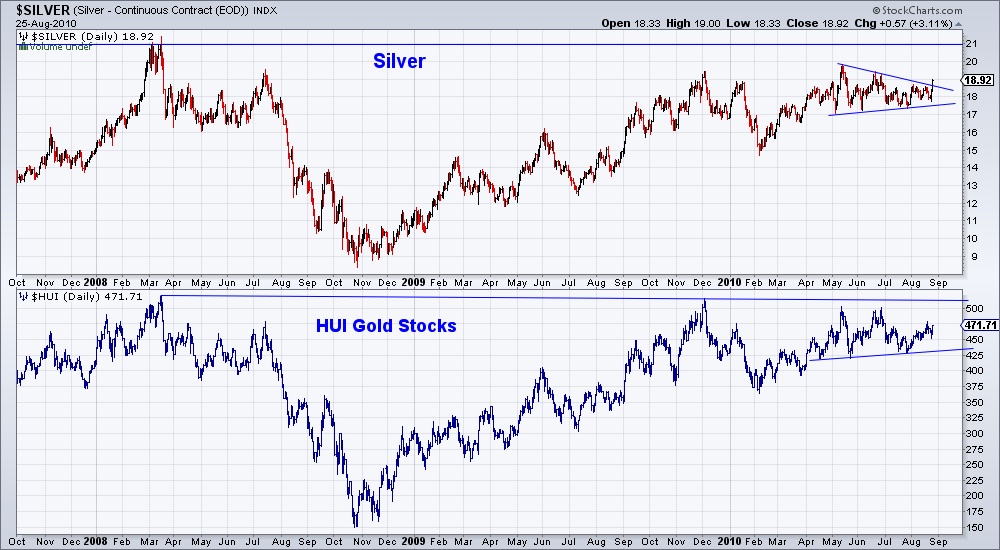

Gold Stocks and Silver Nearing Huge Breakout

Both the gold stocks and Silver had big 3% gains today. As you can see from the chart below, both markets are nearing a test of 2008 resistance.

A move past the 2008 highs would be an important breakout. However, it is important to note that in both Silver and various large-cap gold stock indices, resistance actually dates back to 1980. For the gold stocks we are looking at a potential breakout from a 30-year base, while for Silver, we are looking at a potential breakout from a 29-year base.

Ladies and gentlemen we are looking at the inception of a historic move in precious metals and precious metals companies. Don’t believe me? Consider that at the end of 2009, 0.8% of global assets were in the precious metals complex. Folks, this was above 20% in 1981 and over 30% in the 1930s. Despite what you may read or hear, virtually no one owns precious metals, and those that do don’t own enough.

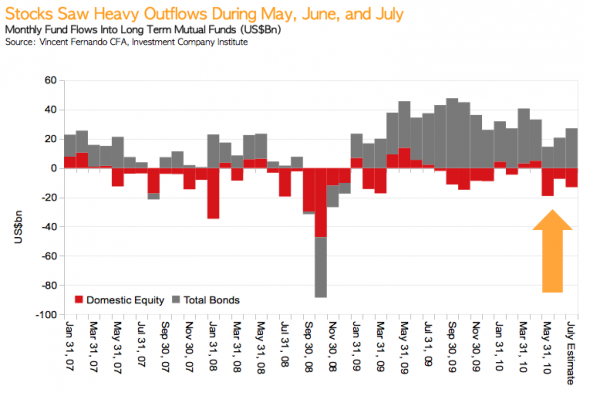

As you can see from the picture below, folks are rushing for safety in Treasury bonds.

Sad to say but most folks don’t get it. Those that continue to stick with crappy stocks and bonds that aren’t going anywhere deserve their own fate. Those that get involved in the precious metals will be wealthy when its all over.

Debt default is unavoidable. Inflation or deflation doesn’t matter. What matters is that the US, Europe and Japan CANNOT grow their way out of the debt mess. A new currency regime is unavoidable. The worse the economy gets, the faster we move towards sovereign default, bankruptcy, hyperinflation and a new currency. It has happened before numerous times and will happen again. Don’t be left behind. The train is getting ready to depart the station.