Impending US$ Peak Should be Catalyst for Gold

Gold has performed very well under the circumstances of declining inflation and a surging US$ index. Since 2014 the US$ index is up nearly 18% while Gold is up 3%. Since Gold’s November low the US$ index is up over 10%. Had we known that at the time, we’d have thought Gold would be headed for $1000 and not the $1300 it recently hit. At present, the US$ index appears ripe for a correction or major pause in its uptrend. Given that Gold is priced in US$ and that Gold has shown strength in real terms, sustained US$ weakness could be a major boon for Gold and precious metals as a whole.

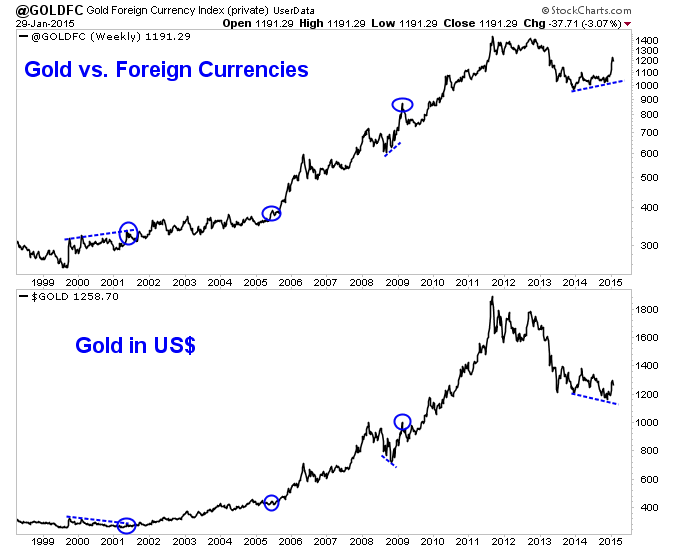

Before we get to the US$, I’d like to provide a comparison of Gold and Gold charted against foreign currencies. To create the foreign currency index we simply took US$ data and inverted it. Thus, we are charting Gold against the currency basket that comprises the US$ index. Over the past 15 years strength in Gold relative to foreign currencies has often preceded Gold strength in US$’s. Gold priced against foreign currencies bottomed in December 2013 and reached a 21-month high last week.

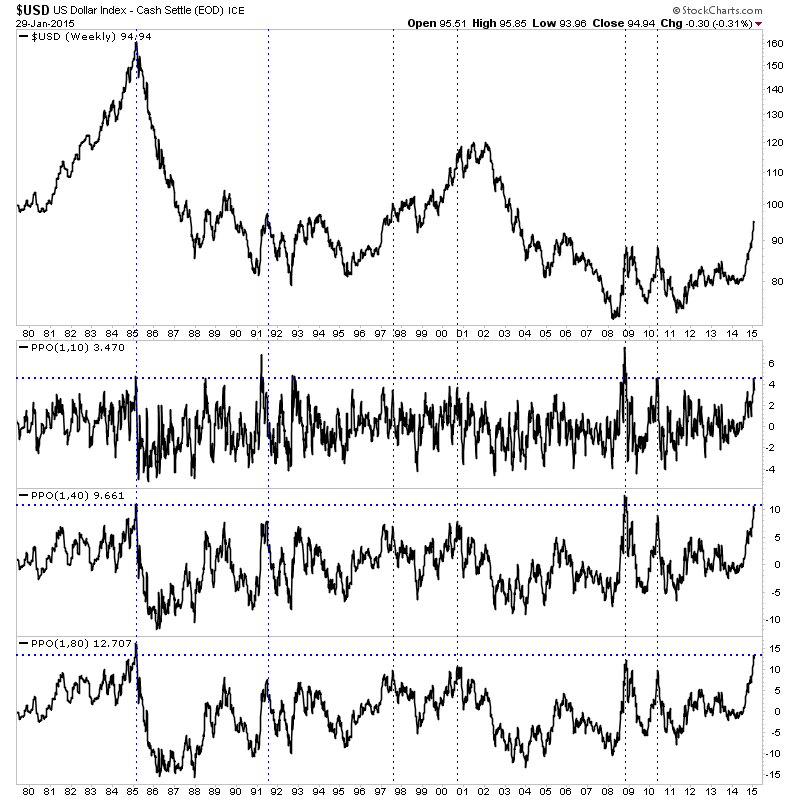

Let’s take a look at the US$ index. We plot the index and its distance from its 10, 40 and 80-week exponential moving averages. A market’s distance from various moving averages can signal overbought and oversold conditions. We highlight the points at which the US$ index has been most overbought. Considering the three oscillators as a whole, the US$ index is arguably at its third most overbought point since the US$ floated in 1971. The other times were at its peak in early 1985 and during the 2008 financial crisis.

