Final Resistance for Gold & Silver

Gold has pulled back after a mini-blow-off on Monday that followed a new monthly and weekly all-time high.

It had cleared monthly resistance at $2000 and weekly resistance near $2030 before surging intraday to over $2100. Gold has settled in the $2000s with strong support, around $2000.

Although Gold has not broken out on the daily chart, the monthly and weekly breakout is more significant and implies a daily breakout will eventually follow.

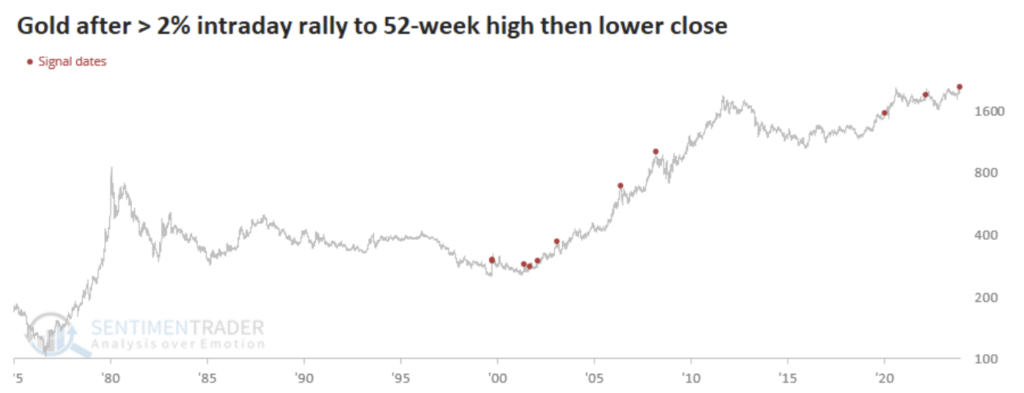

SentimenTrader.com published a chart that can give us insight into the time of eventually.

This chart plots points at which Gold hit a new 52-week high but reversed lower as much as 2% or more.

These points include multiple points from 2001 to 2003, the 2006 and 2007 interim peaks, a peak before Covid, and one in early 2022.

The points in 2001, 2002, and 2003 are the best comparisons because those were early in a new secular bull market, and the gold price was much less overbought than in 2006 and 2007. Those four points bottomed at or around the 200-day moving average one or two months after the reversal.

Gold has support at $1985 to $2000, and its 200-day moving average, at $1960, should reach $1985 in January 2024. Also, note the last line of resistance near $2100.

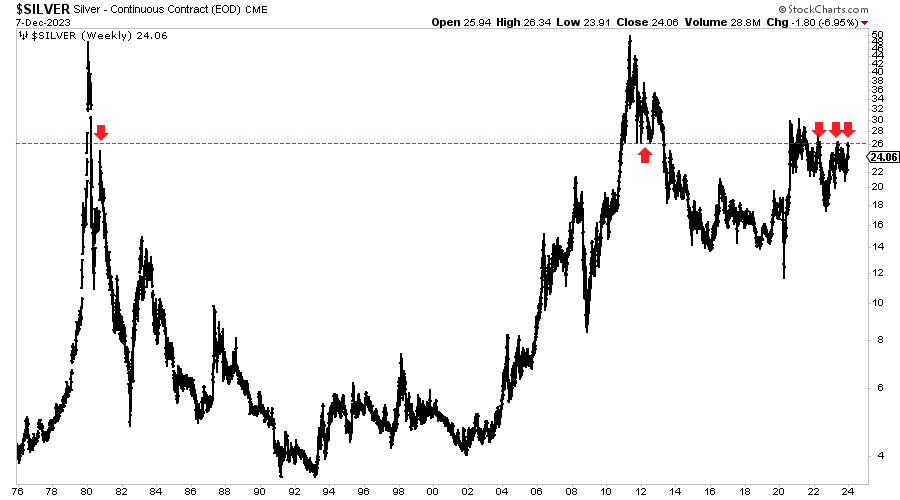

It is easy to see why $2100 is the last stand for Gold bears. Why $26 is the last stand for Silver is more nuanced.

The $26 level is an important historical pivot point (first rally after the 1980 crash, major support after the 2011 peak, and resistance over the past two years) and marks the 50% retracement of the move from the all-time highs to early 1990s lows.

A clear break of $26 projects to a measured upside target of $33-$34, and there is very little resistance to $50.

Gold has already made a new monthly and weekly all-time high, but there is no looking back once the market clears $2100.

And that breakout will lead to Silver breaking above $26.

These are the final resistance levels before a full-blown, raging bull market in precious metals.

Get positioned during this weakness because share prices could accelerate much higher before next spring.

I continue to focus on finding high-quality gold and silver juniors with 500% to 1000% upside potential over the next few years. To learn the stocks we own and intend to buy, with at least 5x upside potential in the coming bull market, consider learning about our premium service.