Topics Covered

- Checking the pulse of the global credit markets

Weekly Overview

The mean reversion rally has stalled again, apart from the powerful rise in Agricultural prices, despite an abundance of bears calling for lower prices. Major commodities have found resistance levels with Crude at $90, Gold at $1640 and Wheat at $8. US Dollar made a new closing high on Friday, while the Long Bond remains in a tight trading range. The bottom line still remains the same: investors are fearful of a disorderly default in the Eurozone and intense funding pressure on large economies like Spain and Italy. At the same time, Asia and especially China is slowing down meaningfully. At present, bearish trades remain slightly crowded, but not as much as they were at the start of the month.

Global Macro

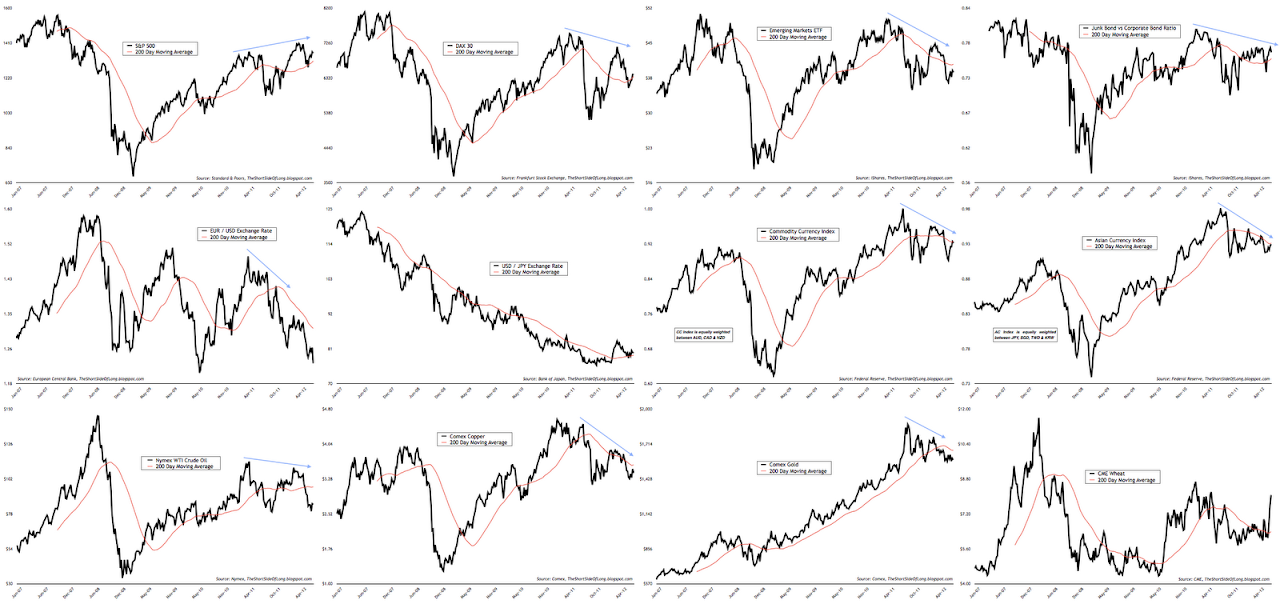

S&P 500 remains the only major risk asset that has made new highs in the cyclical bull market that started in March 2009. US is outperforming the rest of the world, as the reflation trade seems to be over for most other risk assets. Both the DAX 30 and GEMs ETF have registered a lower high in 2012. S&Ps new high is also not confirmed by various credit spreads, risk currencies or commodities. Global engine of growth, Asia, seems to be slowing down meaningfully. This is reflected by weakness in Commodity currencies and Asian currencies, as well as in industrial commodities like Oil and Copper. Many assets including GEMs ETF, Euro, Commodity & Asian currencies and commodities like Crude, Copper & Gold are still at or very close to their major support levels. A break of these levels will intensify a downtrend. Technical observations are as follows:

- S&P 500 remains above its rising 200 MA and has made a new high in 2012

- DAX 30 is above its falling 200 MA, but has failed to make a new high in 2012

- GEMs ETF is below its falling 200 MA and has failed to make a new high in 2012

- Junk bonds continue to under-perform Corporate bonds as credit spreads widen

- Euro Dollar is below its falling 200 MA and in a downtrend at 52 week new lows

- Dollar Yen is above its rising 200 MA and has failed to make a new low in 2012

- Crude Oil is below its falling 200 MA and has failed to make a new high in 2012

- Copper is below its falling 200 MA and has failed to make a new high in 2012

- Gold is below its falling 200 MA and has failed to make a new high in 2012

- Wheat broke out above its 200 MA and has started a new powerful uptrend

Economic Data

Nothing new to report. Refer to the side menu for previous articles.