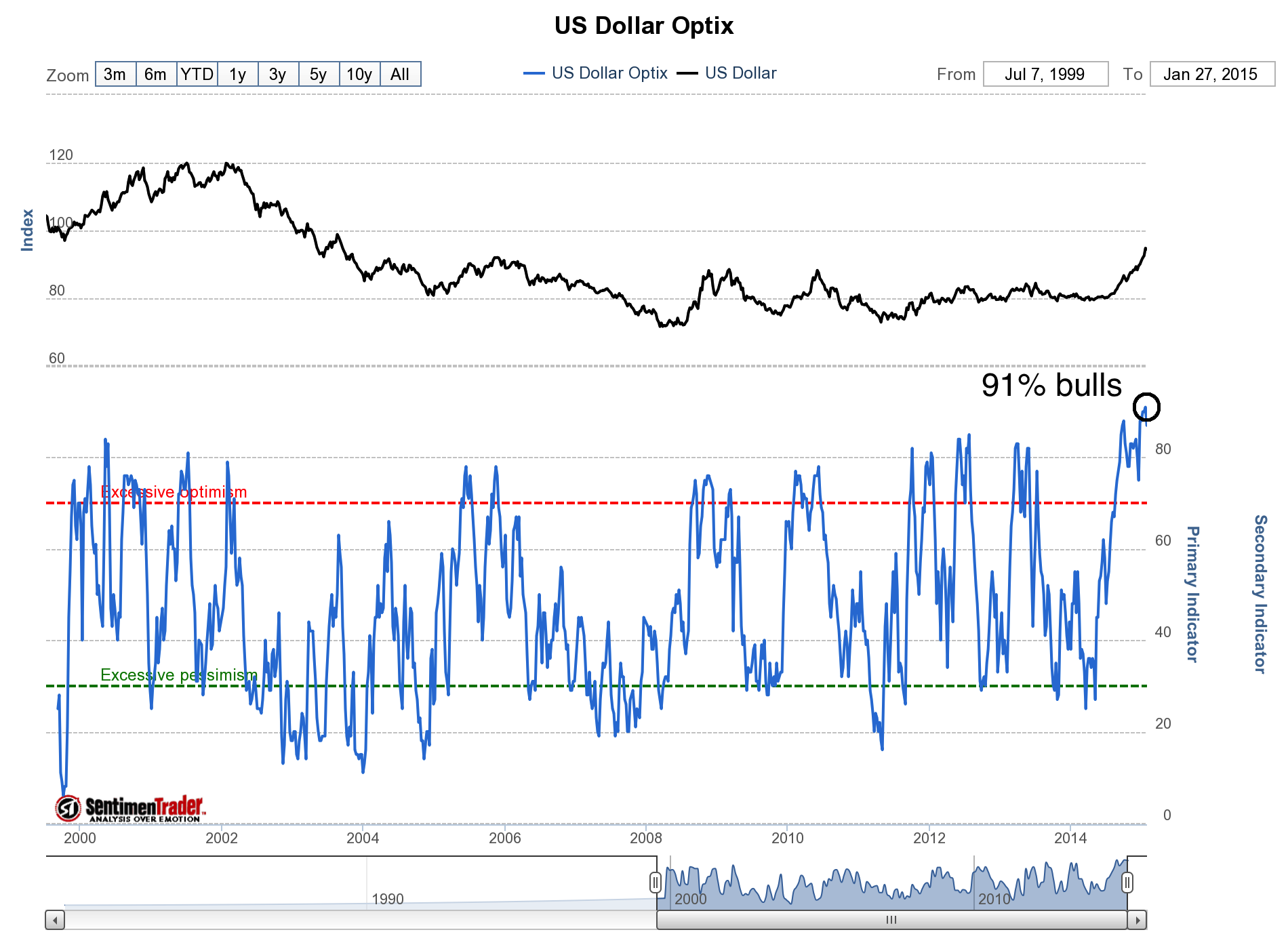

Meanwhile, sentiment on the US$ has reached a major extreme. Public opinion charted below (from sentimentrader.com) recently hit 91% bulls. That is the highest in 15 years. We should also note that the daily sentiment index for the US$ index hit 98% bulls a few weeks ago. That is the highest reading since May 2010. The US$ peaked a month later.

Gold has performed very well amid tremendous US$ strength and could get a further boost if and when the US$ weakens. The US$ index is extremely overbought and sentiment is extremely bullish. At the least it figures to correct or consolidate for a while. That could be Gold’s chance to begin its next leg higher and force the bears to capitulate. While recent correlations have been atypical, I find it hard to believe Gold doesn’t perform well if the US$ corrects. In the days and weeks ahead, the key support levels are GDX $20 and Gold $1240 to $1250. Consider learning more about our premium service which includes a report on the top 10 junior miners to buy.

Good Luck!

Jordan Roy-Byrne, CMT