Posted on

Bullish Outlook for Gold Still Valid Despite the Recent Pause in the Rally

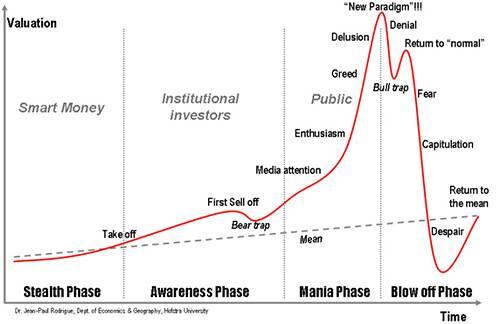

This week’s events are like theater, with shades of a Greek tragedy. In a play the audience knows that if there is a gun in the first act, it will be fired in the third. Now we’re in the second act and so far, the plot is predictable. The script was written back in 2008 when the subprime crisis hit.