Equity Markets

Nothing new to report. Refer to the side menu for previous articles.

Bond Markets

Nothing new to report. Refer to the side menu for previous articles.

Currency Markets

Nothing new to report. Refer to the side menu for previous articles.

Commodity Markets

Nothing new to report. Refer to the side menu for previous articles.

Credit Markets

Why is it important to follow credit markets? Monetary Bulletin writes that “well-functioning money markets, foreign exchange markets, and secondary markets for securities are important factors in the transmission of monetary policy to the economy as well as a key foundation for long-term economic growth and stability.” In other words, if we think of the economy as the human body, then credit markets should be viewed as major blood vessels and arteries that deliver blood (capital) to important areas of the human body (economy) creating growth, expansion and progress. Obviously, the opposite occurs when credit markets start to lock up.

It is my opinion that not enough traders, even the good ones, give credit markets enough time of the day. They use all types of fancy technical indicators, mathematically complex valuation formulas and sophisticated correlations or cycle theories; yet they do not listen to the simple and clear message that credit markets are telling them – especially in the age of de-leveraging and during a global debt crisis.

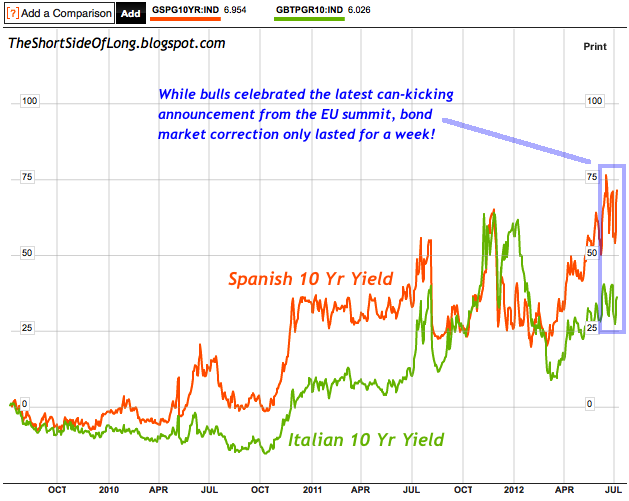

It has only been a week since the last EU summit, which according to many media outlets was a “major break through”. Furthermore, I was so surprised by many traders which I follow, who claimed that the bottom for risk assets was in and the ECB was about to start printing money. Well, while many were easily fouled by Eurocrats, those who follow the credit markets knew that another can-kicking exercise just won’t work. The European bond markets did not buy a word of it…

… and neither did the European Credit Default Swaps markets, used to insure investors from a potential default in Italian and Spanish debt markets. Spanish yields on the 10 Yr are now back up to all important 7% line in the sand, while the CDS are once again close to making all time new highs. What was all the fuss about? Honestly, did you actually think Eurocrats solved anything by bailing out indebted banks with more debt? The overall risk on rally lasted for a couple of weeks to be quite honest. It was only a week ago that I wrote:

“This pretty much means more of the same, ever since this crisis started and Greece was first bailed out in middle of June 2010. Solving a debt crisis with more debt through bailouts does not work. Furthermore, every relief rally connected to bailouts seems to last for a shorter time duration and accomplishes less gains in percentage terms.”

If you the Eurocrats wanted to solve this crisis properly, they should have let Greece default in early 2010, when the problem first came to the forefront of global crisis. That would have sent a clear message to the rest of the peripheral countries that no bailouts will occur and no free lunch will be given. Instead, politicians are only ever interested in getting reelected and postponing debt problems with more debt. Now we have an even bigger crisis on our hands and credit markets have had enough of can kicking!

