Return of Quantitative Easing Good for Gold

By Frank Holmes

http://dailyreckoning.com/return-of-quantitative-easing-good-for-gold/

09/28/10 San Antonio, Texas – The Federal Reserve said two words in its statement this week that should make every gold investor happy: Quantitative Easing. The Fed hinted that we may see additional QE measures as early as November. The news is good for gold investors because it means there could be more dollars chasing a finite amount of resources, further devaluing the U.S. dollar.

We’ve already seen an intervention by Japan’s central bank to weaken the yen in an effort to boost the nation’s sagging export sector. Japan is currently the world’s third-largest economy.

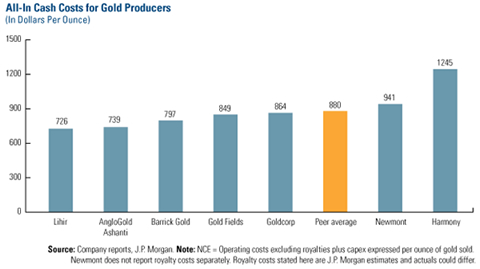

Another key driver for gold has been diminishing supply from gold mines. This chart from JP Morgan shows the all-in cost to produce and replace an ounce of gold for a handful of miners.

Despite $1,300 gold, margins are still relatively modest. The costs vary widely depending on the company, but the peer average is $880 an ounce. Gold miners will be looking for ways to expand these margins and cash in on higher gold prices.

Another good sign for gold equities is the recent pickup in M&A activity we’ve seen in the sector. There are generally about 1,000 mining M&A deals a year but we’re already above 1,300 deals so far this year, according to a Pricewaterhouse Coopers report.

Faced with diminishing production from existing mines, many of the seniors have looked to acquire additional reserves at a reasonable price as many junior companies remain below their 52-week highs. In many cases, these are the small- to mid-tier miners who’ve already put in the initial legwork in taking a discovery to production.

This week, two of our portfolio managers attended the Denver Gold Forum and both returned with a constructive outlook on gold for the near- and long-term.

Another observation from the conference was large amount of interest in gold as an investment and that there’s still a lot of education taking place on the best ways to invest in the gold sector. It’s important that investors don’t get caught up in the media’s pejorative view of gold and remember to utilize exposure to the gold sector as a portfolio diversification tool.

By the way, if you haven’t already had the chance to listen to what Roger Gibson had to say about the role of commodities in asset allocation, you can do so here.

Gold can be a portfolio tool for both the individual and professional investors. Energy stocks have been pummeled since the Deepwater Horizon accident earlier this spring, but the managers of our Global Resources Fund (PSPFX) have used gold as a way to protect against the recent financial and economic malaise. By increasing their portfolio weighting in gold and gold stocks, they’ve managed to limit exposure to a sector that has fallen out of favor with investors at the moment.

If you’re interested in gold, we suggest investing no more than 5 percent to 10 percent in the gold sector. In addition, this allocation should include both the physical asset—like gold bars or coins—and gold mining shares.

An opportune chance to enter the market may be just ahead. With gold moving up sharply in recent weeks, it’s likely there’s a pullback on the horizon but if the Fed reinstitutes QE measures as expected later this fall. Combine that with rising fiscal deficits and currency debasement among countries in the developed world and the future looks bright for gold.

Regards,

Frank Holmes,

for The Daily Reckoning

P.S. Brian Hicks, co-manager of the Global Resources Fund (PSPFX), contributed to this commentary. For more updates on global investing from me and the U.S. Global Investors team, visit my investment blog, Frank Talk.