Posted on

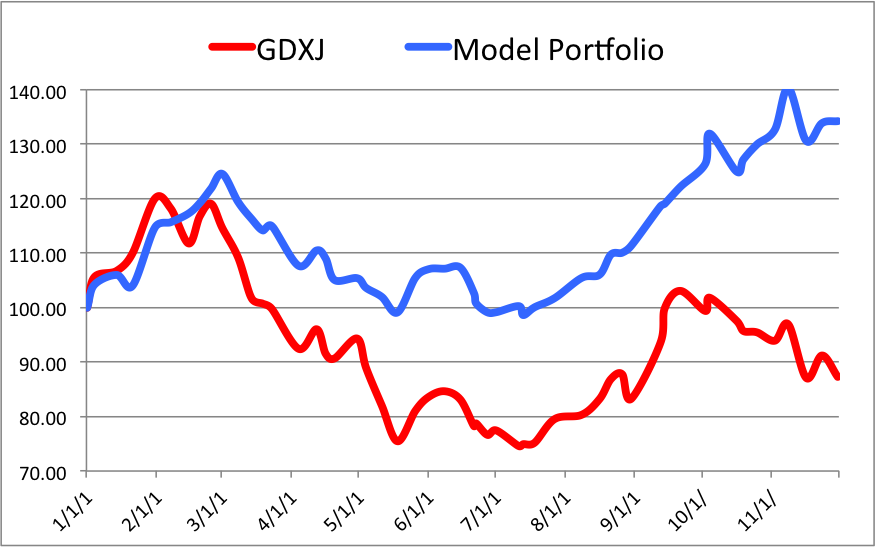

A Look at Junior Gold Producers

GDX is our favored index or ETF for tracking the gold stocks but it only tracks the large cap unhedged companies. In the world of gold mining and exploration, there are several sub sectors below the largest producers which comprise GDX, the HUI and the XAU. In recent weeks we have charted GDX to death. … Continue reading