Gold’s Fundamentals Not Bullish

Last week we wrote about potential downside targets in Gold & Silver.

They are in a correction and have been in a downtrend that has begun its 17th month.

The fact that they are in a severe correction and not a bullish consolidation speaks to the fundamentals, which currently are not bullish.

Let me explain.

The primary fundamental driver for Gold and precious metals is declining real interest rates.

The keyword is declining. Declining real rates (or real yields) enhance the attractiveness of precious metals as money. Rising real rates do the opposite.

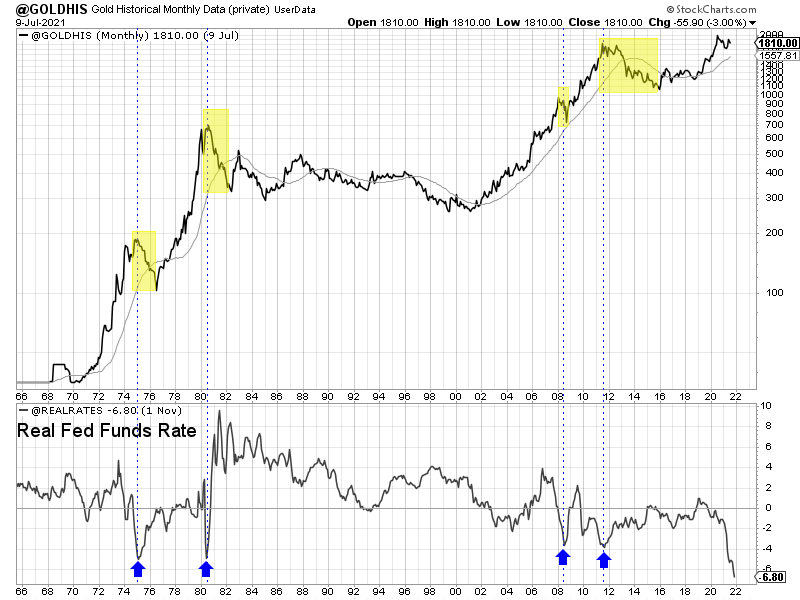

One measure of real rates is the real Fed Funds rate (FFR). Subtract the FFR from the rate of inflation. This is somewhat of a lagging indicator, but it’s historically accurate.

Many charts like this are floating around gold bug Twitter as if they are supposed to be a strong fundamental argument for buying Gold.

Can you spot the problem?

The real FFR already blew out to the downside!

It’s extremely unlikely to continue to decline, and Gold has already discounted that. Gold is sniffing out the coming rebound in real rates.

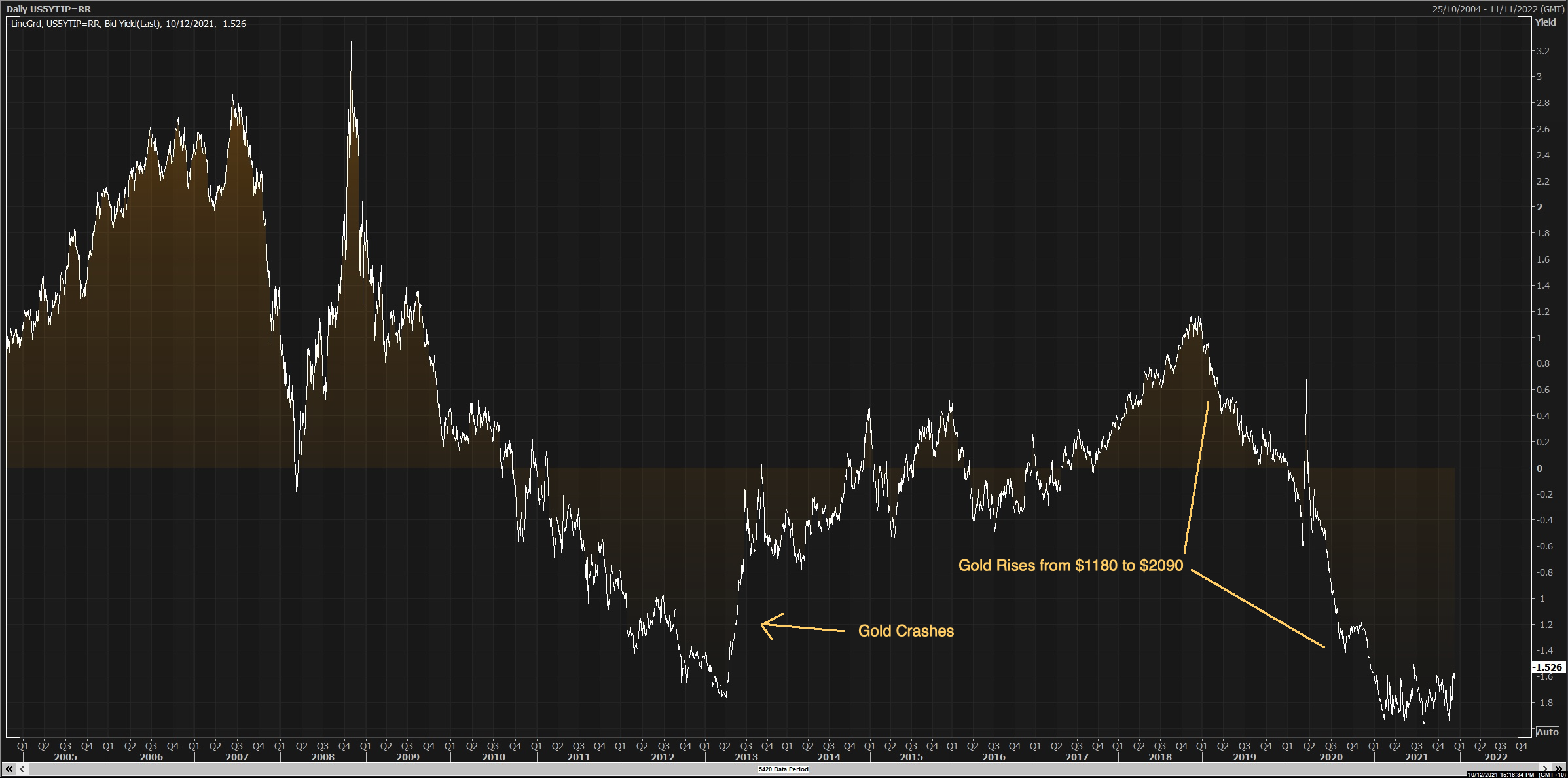

The chart below shows the real 5-year yield measured from the TIPS market. It’s a real-time, market-based indicator of real yields.

Recall that Gold peaked in 2011, but this indicator didn’t bottom until early 2013. Also, Gold peaked in August 2020, but this indicator did not bottom until a year later. (It tends to be inversely correlated to Gold).

If the inflation rate declines from 6% to 3%-4% and the Fed hikes rates a few times (a plausible scenario), real interest rates will rebound by several percentage points.

The weakness in Gold could be a reflection of the likelihood of this or a similar outcome.

From a 30,000 foot view, Gold’s fundamentals are very bullish. Real interest rates have to remain low and negative to bring the debt burden under control.

But there will be periods when real interest rates rebound, and the current period of such should coincide with Gold building the handle of its super bullish cup and handle pattern.

Gold’s “not bullish” fundamentals and the downtrend in juniors and miners should allow you to buy some incredible bargains over the coming months. The tide for Gold will turn after the Fed hikes interest rates.

I continue to be laser-focused on finding quality juniors with at least 5 to 7 bagger potential over the next few years. To learn the stocks we own and intend to buy, with at least 5x upside potential after this correction, consider learning more about our premium service.