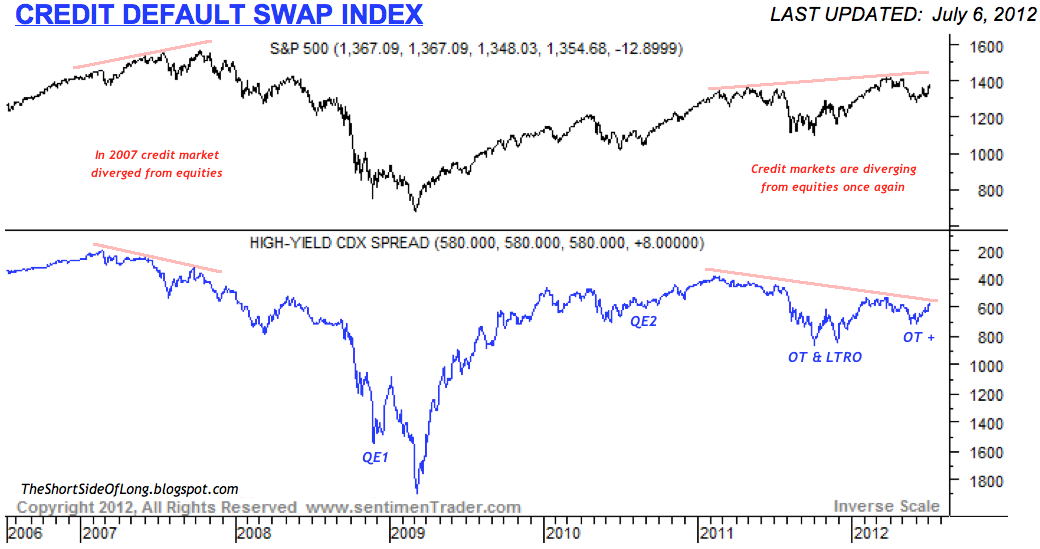

In the US, corporate bond market credit spreads are widening to three year highs as we can see in the chart above. There is a clear risk-off uptrend in place and credit spreads are above the 200 day MA. Furthermore, a lot of investors believe that central banks won’t let any type of a default occur and all will be well in the future. What a load of you know what. Chart above shows that QE2, Operation Twist and LTRO have not stopped credit spreads from widening, so I can safely assume that QE3 won’t do too much either. We are moving towards the final phase of the EU Crisis and I am expecting a corporate spike in spreads in coming quarters. Updated recently in my trading dairy (below), I am now short Junk Bonds.

Be it globally or locally in the US, there will be on de-coupling. Financial Stress Conditions are deteriorating as we can see chart above. There is a powerful negative divergence in progress between the credit markets and equity markets right now. One should not take this message with a grain of salt, as we saw similar occurrence in 2000 top as well as the 2007 top.

Credit Default Swaps on US corporations also speak of a completely different message to what the equity markets are saying and yet majority of investors are not listening. The chart below shows the majority of investors would not even think twice about calling this a market top or turning bearish on risk assets right now. On the other hand, I am extremely worried about the way final phase of the EU crisis will play out in coming quarters.

In a simple and straight forward summary, until I see credit markets moving positively in sync with the risk assets, the recent rally is more of a selling opportunity then anything else. In all honesty, I am very sceptical right now. Only a major Federal Reserve printing intervention would possibly change my mind in short to media term.

Trading Dairy Update

- Fundamental Outlook: I believe that we approaching another bear market as the recovery loses steam. I am not sure if politicians can hold it off until elections in both US and Germany pass, but 2013 and 2014 will most likely be bad years. US GDP has grown 5 quarters at around 2% or lower which is stall speed. Over the last 60 years, whenever the economy grows at subpar levels it has always entered a recession. At the same time earnings and margins are at record highs, so I expect that they will mean revert. During recessions since the 1950s, earnings tend to fall on average by 25%, so a drop to $70 from current levels in earnings could take the S&P 500 down below 1,000 points (P/E = 12 * $70). Cash levels in money market funds are as low as 1998/99 and 2006/07, so I believe investors are extremely exposed to equities. Corporate credit spreads are very narrow relative to economic fundamentals, so I expect they will widen dramatically in due time. Recessions occur every 3 to 4 years of expansion during secular bear markets, so in 2013 or 2014 we are overdue for a slowdown (but it could be much earlier).

- Asset Watch-list: On the long side, commodities still remain on my watch list. These include Commodity Indices (GCC / RJI), Brent Crude (BNO), Precious Metals (CEF, SLV, PSLV) and Agriculture (RJA / MOS). I believe commodities are very oversold right now especially Crude Oil’s and Silver’s sentiment. As already mentioned, I’ve recently bought more Silver on the long side, but will not do anything more until I hear stronger action response from the Fed or until European crisis plays out its final leg. On the short side, Tech sector (XLK) & Discretionary sector (XLY) are on my list of stock shorts. I am also looking at Emerging Market bonds (EMB) and have already engaged into shorting high yielding Junk bonds (HYG). Finally, a major short in due time will be US Treasury long bonds (TLT), but I believe we are just not there yet. I am slowly gearing up to open some more shorts for the first time since 2008.

Source Tiho’s Site