Gold’s Fate Hinges on the Stock Market

I have been writing about this for over five years.

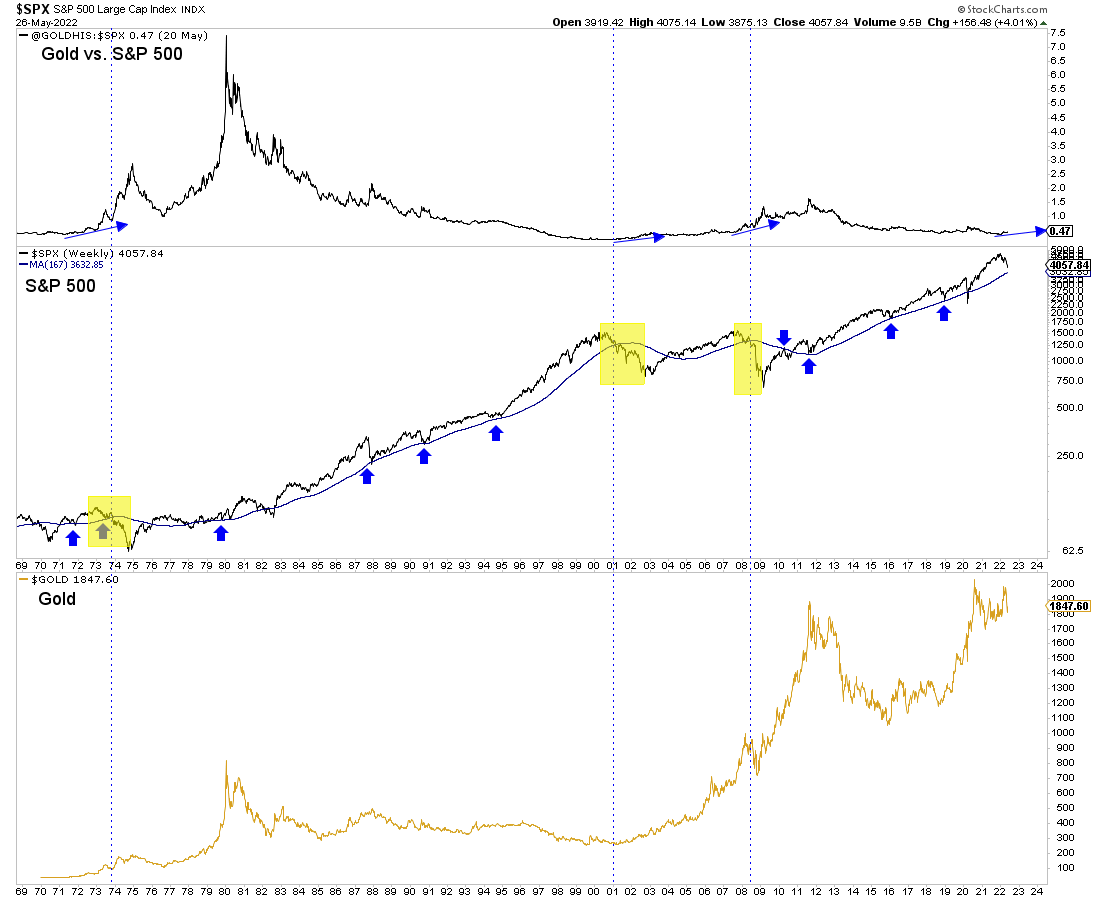

For Gold to perform well, it has to outperform the stock market. In recent years, that has happened but only occasionally and not consistently.

In a much broader sense, Gold’s best moves and real bull markets occur when equities are in a secular bear market. One only needs to consider the 1970s and 2000s.

Stocks have been in a secular bull market since 2009, but there is a real risk that a new secular bear market has begun.

The chart below shows the importance of the 40-month moving average (equivalent) for the S&P 500. In secular bull markets, it acts as support.

If the S&P 500 loses the 40-month moving average over the months ahead, it will signal a new secular bear market as it did in 1969/1973 and 2001. Note how well Gold performs after that happens (yellow).

Should the S&P 500 lose its 40-month moving average later this year, then, it would be in its worst bear market in 14 years, and the Fed would likely be talking about easing. Gold would be in a position to break out.

At present, the S&P 500 looks to have begun a bear market rally, which fits the historical template of bear markets in a secular bear market.

There are six of these bear markets.

After the initial decline, each of the six rallied for a few months while holding above the 40-month moving average. They all broke below the 40-month moving average and the average and median time of the break was roughly nine months into the bear market.

The current bear market rally will allow the Fed to hike in June and July. The real question is how soon the Fed will have to shift policy and whether the economy is headed for a mild recession or a more severe one.

In any case, Gold is in a position to rebound when the market senses an end to tighter policy.

Further weakness in the stock market and the economy will inevitably lead to a Gold breakout and the start of a real bull market.

I continue to be laser-focused on finding quality juniors with at least 5 to 7 bagger potential over the next few years. Periodically I will publish and update a list for subscribers of my favorite stocks with at least 10-bagger potential. To learn the stocks we own and intend to buy, with at least 5x upside potential after this correction, consider learning more about our premium service.