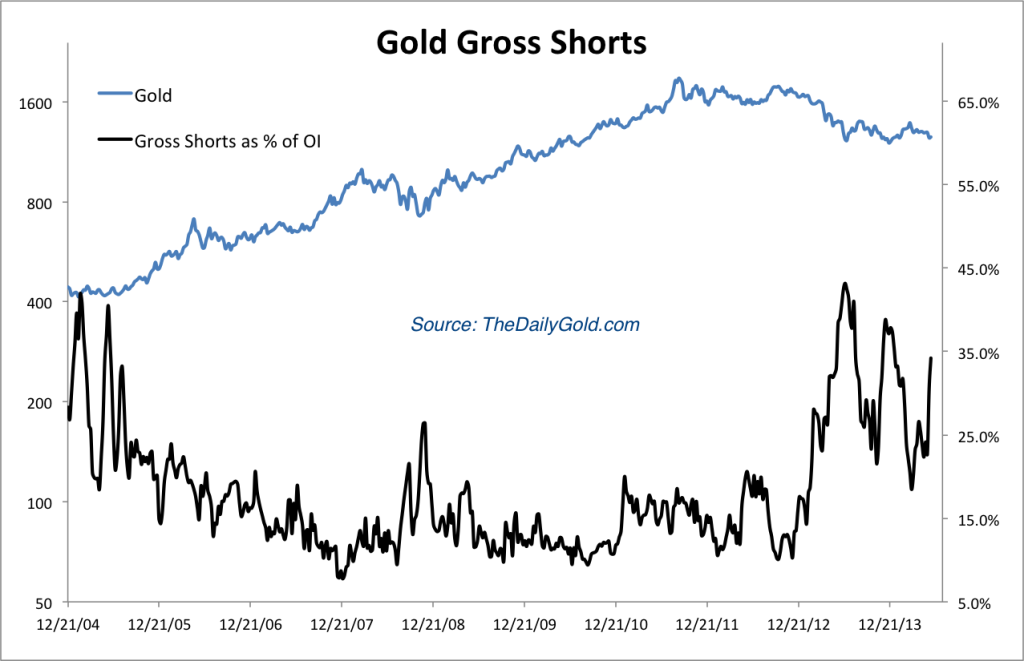

Circling back to Gold, here are the gross short positions as a percentage of open interest. Shorting has increased strongly in the past few weeks but remains well below the highs from a year ago.

For more premium analysis of the COT and many other things, consider our premium service.