Gold Bull Catalysts Coming

Gold and gold stocks showed unexpected strength last week, and although they closed the week in a disappointing fashion, their larger outlook is growing increasingly positive as multiple catalysts abound.

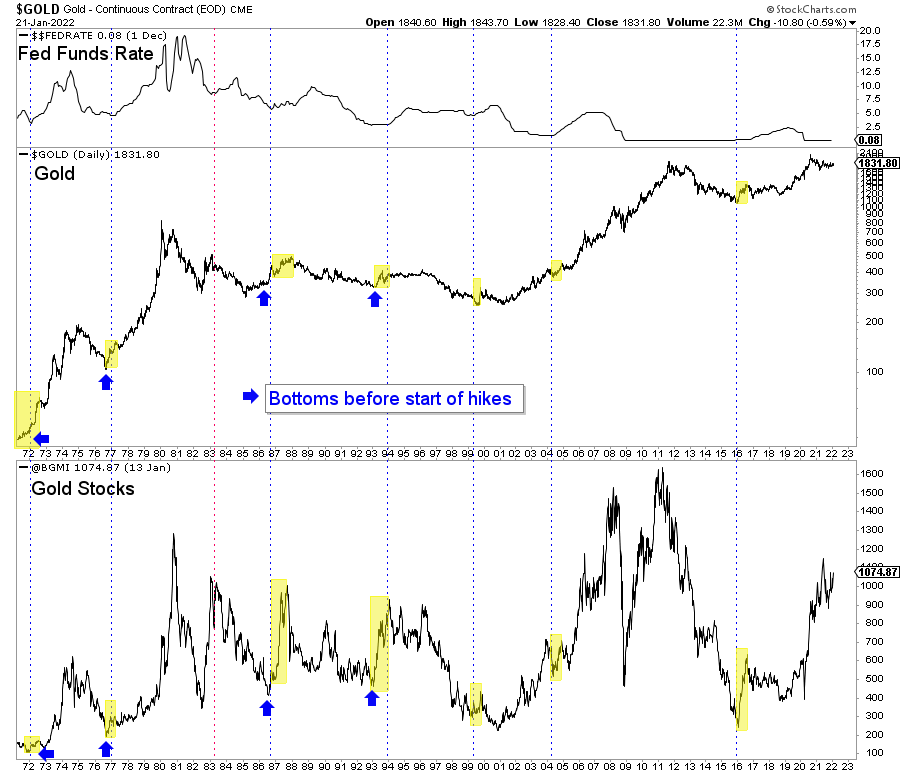

We have touched on the Fed rate hike cycle catalyst.

In seven of the last eight rate hike cycles, Gold and gold stocks gained after the first rate hike.

As you can see, there are also some cases in which Gold and gold stocks bottomed before the first rate hike. However, if there is weakness over the weeks ahead, that would set up the post-rate hike rally that has been common throughout history.

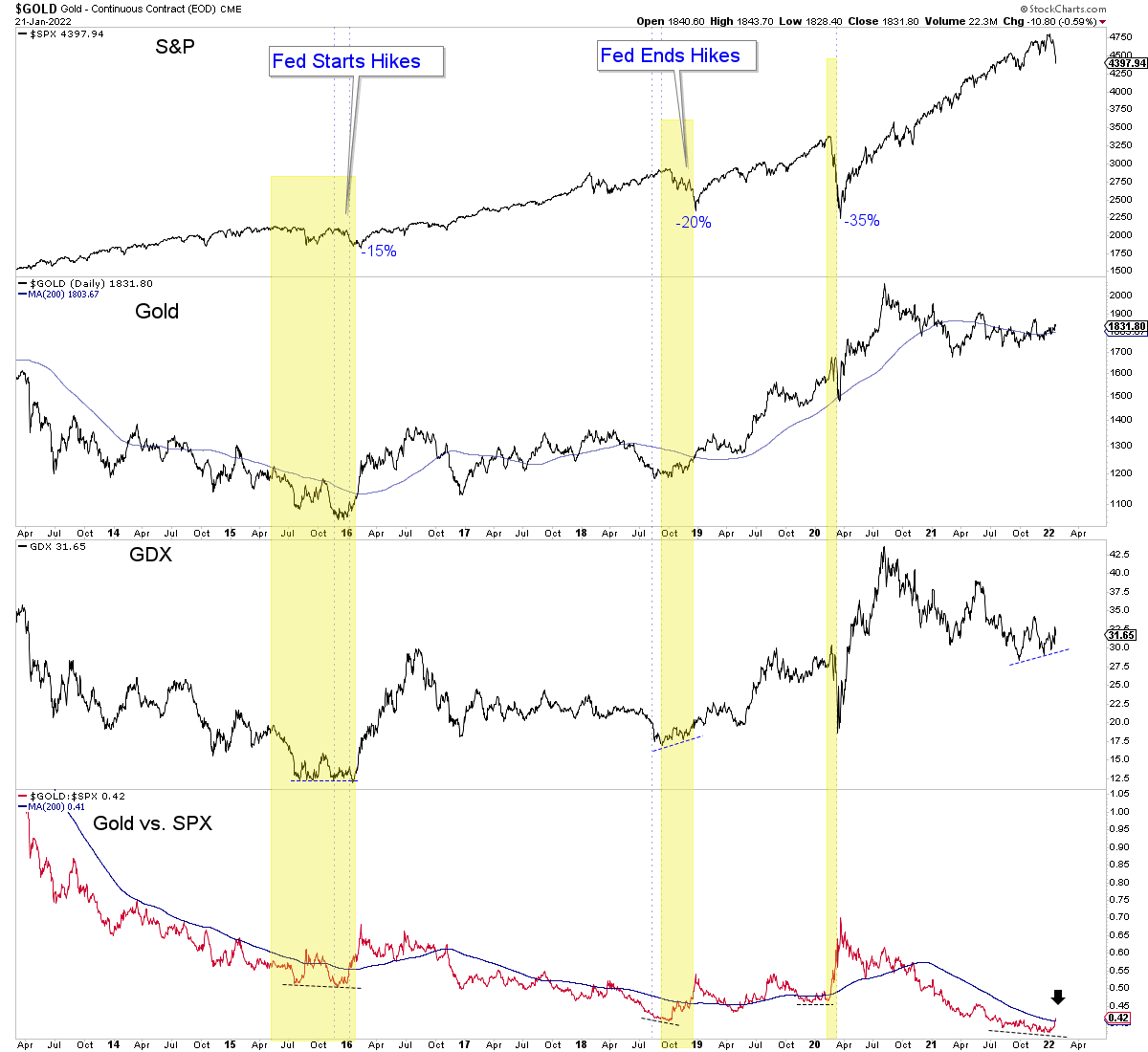

The other catalyst is the potential for an extended correction in the stock market. The three most recent significant lows in precious metals coincided with the three most significant stock market corrections over the past eight years.

The S&P 500 has corrected nearly 9%, and the Gold to S&P 500 ratio (bottom) has pushed above its 200-day moving average for the first time in 15 months.

Should the stock market correct further, then that could force a pause in the rate hikes. Gold would continue to outperform the S&P 500, and precious metals could embark on a sustained move higher.

The gold stocks and Silver have held up well given the selloff in the stock market. They could get hit if the selloff turns into a steep decline, but one should recall their propensity to rebound after sharp declines.

Even though there could be more weakness and volatility, the precious metals complex is setting up for a good run in the spring and summer.

I continue to be laser-focused on finding quality juniors with at least 5 to 7 bagger potential over the next few years. To learn the stocks we own and intend to buy, with at least 5x upside potential after this correction, consider learning more about our premium service.