Gold Sector Sentiment Update

Over the last few weeks we’ve been writing about potential macroeconomic developments, which will drive Gold in the near term and in the years ahead. We thought we’d take a break from that and focus on what we enjoy most: analyzing technicals and sentiment.

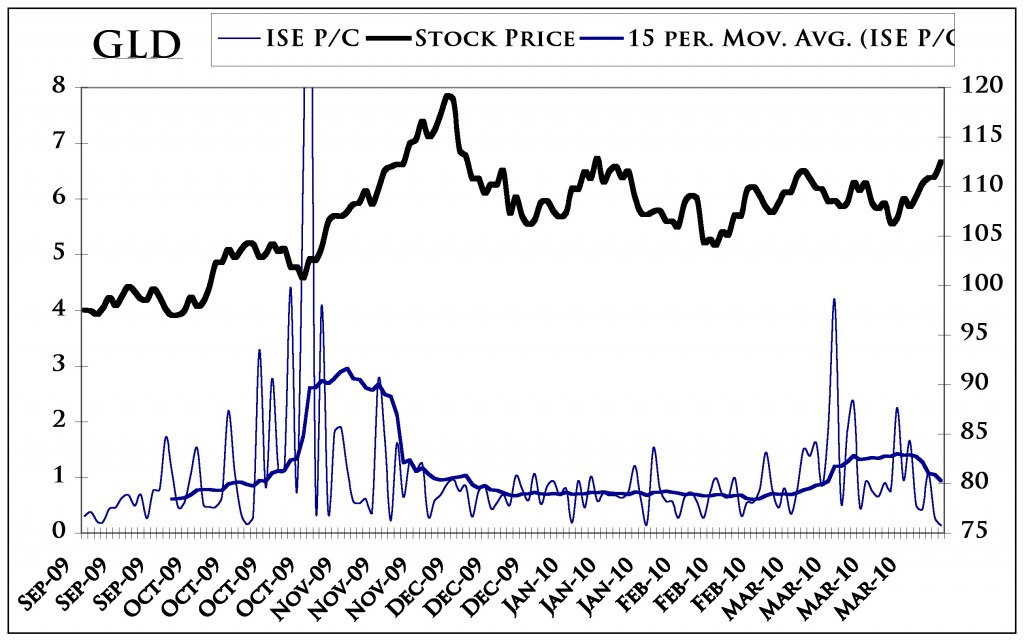

We track many different things for sentiment (including public opinion, Rydex data and of course the COT reports). Yet, the most powerful tool has been put-call data from the International Securities Exchange (ISE).

Below is our chart showing the ISE put-call data for GLD. In the last month we’ve seen several spikes and we should note that the 15-day MA of the put-call ratio reached a four-month high.

