Ingredients for Huge Rally in Gold Stocks

Gold continues to hold above $2000/oz, but the gold stocks, which have failed to get any traction, grind lower as the stock market surges.

Apathy has set in as valuations and investor sentiment in gold stocks probe multi-year lows. In other words, the weakness of the last several quarters is more a result of investor behavior and preference rather than fundamentals.

The other component of a major bottom is a very or extremely oversold market.

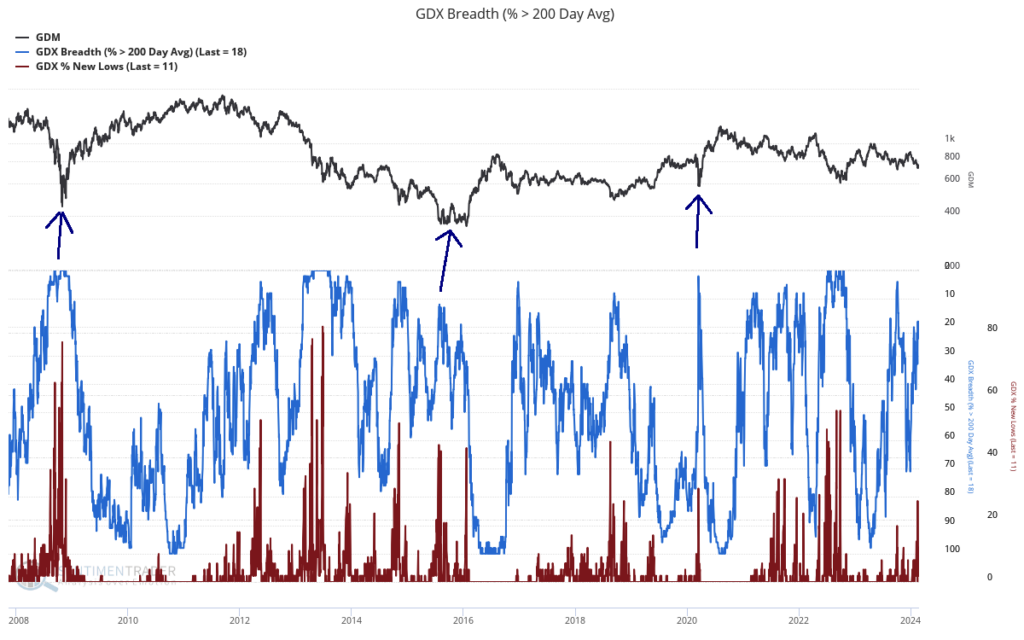

The chart below plots GDX (black), new 52-week lows (brown), and the percentage of GDX stocks trading above the 200-day moving average (blue).

The sector is certainly oversold but not yet at historical extremes seen at major lows.

But the sector is certainly closing in on an extremely oversold condition.

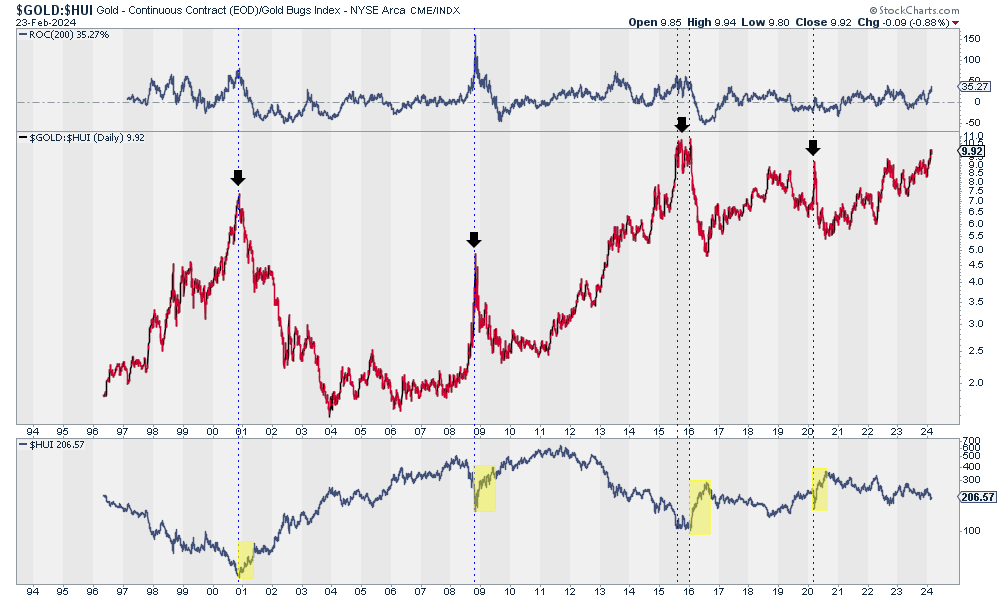

Another indication is the ratio of gold stocks against Gold, which is trending towards a historical extreme.

We plot the inverse (Gold divided by the HUI) and the HUI at the bottom. Sharp rises in the Gold to HUI ratio typically precede major lows and huge rebounds in the gold stocks.

If the gold stocks were to become extremely oversold over the next few weeks or months, it would fulfill the setup for a huge rebound.

The final ingredient is a big rebound in Gold.

The biggest rebounds in gold stocks sprung from lows in October 2008, January 2016, and March 2020.

Following the lows in 2008, Gold rebounded 42% in four months, while GDXJ rebounded 124% in three months and gained 212% in six months.

After months of basing and grinding in the second half of 2015, GDXJ gained 202% in seven months. Gold rebounded 31%.

Finally, after the Covid crash, GDXJ rocketed higher by nearly 200% as Gold rebounded by 41% in only five months.

Should the gold stocks become even more oversold and Gold fall below $2000, it would create the setup for a dramatic rebound. A move in Gold from $1900 to $2400-$2500 could lead to another 200% rebound in GDXJ, albeit from lower levels than today.

As gold stocks are cheap and hated and may become even more so, the opportunity is finding the companies that can create value at present metals prices but are priced too cheap.

Those companies can hold up now and would enjoy accelerated upside performance during that Gold move to $2400-$2500.

I focus on finding high-quality gold and silver juniors that can perform in a static metals environment but have 500% to 1000% upside after the bull market begins. To learn the stocks we own and intend to buy, with at least 5x upside potential in the coming bull market, consider learning about our premium service.