An Important Low for Gold and Gold Stocks?

Gold and gold stocks bounced to end the week thanks to an oversold condition coupled with a softer than expected jobs report which likely delays Fed action until December. At one point this past week the market had priced in a 64% chance of a single rate hike by December and a 42% chance of a rate hike this month. A single rate hike is not going to derail the young bull market in precious metals and as long as the lows of this week hold then the bull market is in position to grow stronger by the end of the year.

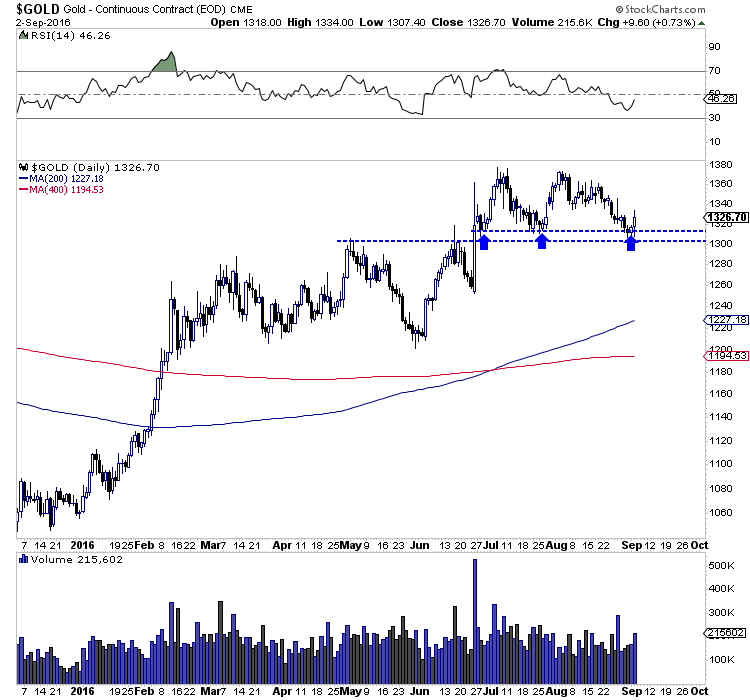

Gold this week was able to successfully hold $1300 to $1310 for the third time in the past two months. The daily candle chart below shows how resistance in the spring has become support in the late summer. If Gold can retake $1350 on a weekly basis and $1360 on a daily basis then it would be setup for the next leg to new highs for 2016. Note how the recent two month consolidation held support and did not even test the 50% retracement of the previous advance.

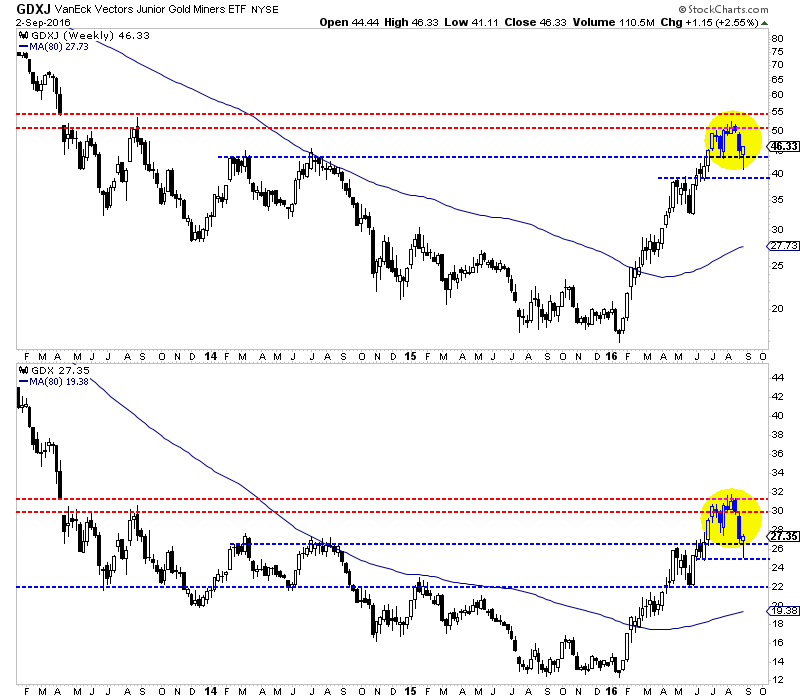

Turning to the miners, we see that they closed the week above a key support level, the 2014 highs. Both GDX and GDXJ, which declined 21% and 22% from their highs closed the week forming bullish reversal patterns (hammers). Miners could continue to rebound towards immediate resistance at GDX $30 and GDXJ $50. That resistance should hold on the first test.

Last week we noted that buying 20% to 25% weakness in a young bull market is likely to payoff in the long run. Traders and investors had that opportunity the middle of this past week. Look for this rebound to continue towards the aforementioned resistance targets. It is too early to say if precious metals are ready to immediately launch higher again. I would not rule out a retest of these lows but at the same time, we should in any case give the benefit of the doubt to the young bull market. For professional guidance in riding the uptrend in Gold, consider learning more about our premium service including our favorite junior miners which we expect to outperform in the second half of 2016.

Jordan Roy-Byrne, CMT, MFTA