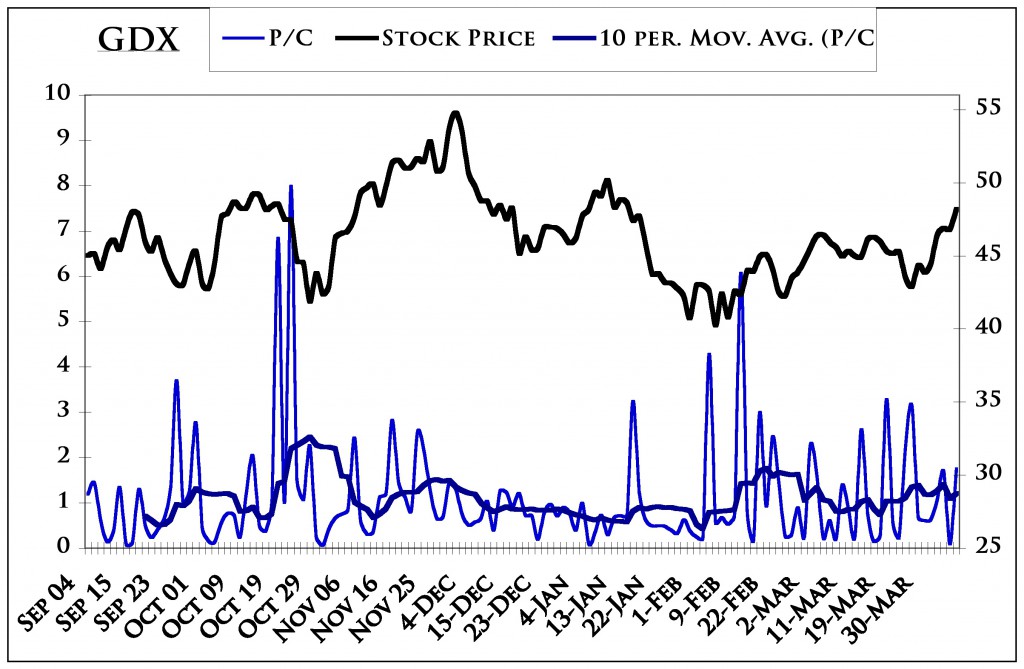

Next up is a look at the GDX put-call. Note the two large spikes at the time of the February bottom as well as the buoyant activity in recent weeks.

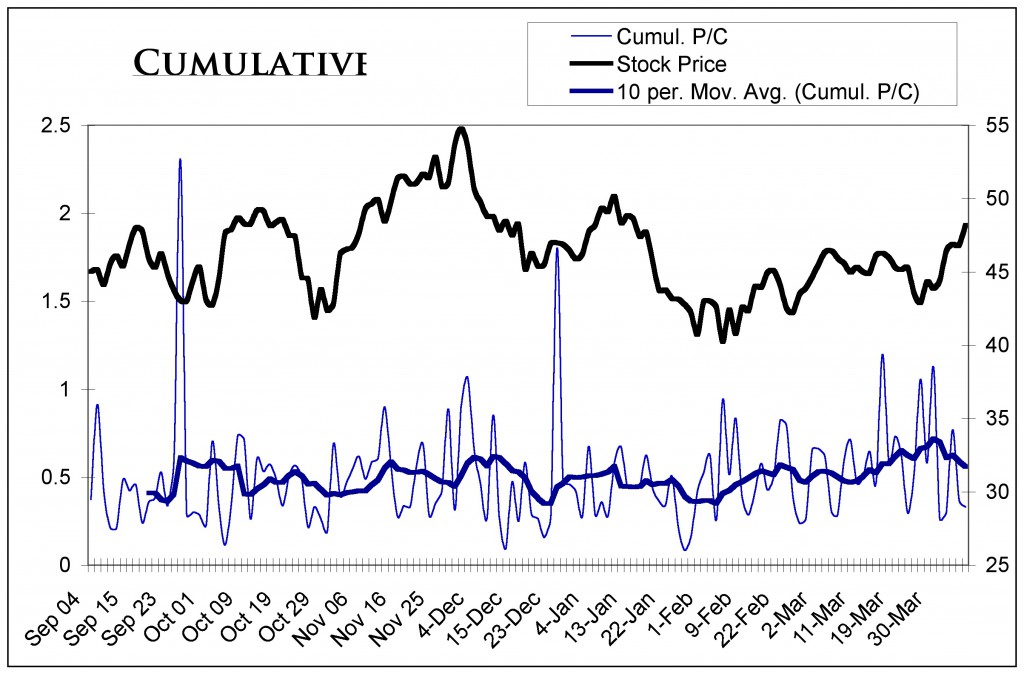

Here is a look at the cumulative put-call reading. This is a sum of the options activity for all of the gold stocks we track. There was a small spike during the February bottom and larger spikes at the recent low. Also the 10-day MA was at a seven month high.

This is only a small sample of the kind of actionable information and analysis we provide in our premium service. As you can see, the ISE put-call data, among other things has helped our subscribers stay ahead of the short-term trend changes in the sector. If this interests you, along with complete coverage of large cap and junior gold and silver miners, then consider a 14-day free trial to our newsletter.

Good luck ahead!

Jordan Roy-Byrne, CMT