How Low Can Gold & Silver Go?

Last week we wrote that the precious metals sector remained in a larger correction.

We discussed the performance before the first rate hike in a new Fed rate hike cycle. Gold typically declines several months before the hike, but then rebounds significantly. Same for the gold stocks.

Although the recent decline could be part of the pre-rate hike decline, its speed surprised us.

We noted that a decline in line with history would take Gold below $1700.

Let’s look at important support levels that would come into play should the decline continue.

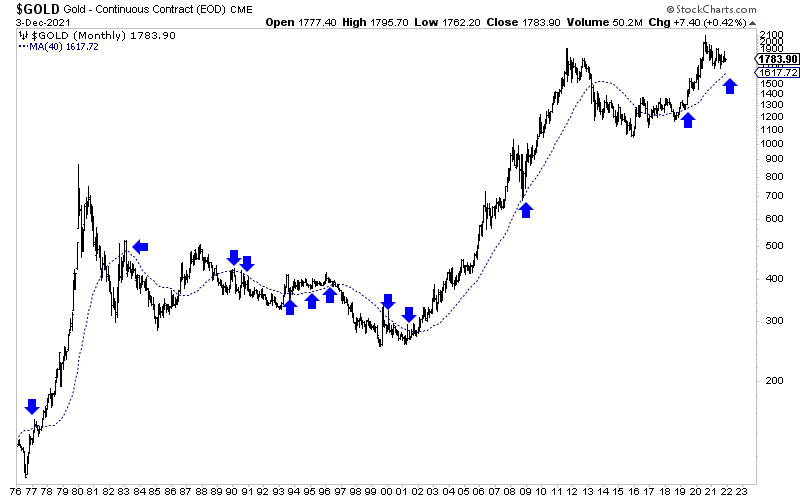

The 40-month moving average has been an excellent trend indicator for decades. It currently sits at $1618.

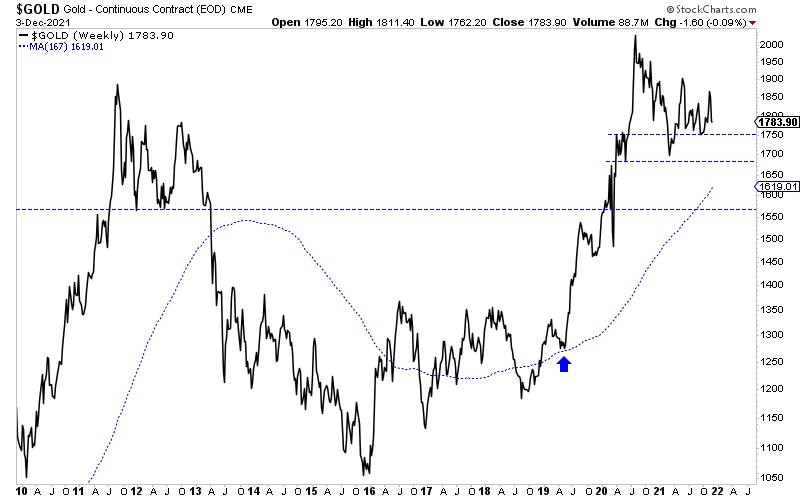

Here we plot Gold’s weekly line chart with an equivalent moving average (to the 40-month).

Gold has initial support at $1750, followed by the corrective low at $1670 to $1690. The two major support lines are the rising 40-month moving average and the 50% retracement near $1570.

The 40-month moving average could reach $1670 by April 2022.

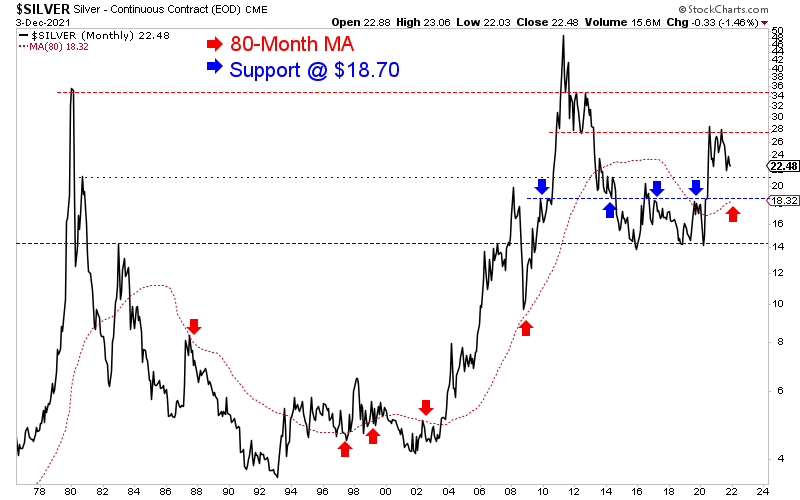

The monthly line chart for Silver shows key support at $21 and strong support at $18.70. The 62% retracement from the 1993 low and 2011 high is $21. The 80-month moving average for Silver should reach $18.70 in 2022.

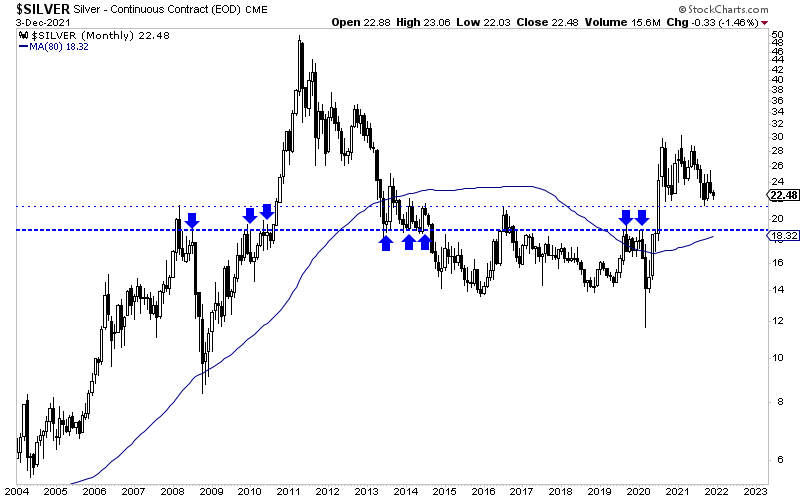

Here is a zoomed-in look at Silver using the monthly candle chart. Support at $18.70 stands out. Initial support is at $21.

The trend remains down, and the relative weakness in Silver and the gold stocks is a warning signal of potential for more selling.

Although I am confident that bullish catalysts lie ahead for precious metals in 2022, one must respect the technicals and potential for more downside into 2022. It is advisable to cut your losers and other positions in which you have low confidence.

That would also allow you to build some cash to buy bargains over the coming months. I have covered potential buy targets for my top 10 stocks in my premium service.

I continue to be laser-focused on finding quality juniors with at least 5 to 7 bagger potential over the next few years. To learn the stocks we own and intend to buy, with at least 5x upside potential after this correction, consider learning more about our premium service.