Gold is Where Stock Market was in Early 1980s

Although Gold has pulled back and its latest breakout attempt failed, it remains fairly close to the most significant Gold breakout in 50 years and the most significant macro breakout since the S&P 500 broke out in 2013.

However, generalist investors and generalist technicians are more enthusiastic about the recovery in the stock market and the prospects for a new bull market even as the economy trends towards a recession.

Gold is the only asset that recently traded around its all-time high, but you would not know it when judging sentiment.

Assets in Gold and Silver ETFs are around three-year lows as investors ignored the latest rebound.

A few months ago, Bloomberg noted how news stories on Gold were far from the levels at the 2022 and 2020 highs.

Make no mistake, more investors and bullish sentiment are needed to trigger a sustained bull market.

But for now, the current backdrop in Gold looks like that of the stock market at the start of the 1980s. There are quite a few similarities.

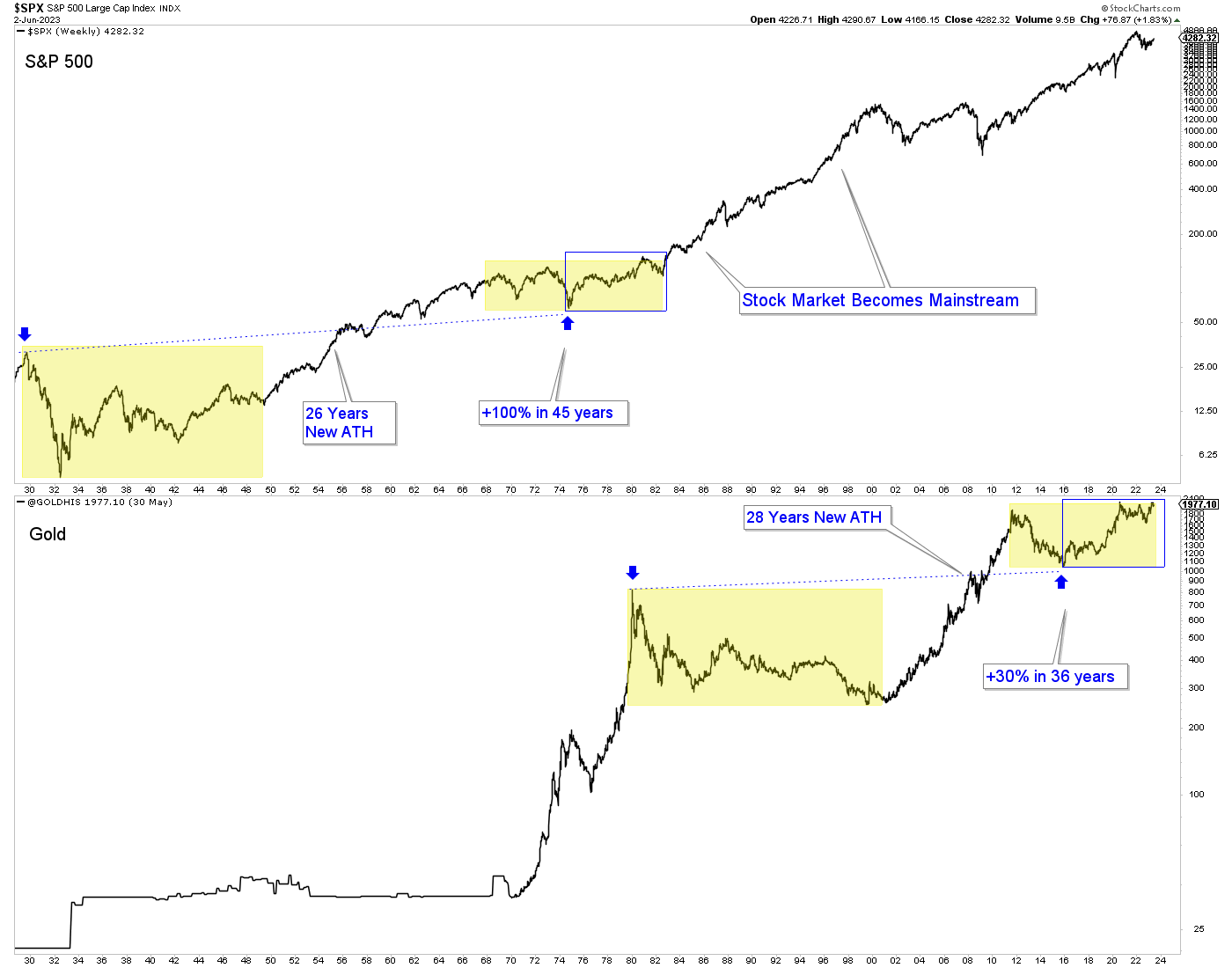

Gold, like the stock market then, is at the end of its second secular bear market of the past 40+ years. The first secular bear for each was a Depression.

The 1969 to 1982 secular bear in the S&P 500 lasted 13 years before giving way to an epic breakout and new secular bull. Gold has been in a secular bear for 12 years, and a strong breakout above $2100 would give way to a new secular bull.

In addition, each market made a significant low in price in the middle of the secular bear. For the S&P 500, that was 1974, and Gold made its price low at the end of 2015.

Gold’s price action during the last nearly eight years is similar to the S&P 500’s from 1974 to 1982. Each market trended higher during this period, and the S&P 500 would not begin a secular bull until it cleared all-time high resistance significantly and outperformed in real terms. That sounds like Gold at present.

Fed rate cuts, huge tax cuts, and a decline in the inflation rate triggered the stock market breakout in 1982 and the bull market of the 1980s.

The coming recession, Fed policy easing, and additional fiscal stimulus likely trigger the breakout in Gold. The recession should begin at the end of the third or in the fourth quarter.

Speculators and investors have some time to research and uncover the best opportunities while they remain cheap. This correction is also the time to reconsider the strong stocks you missed.

I continue to focus on finding high-quality gold and silver juniors with 500% upside potential over the next few years. To learn the stocks we own and intend to buy, with at least 5x upside potential in the coming bull market, consider learning about our premium service.