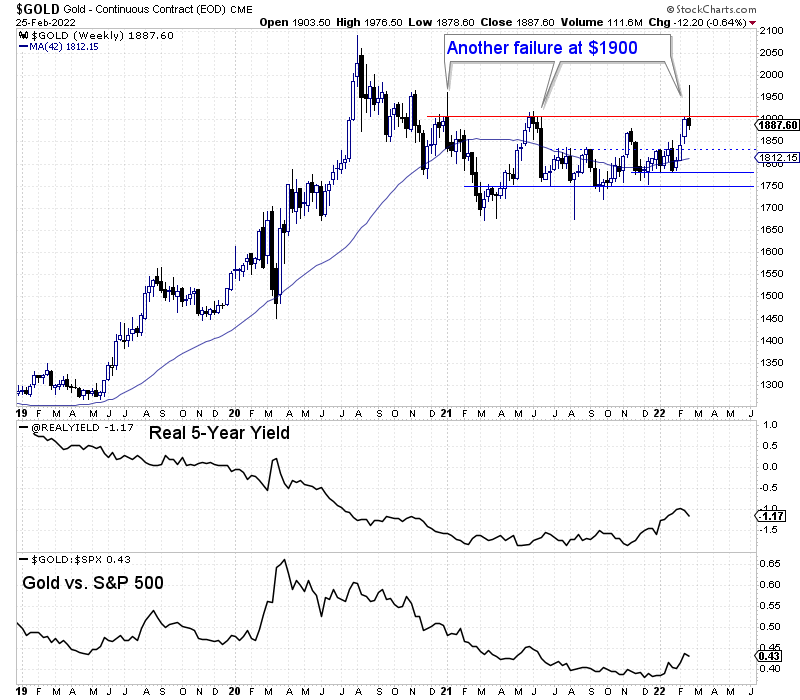

Failed Breakout in Gold Amid Russia Invasion

Buy the rumor, sell the news.

Traders were front-running the invasion.

They pushed Gold from $1840 to $1975 in eight trading days. On Thursday, the day of the invasion, Gold advanced from $1910 to $1975 before reversing nearly $100.

Gold has closed the week below $1900 and figures to close the month (on Monday) below $1900.

Weekly and monthly closes are important because they are on a longer time frame, and they smooth out this kind of volatility.

They also signal if investors held their positions into the weekend and into the next month. In other words, they signal if the move “sticks.”

In the current case, the answer is no. The weekly Gold chart shows the clear failure at $1900.

The positive is that Gold is currently in a stronger technical position than at the beginning of 2021 and in spring 2021. Then it was broken and correcting. Now it is above rising moving averages and trying to establish a new uptrend.

It has support at $1830, $1812, and $1780.

Moving forward, I see two potential paths for Gold.

Gold continues a bullish consolidation, in which the low to mid $1800s are a floor or Gold falls to $1780 or $1750, and the $1830s become resistance again.

The stock market and economy will determine how Gold performs.

If the stock market cannot make new highs and the yield curve inverts, the Federal Reserve will be forced to shift policy. In recent decades, they cease rate hikes when the yield curve inverts. Gold would benefit and be primed for a real breakout.

However, if the stock market can rally to new highs and the economy stabilizes, the Fed will hike rates for much of this year.

In any case, the Fed ending its hikes and shifting its policy is likely to be the next catalyst for Gold.

Furthermore, as we noted last week, Gold breaking above $1900 is critical for the rest of the sector. It would unleash a move in gold stocks, junior gold stocks, and Silver.

Until that break occurs, weakness in the best juniors is a buying opportunity.

For example, I just bought a position in my top silver stock, a company that could have up to 8x potential over the next few years.

I continue to be laser-focused on finding quality juniors with at least 5 to 7 bagger potential over the next few years. To learn the stocks we own and intend to buy, with at least 5x upside potential after this correction, consider learning more about our premium service.